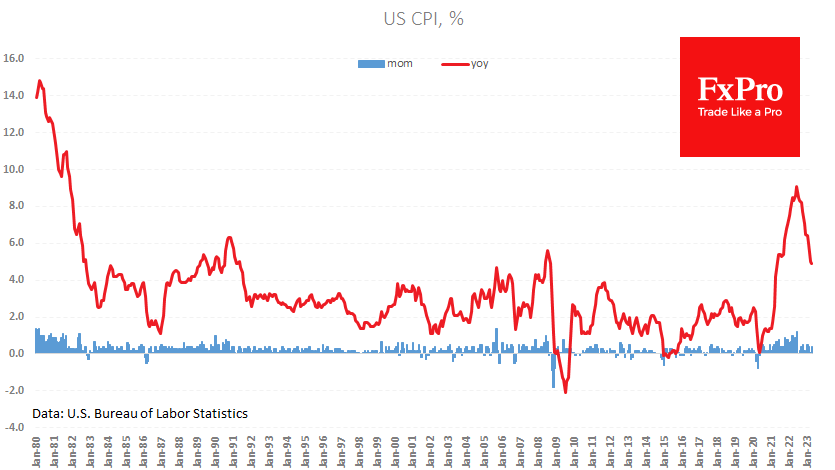

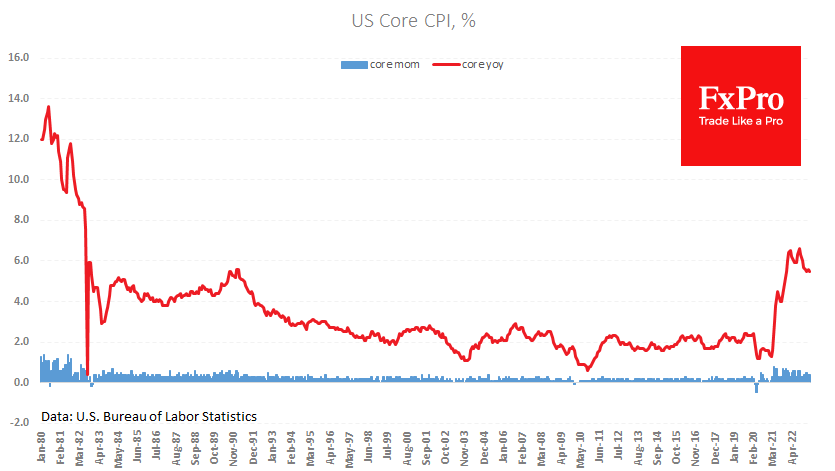

US price growth remains above the Fed target

US consumer inflation slowed to 4.9%, just below the expected 5.0% and unchanged from the previous month. The initial market impulse was to sell the dollar and buy equities as the slowdown in price growth brings the end of the rate hike phase and the Fed’s dovish stance closer. However, the strong market move had no chance of being sustained as it was too early to celebrate victory over inflation. Moreover, there are increasing signs that an inflationary spiral is taking hold.

Monthly price increases are still below the 2% target, with total price increases over the past six months close to 1.8%, or 2.4%, excluding food and energy. The slowdown in the annual rate is mainly due to the high base effect, but the monthly rate does not allow for a monetary policy reversal to be considered as an actual plan for the coming months.

Moreover, the latest economic data points to the strength of the economy, which does not allow for the expectation that weaker demand will allow price pressures to cool. The source of disinflation is more likely to be lower import and commodity prices, but this is not a sufficient reason to cut interest rates.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)