What is next for the markets

What is next for the markets?

The new week will focus on the US labour market and the UK rate decision.

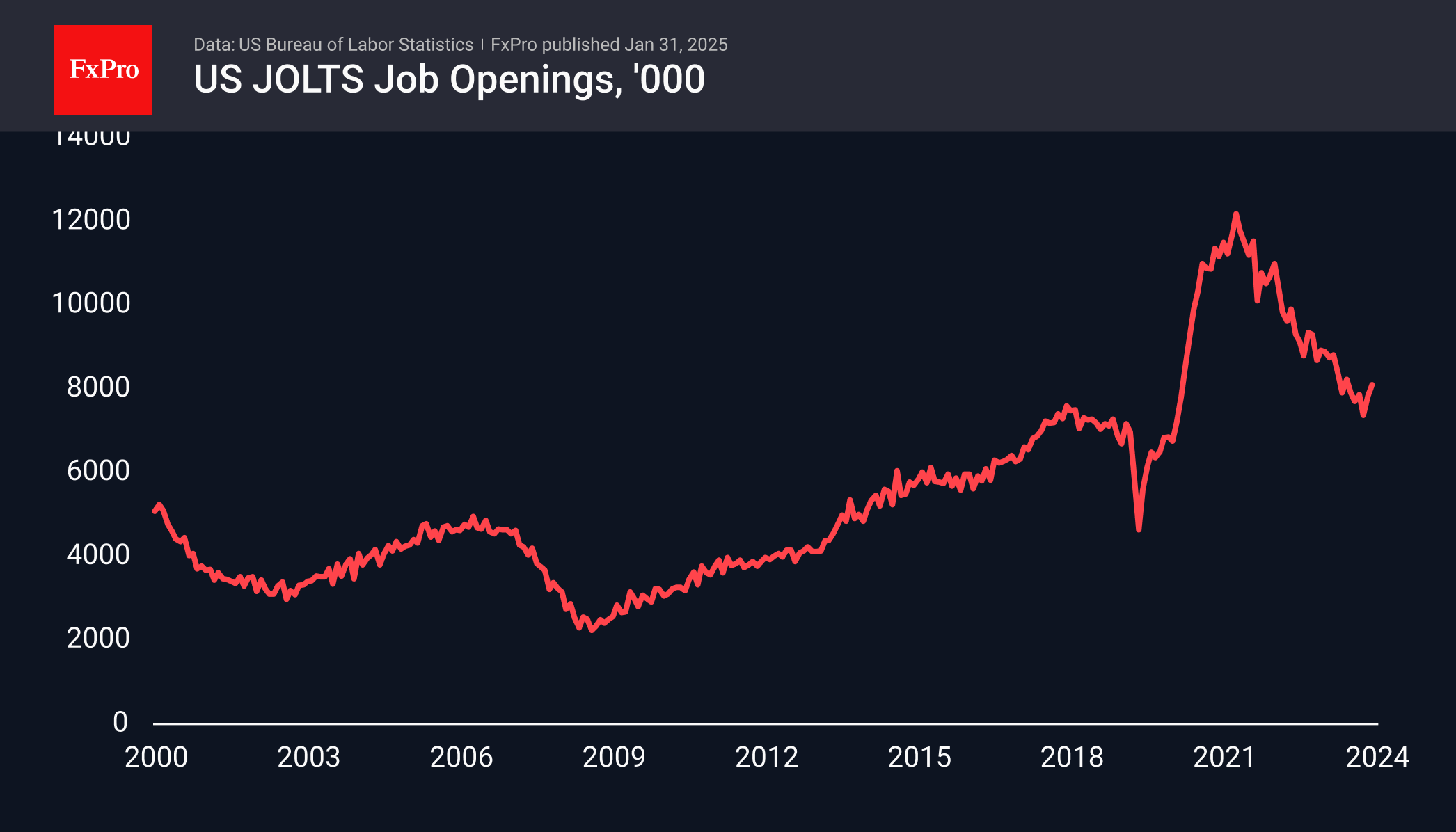

On Tuesday, 4 February, the focus is on the new US job opening statistics. The indicator's fall over the past two years was viewed with alarm, but the figure has stabilised in the region of the 2019 highs. A rise would be a strong positive signal.

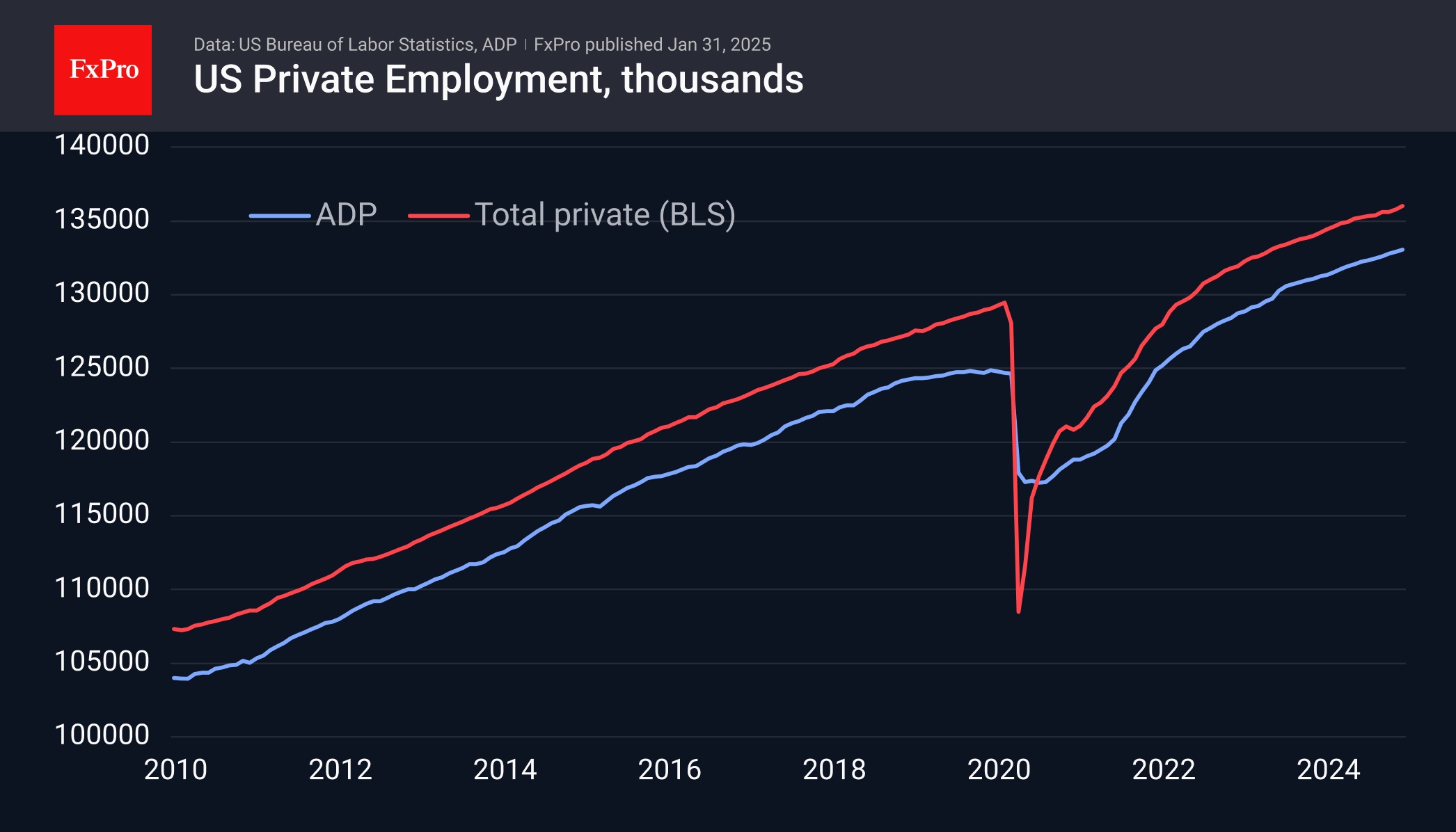

Wednesday, 5 February, sees the release of ADP private sector employment data. This is the closest indicator to Friday's NFP. The indicator has been adding at a slightly below-trend pace in recent months, but so far, the labour market as a whole has not turned around. Surprises can't be ruled out here, though.

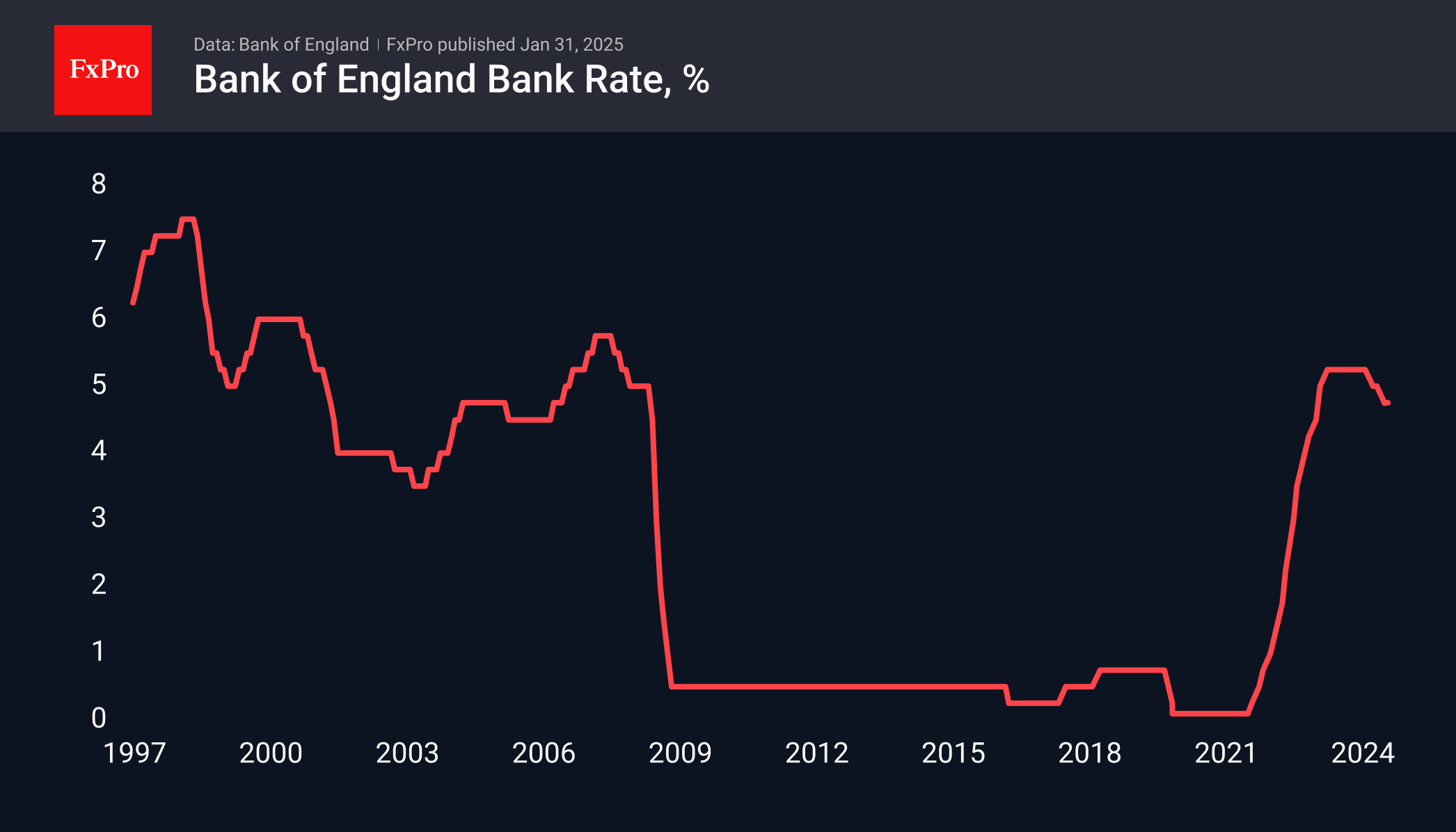

On Thursday, 6 February, the focus is on the Bank of England's key rate decision. Markets are expecting a 25-point cut. The central forecast is for two more cuts within a year. Signalling a change in this expected trajectory will be the main driver of UK markets. More declines will increase pressure on the pound.

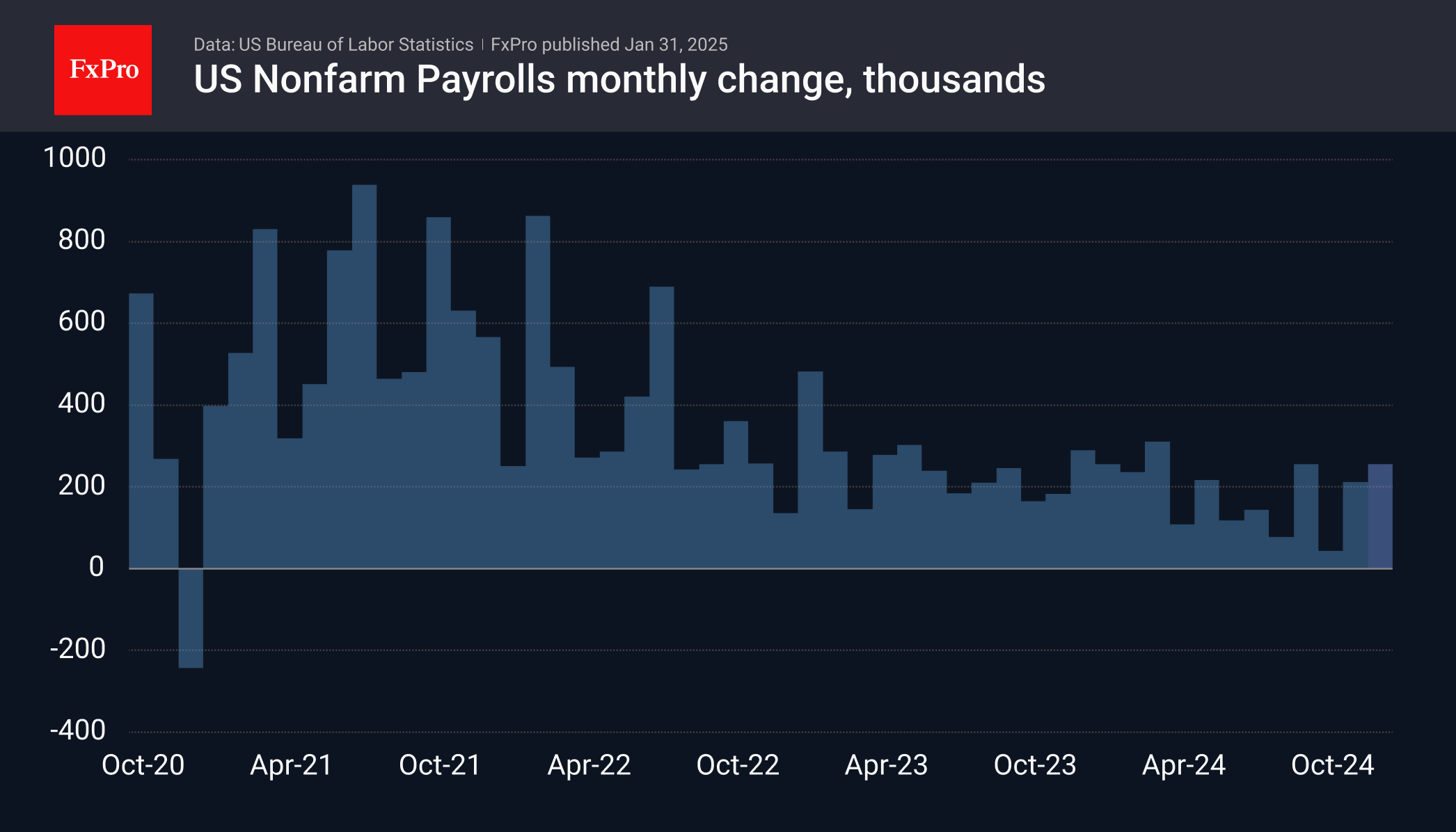

On Friday, 7 February, all eyes are on Nonfarm Payrolls. Often, markets are quiet, going into a waiting mode a day before the release. The last couple of months have seen growth rates above the trend of 200K, also working to strengthen the dollar. However, strong data can also trigger a sell-off in stocks.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)