Gold touches new record, dollar holds firm, pound’s losses deepen

Gold hits another record but stronger dollar caps gains

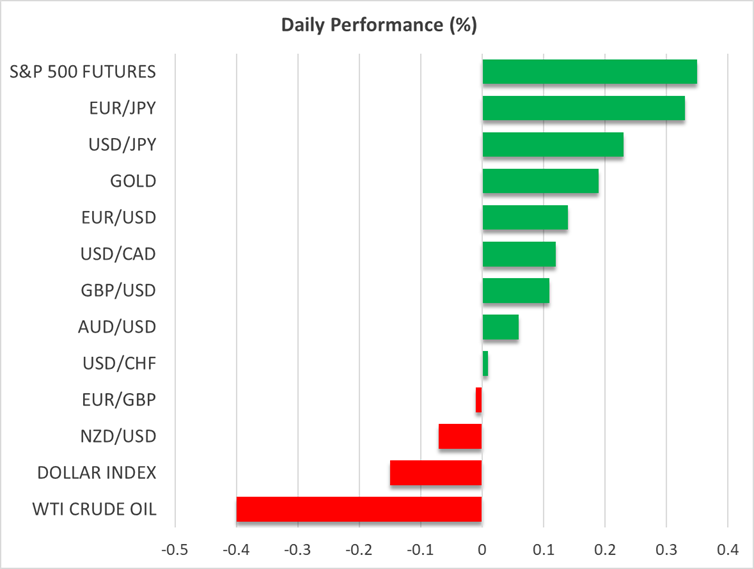

Gold and the US dollar competed for safety flows on Tuesday and continued to do so on Wednesday, as the fallout in bond markets spread through equity markets, with volatility spiking across the board. Much of the selloff in long-term government bonds is being driven by the concerns about unsustainable borrowing against a backdrop of weak economic growth.

The UK and France have been singled out by investors as both governments are struggling to get to grips with their public finances. Unless they are able to come up with a convincing plan soon on reducing the deficit, there’s a real risk of the current jitters developing into a full-blown debt crisis.

However, markets are grappling with a host of other uncertainties, such as President Trump’s erratic trade policy, his interference in Fed decision making and the possibility of the US Supreme Court ruling against the legality of the new tariffs. Meanwhile, stagflation fears just don’t seem to go away, permanently weighing on risk sentiment.

For gold, which had already enjoyed strong demand from central bank purchases even before Trump’s return to the White House, the latest risks are only adding to its appeal as the world’s most popular safe haven. The spot price rose to a new all-time high of $3546.99 earlier today after its advance yesterday was temporarily halted by a rally in the dollar. The greenback is currently trading at a one week high against a basket of currencies.

Pound, euro and yen mired in woes

The pound remains on the backfoot on Wednesday, although it is showing signs of stabilization after brushing a one-month low of $1.3330 earlier in the session. The yield on 30-year gilts hit a new 27-year high of 5.75% today before easing to around 5.70%. The run-up to the UK government’s Autumn Budget, likely to take place in late November, looks set to be a rocky one for the pound. It remains to be seen whether any plans for higher taxes will be enough to allay concerns about excess borrowing.

The euro is having a somewhat better day, supported by dwindling bets of further rate cuts by the ECB this year. The key risk for the euro is next Monday’s confidence vote in the French parliament where lawmakers have to decide whether to approve Prime Minister Francois Bayrou’s budget that contains €43.8 billion in cuts. Should Bayrou’s minority government collapse, leading to fresh elections, there’s a danger that a new government composition would not support measures to lower the deficit.

Political risks are also on the up in Japan. The resignation of the ruling LDP party’s secretary general on Tuesday has sparked speculation that Prime Minister Ishiba may be forced to quit too over the coming days. The yen is extending its slide today, weakening to a one-month low of 149.13 per dollar, finding little support from a jump in Japan’s 30-year government bond yield to a record high of 3.29%.

US labour market in the spotlight

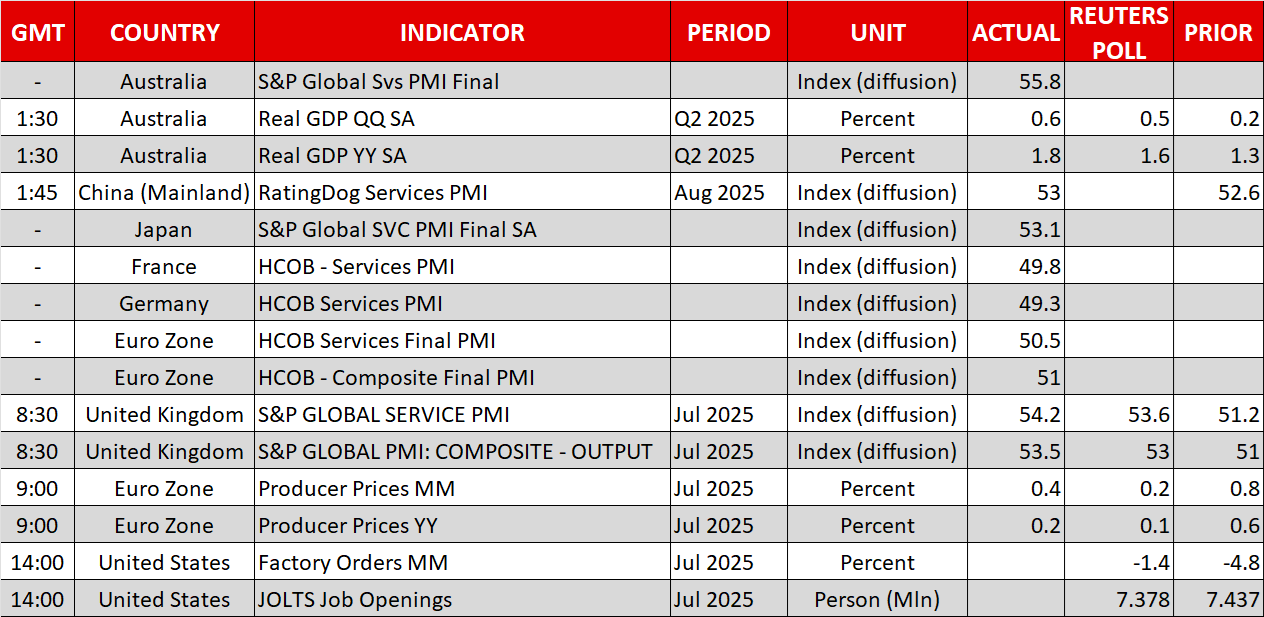

US Treasury yields have also been rallying this week, although they remain below their recent highs. Yesterday’s softer-than-expected ISM manufacturing PMI has solidified expectations of a September rate cut by the Fed, particularly as the prices index fell in August. This may have helped to limit the selling pressure on US bonds and briefly lifted stocks.

The focus today will be on the JOLTS job opening numbers for July, as any decline would confirm the view that the US jobs market is in trouble. But ultimately, it’s all about Friday’s nonfarm payrolls report this week, amid some speculation that another poor print could prompt the Fed to cut rates by 50 bps later this month. In the meantime, traders will be keeping an eye on the confirmation hearing of Trump’s nominee, Stephen Miran, for a seat on the Fed board in the Senate tomorrow.

Mood in equities might be improving

On Wall Street, all three major indices slumped on Tuesday, but futures for the Nasdaq and S&P 500 are positive today, likely lifted by a rally in Google parent Alphabet’s stock, which is up more than 7% in pre-market trading. The company is celebrating a major win after a US judge ruled that it does not have to sell its Chrome browser or Android operating system. While Google still has to share search data with competitors, investors see this as a small price to pay.

Shares in Europe are also rebounding today, in a potential sign that risk appetite is recovering.

.jpg)