A remarkable reversal of Bitcoin

A remarkable reversal of Bitcoin

Market picture

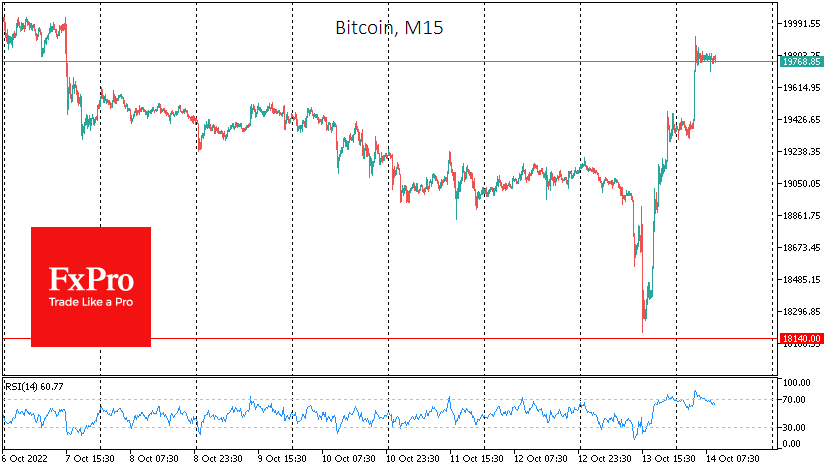

Bitcoin added a modest 1.2% on Thursday, but this subtle result hides the real roller coaster. Bitcoin was losing 5% intraday, coming close to $18K, but following the stock market, it not only recouped its initial losses but also showed impressive gains. At the time of writing, the price is stomping around $19.8K.

This way, the bulls managed to defend the lower boundary of the trading range. Moreover, this intraday reversal pattern is often the harbinger of a global reversal in the trend. In our case, it could change from a bear market to a sideways market or a moderate rise. Talking about the start of FOMO does not make sense yet.

The closest confirmation of a downtrend reversal would be a fixation above the $20K level - above the psychologically crucial round level and the 50-day moving average.

News background

Devere Group CEO Nigel Green expects bitcoin to decline for the rest of the year amid rising inflation in the global economy. However, long-term investors can benefit by buying crypto assets "on the cheap" from panicked traders.

The head of cryptocurrency investment firm Galaxy Digital, Mike Novogratz, said the bearish trend could last another two to six months. He said sellers are highly depleted, and most investors who needed fiat have already sold their assets. But to reverse the trend, a change in the Fed's monetary policy is required.

Tim Rice, CEO of analyst firm CoinMetrics, said that more companies from traditional finance have started to emerge in the cryptocurrency industry. However, big banks are still waiting for more transparent crypto industry regulation to reduce their risks.

According to the People's Bank of China, the volume of transactions using the digital yuan has exceeded 100 billion yuan (about $13.9 billion) due to its full-scale deployment in China.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)