Bitcoin beats resistance but does not give up

Market Picture

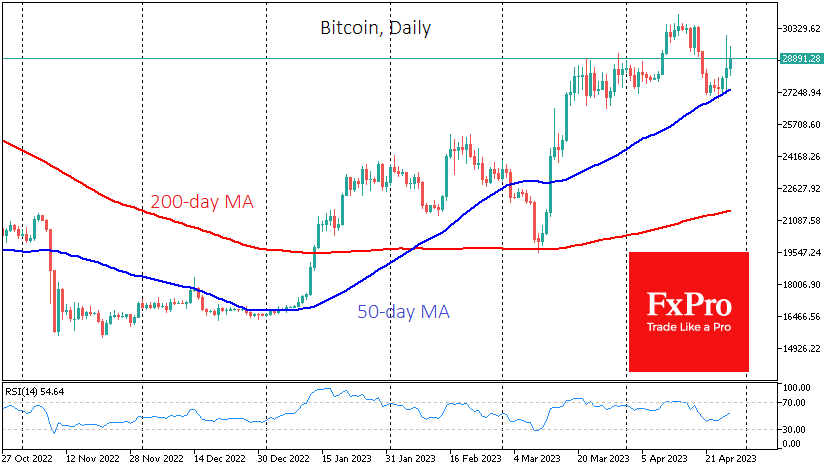

Bitcoin's rally accelerated late Wednesday after hitting $29K but ran into strong resistance as it approached $30K (the level passed on some exchanges). The inability to break above this level triggered a massive wave of capitulation. It quickly, but not for long, pushed the price back to $27K, the price at the start of the week. By Thursday morning, buying prevailed again, returning the price to $29K.

Despite the wide intraday swings, the broader market picture is still very bullish as the bulls have managed to push the price above the 50-day moving average, which is pointing up from $27K on Monday to $27.4K. At the end of March, the market bought Bitcoin near this level. In other words, we have strong indications that the first cryptocurrency maintains its uptrend.

Financial news is also helping the buying. The rally comes on the heels of reports of the stock collapse of troubled First Republic Bank, which was bailed out in March. Another bout of capital preservation fears has brought attention back to crypto.

News Background

BitMEX co-founder Arthur Hayes said that with the "broken banking system", investing in cryptocurrencies would help people protect themselves against the risk of losing money. He says, "Those who believe in traditional finance will inevitably suffer losses".

Twitter analyst TechDev believes Bitcoin is in the early stages of a parabolic rally as the technical picture now resembles the bull market of 2015 when BTC went from less than $200 to $20,000 in two years.

Cryptocurrencies have evolved from "rebellious instruments" to a mainstream asset class, according to the UK's Financial Conduct Authority (FCA). However, the agency expressed concern that organised crime could use crypto.

The CFTC intends to go to Congress with a proposal to remove the anonymity of crypto-assets and introduce digital identification of owners, said Commissioner Christy Goldsmith Romero.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)