Bitcoin maintains a positive short-term outlook

Bitcoin maintains a positive short-term outlook

Market Picture

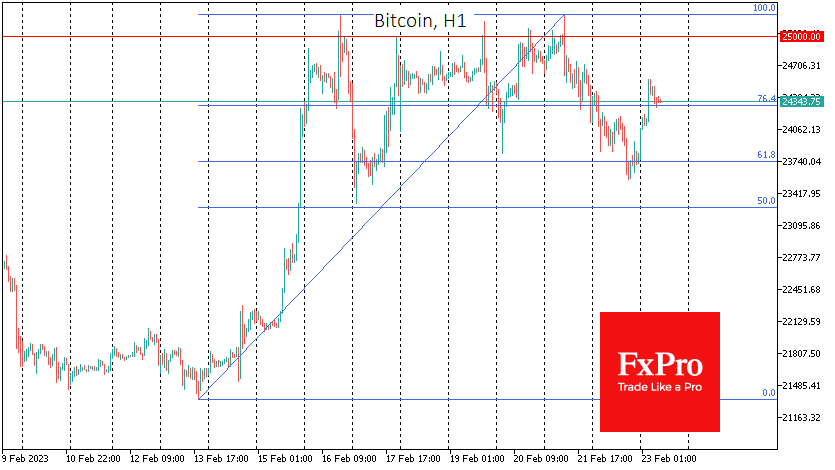

Bitcoin closed below $24K for the first time in 8 days on Wednesday. On Thursday morning, however, buyers regained the upper hand, pushing the coin up to $24.4K. BTC came under pressure on Tuesday and Wednesday amid falling stock indices. Last night, the decline paused, which helped the crypto market recover some of its losses, bringing its total capitalisation back to $1.11 trillion.

Interestingly, according to Bloomberg, the monthly correlation between bitcoin and the S&P 500 has fallen to its lowest level since 2021. And it was easy to see how long cryptocurrencies ignored the decline in equities.

In our view, these markets remain interconnected and only "hear" each other's murmurs when they are persistent and pronounced. Less pronounced trends are perceived as noise that is filtered out.

The technical view of bitcoin's short-term momentum leaves room for further upside, as the most recent downside momentum was stopped at 61.8% of the upside momentum from last week's lows. Without the strong negative momentum of the equity indices, bitcoin retains a chance to test the 25,000 level before the end of the week. Such sustained attempts to climb higher could well take it there.

News Background

New York's financial regulator is stepping up its crypto market oversight as its Department of Financial Services (NYDFS) has announced an update to its tools for monitoring illegal cryptocurrency activity among its regulated entities.

The Ethereum team has scheduled the rollout of the Shanghai-Capella (Shapella) update to the Sepolia test network for 28 February. This update will follow The Merge and allow validators to withdraw funds from stacks. After Sepolia, the hardfork will be tested on the Goerli network and then (probably in March) implemented on Mainnet.

Shops in France will start accepting bitcoin payments thanks to a partnership between the Binance exchange and credit card company Ingenico. The programme will later be extended to European countries where Binance is licensed to operate, including Italy, Lithuania, Spain, Cyprus, Poland and Sweden.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)