Bitcoin recovers, altcoins humbly follow

Market picture

The crypto market is moving upwards, encouraged by Bitcoin's positive momentum. Total cryptocurrency capitalisation reached $2.44 trillion, up 1.6% in 24 hours and 0.8% in seven days.

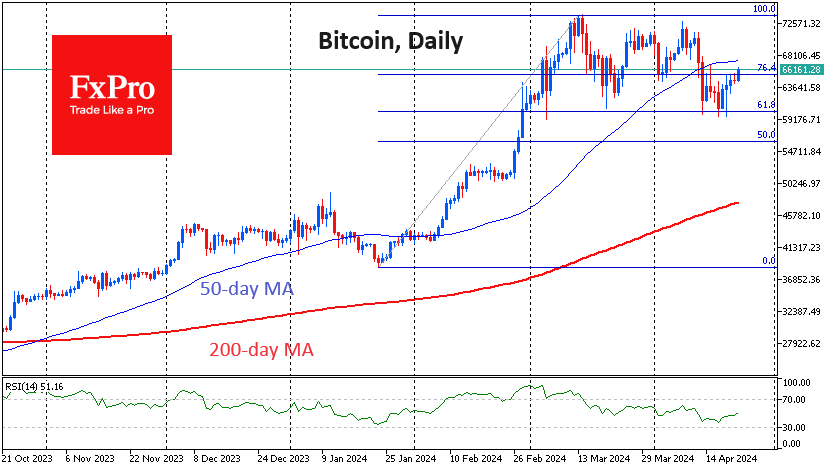

Bitcoin added 1.9% in 24 hours to $66.4K, gradually adding since last Thursday. The price hasn't moved much in recent days, balancing the positivity from the halving and the negativity from the Nasdaq index's decline.

Bitcoin is sticking to a classic upside pattern with a 61.8% Fibonacci retracement from the last rally. However, it's worth remaining cautious until the price breaks above the 50-day moving average, which is now at $67.4K.

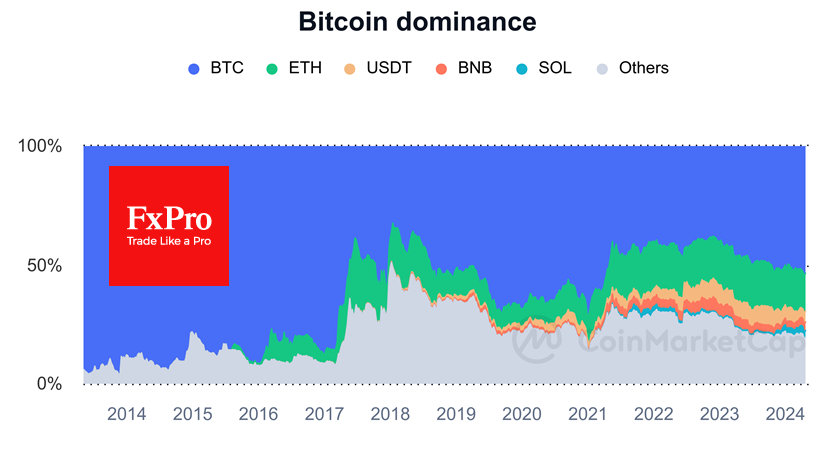

Altcoins are repeating the positive dynamics of the first cryptocurrency, adding since the end of last week. Still, they fell harder a fortnight ago and are recovering very sluggishly so far. As a result, the share of Bitcoin in total cap reached a three-year high near 55%.

News background

On 20 April at 0:10 GMT, the fourth halving in history took place on the Bitcoin network on block #840,000. The ViaBTC mining pool mined the block, and it saw the miners' reward drop from 6.25 BTC to 3.125 BTC. Commissions in the first block of the BTC network rose sharply to $2.4 million after the halving. The record commission is attributed to user activity in the Runes Protocol.

The first cryptocurrency may enter a "re-accumulation phase" after halving. Then, a "parabolic uptrend" will begin, according to an analyst at Rekt Capital. In his opinion, the movement of BTC now follows the same pattern as in previous post-halving cycles.

In a clarified lawsuit against Tron founder Justin Sun, the SEC said his frequent visits to the United States entitled him to legal action. According to the SEC, San spent more than 380 days in the US between 2017 and 2019.

Ethereum blockchain made a net profit of $365.46 million in the first quarter, up nearly 200% from the previous period's $123 million, according to The DeFi Report. Total transaction fees reached $1.17bn.

Tether, the issuer of USDT stablecoin, added support for The Open Network (TON) blockchain. Via Telegram, Crypto Bot users can now deposit USDT on the TON blockchain. Withdrawals will appear in the near future. There will be no fees for USDT transactions within Telegram, and users can instantly send the asset to their contacts in the messenger without a wallet address.

Telegram will start rewarding content creators and allow the purchase of goods for cryptocurrency, said Pavel Durov, the messenger's founder. According to him, Telegram has integrated blockchain at a deep level.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)