Bitcoin's Ascending Channel and Ethereum's Bounce Back

Market picture

Crypto market capitalisation rose 2.4% in 24 hours to $1.42 trillion, with gains across a vast range of altcoins from +0.4% (BNB) to +15.6% (Uniswap). The Crypto Fear and Greed Index added 4 points to 66 (Greed), though it’s still some way off the indicator's November peak of 74.

Bitcoin continues to bounce around in an ascending channel, hitting its three-week upper resistance of $37.8K on Wednesday evening. An intensifying sell-off thwarts attempts to heat the price, but the pullbacks have become less deep over the past three weeks, suggesting the building up of bullish sentiment. At the same time, this relative stabilisation in the range removes local overbought conditions, allowing to stick to gains of the previous advance. A break of resistance could see a quick rise above $40K.

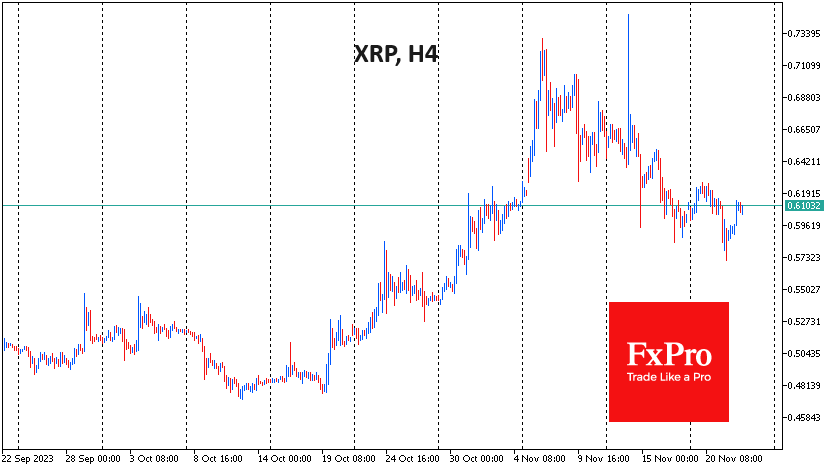

XRP received buyers' support on Wednesday after touching the 50-day moving average, giving it a chance to stabilise after a pullback of more than 20% from its early November peak.

However, the buying of Ethereum on its dip below $2,000 on Wednesday was more notable. Active buying in the world's second most-capitalised coin took the price back to $2060, near the top of the range since the 10th of November.

News background

Grayscale met with the SEC to discuss converting the GBTC ETF into a spot bitcoin ETF. Grayscale officials announced that they have signed a fund servicing agreement with Bank of New York Mellon. The institution will act as GBTC's counterparty, facilitating the issuance and redemption of shares.

In a joint statement with the DOJ, US Treasury Secretary Janet Yellen expressed the view that Binance had paid for its greed and non-compliance with the law.

Binance will remain one of the largest crypto exchanges for two to three years. The agreements with US authorities are a positive outcome despite the lack of SEC inclusion, Matrixport believes.

Mt. Gox's creditors will start receiving payments before the end of this year, the bankrupt exchange's trustee Nobuaki Kobayashi assured. However, given the large number of creditors, the payouts will likely continue until 2024. Mt. Gox's creditors have been expecting repayment for nearly a decade, and the payment deadline has been repeatedly postponed.

Meanwhile, the crypto exchange HTX (formerly Huobi) and the HECO network were hacked. Unknown persons withdrew assets worth $110 million. The head of HTX has already confirmed the fact of the hack.

Lastly, former Revolut VP of development Hannes Graah, ex-employee of Coinbase and Spotify, backed by Galaxy Digital, will launch the Zeal cryptocurrency wallet in Q1 2024.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)