Canadian Dollar Strengthens, But Its Outlook Hinges on Oil Prices and Trade Tariffs

By RoboForex Analytical Department

The USD/CAD pair settled around 1.4393 after experiencing a volatile start to January. On Monday, the market showed interest in buying the Canadian dollar, which had earlier strengthened to a monthly high against the USD. This movement was driven by a weaker US dollar and a more favourable risk sentiment in global markets.

Factors influencing the Canadian dollar

The Loonie was boosted after US President Donald Trump called for an immediate interest rate cut by the Federal Reserve, which weighed on the USD. Additionally, enhanced risk appetite in the market supported currencies like the CAD.

However, the Canadian dollar’s ability to strengthen further is uncertain due to looming trade policy concerns. The potential of the US imposing 25% tariffs on Canadian imports in February 2025 has raised fears. This move could prompt the Bank of Canada to lower its interest rate by 25 basis points during its meeting.

Adding to the uncertainty is the continued decline in crude oil prices, a critical factor for the Canadian economy, given its reliance on commodities. The oil sector is particularly concerned about the potential impact of tariffs on Canada, Mexico, and China, as well as the broader implications for global energy demand and economic growth.

Technical analysis of USD/CAD

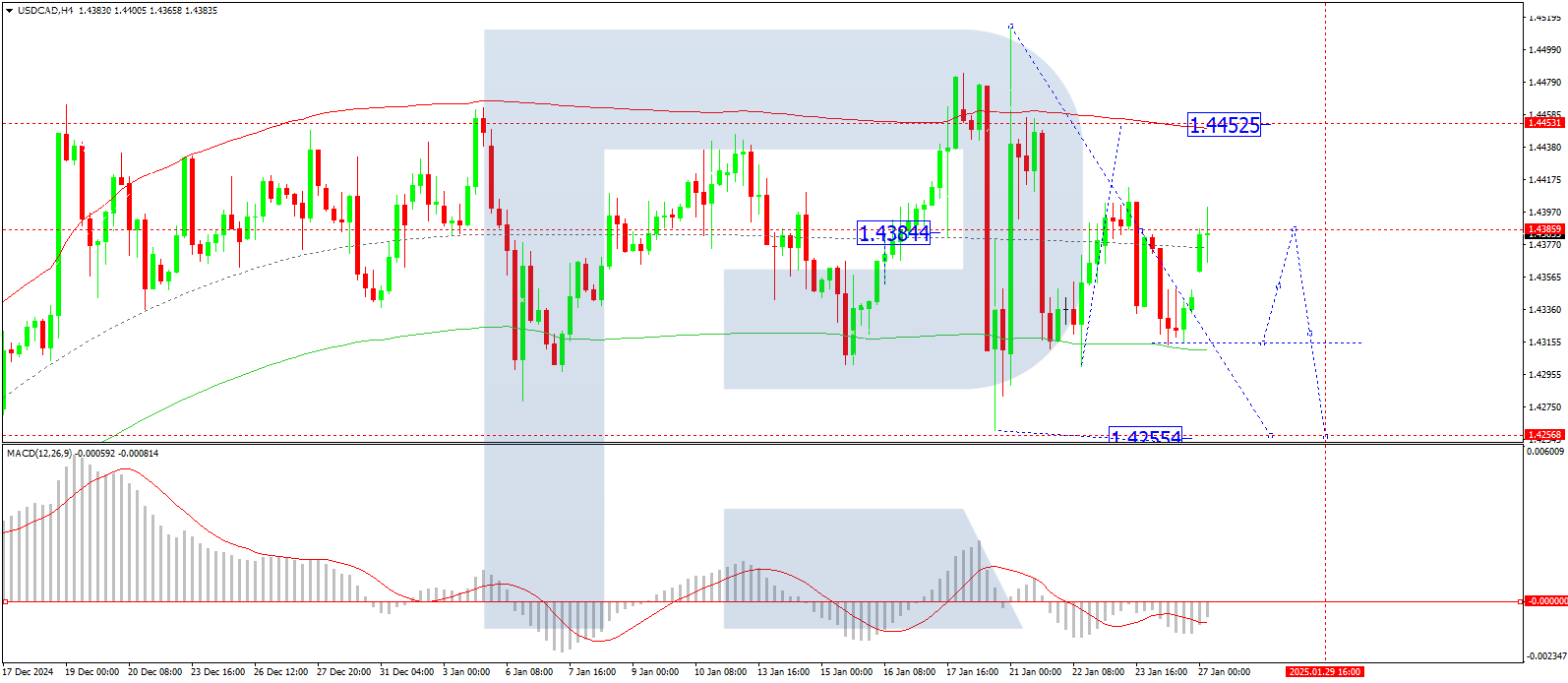

On the H4 chart, USD/CAD is in a broad consolidation range around the 1.4384 level. A short-term growth to 1.4455 is possible. After reaching this level, the pair may reverse and develop a downside wave targeting 1.4255. The MACD indicator supports this outlook, with its signal line positioned below the zero mark and signalling further potential for lower lows.

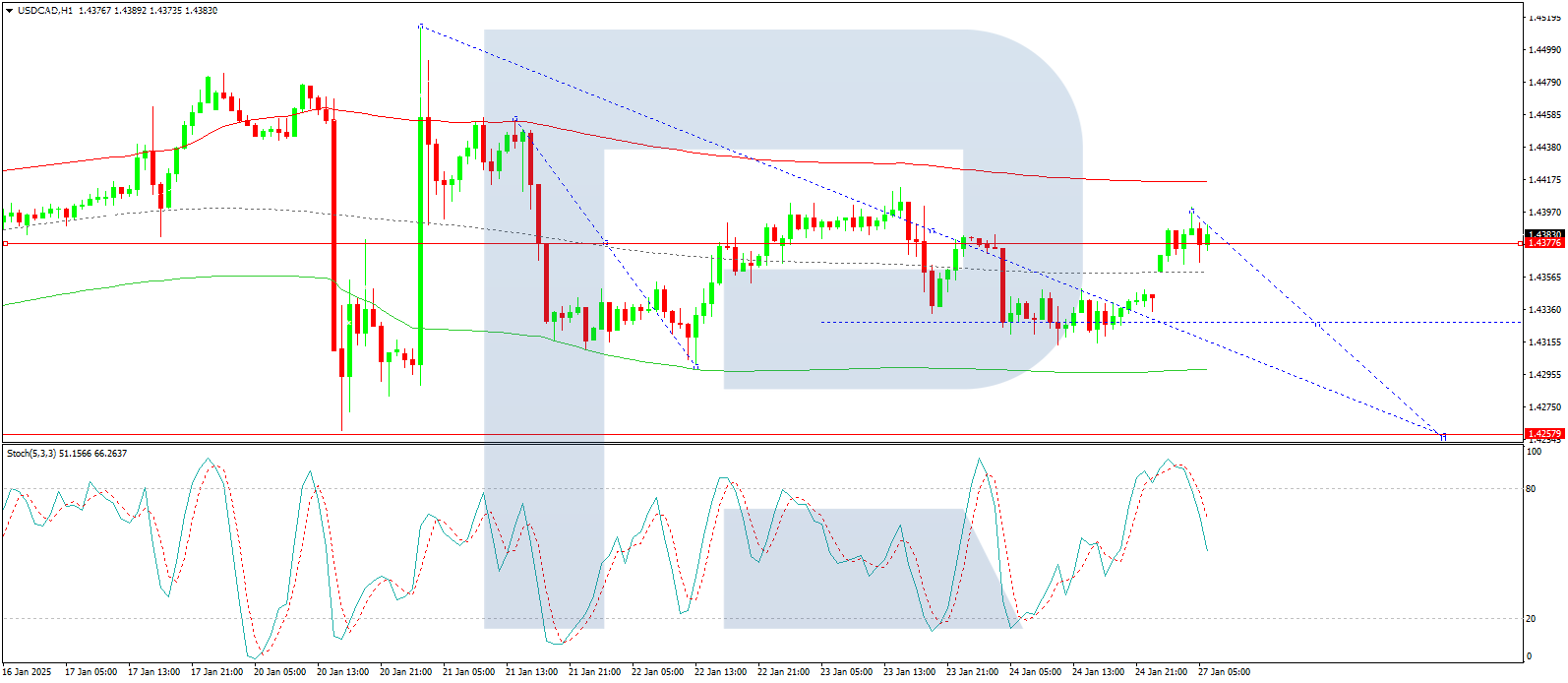

On the H1 chart, the pair completed a local decline wave to 1.4300 and then rebounded to 1.4377. The market is forming a consolidation range near 1.4377. If the pair breaks upwards, the range could extend to 1.4455. Conversely, a downward breakout would open the potential for a move towards 1.4255. This scenario is supported by the Stochastic oscillator, which shows its signal line below the 80 mark and trending sharply downwards towards 20, indicating bearish momentum.

Conclusion

The Canadian dollar’s recent gains reflect short-term factors such as a weaker USD and improved market risk sentiment. However, its outlook remains uncertain, with oil prices and potential US trade tariffs presenting significant risks. Technically, the USD/CAD pair is consolidating, with key levels to watch at 1.4455 on the upside and 1.4255 on the downside. Market participants will closely monitor developments in US trade policy and the Bank of Canada’s upcoming rate decision for further direction.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.