Crypto: Bulls cautious steps after pause

Market picture

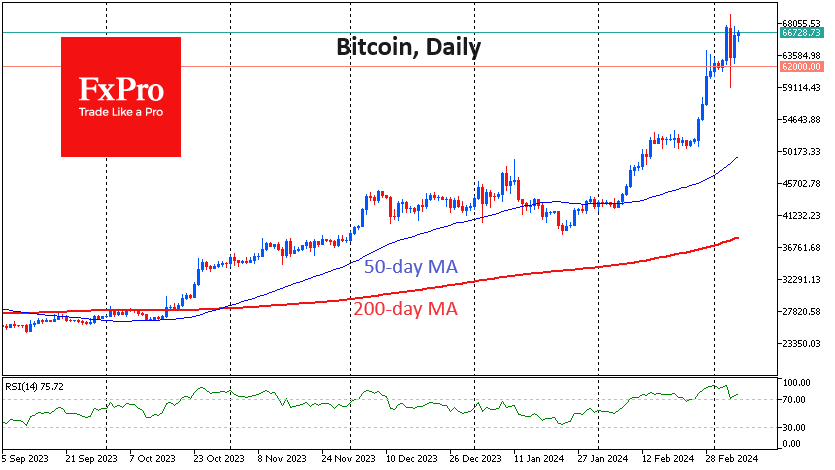

The crypto market cap remains at $2.52 trillion, close to Tuesday's highs. It is also worth noting the positive market momentum in the last few hours after the lull, which looks like the first tentative steps of buyers. We would not be surprised if they have enough strength to push Bitcoin to new highs, as is now happening with gold.

We continue to believe that an essential driver of buying in Bitcoin and gold is the uncertainty of large investors in US regional banks. There was a similar buying spree a year ago, which was only halted by the Fed's capital injection. But the fear is that a domino effect has already been set in motion for the entire industry.

News background

Bitcoin's new all-time high triggered a wave of selling that was amplified by liquidations in the open-ended market. According to Santiment, the correction caused the OI on bitcoin derivatives to fall by 12%, or $1.42 billion.

Bitcoin's brief collapse helped to normalise financing rates in the open-ended cryptocurrency futures market, removing excessive leverage. Over the day, exchanges unwound about 300,000 traders' margin positions worth about $1 billion.

Analysts interviewed by Bloomberg expressed confidence in bitcoin's long-term upside, in part due to the excitement surrounding the ETF.

BlackRock's bitcoin ETF has increased its investment in BTC, catching up with MicroStrategy, the world's largest corporate bitcoin holder, in terms of initial cryptocurrency holdings. Inflows into the BlackRock ETF exceeded $788 million on a day when BTC hit an all-time high.

Crypto asset manager Grayscale Investments announced the launch of an investment fund that will generate income by stealing cryptocurrencies. The fund's portfolio consists of nine tokens, with income distributed and rebalanced on a quarterly basis.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)