Crypto dragged back to support line on risk-off

Market picture

The cryptocurrency market fell 0.3% over the past 24 hours to $1.2 trillion. Bitcoin lost 0.7%, Ethereum lost 0.97%, and top altcoins ranged from -3.4% (Solana) to +4.8% (Polkadot).

Bitcoin failed to develop any local upward momentum and continues to test the lower boundary of its last trading range. Following the sell-off in risk assets and the rise in the dollar, the first cryptocurrency has returned to below $30,000. A failure below opens the door to a deeper correction to $28.9K, where the 61.8% Fibonacci retracement and 50-day MA are concentrated.

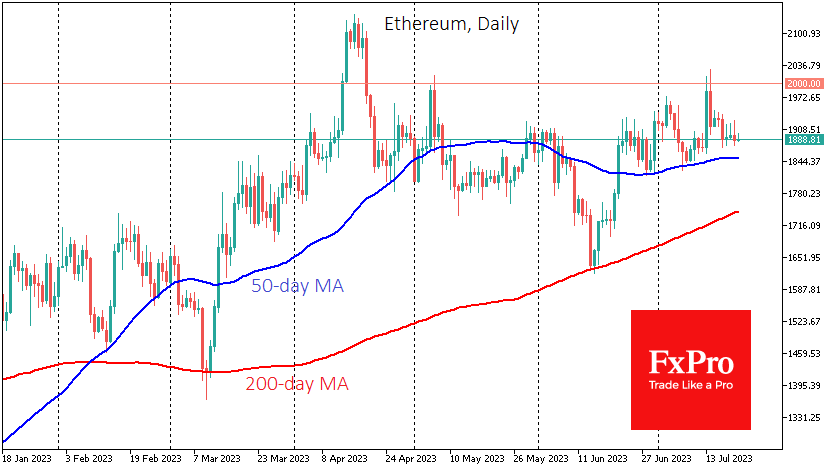

Ethereum has retreated to $1890, the centre of gravity for the past four months. Short-term traders should pay close attention to the momentum near the 50-day average (currently at $1850), as a break below this level could quickly take another $100 off the price.

News background

Spot bitcoin ETFs could increase demand for BTC by as much as $30 billion, NYDIG believes. To achieve this, investments in bitcoin funds should reach the level of gold ETFs, taking volatility into account.

The US Federal Reserve has launched its payment system, FedNow Service, for instant money transfers to bank customers. Earlier, the regulator stressed that FedNow is not linked to the central bank's digital currency and has yet to decide on the CBDC’s fate.

Kuwait has banned cryptocurrency transactions, including investment and mining. Cryptocurrencies "have no legal status, are not issued or backed by any government, and the prices of these assets are always driven by speculation," the country's regulator said in a document.

The UK government has rejected the idea of regulating cryptocurrencies as gambling instruments. The country's Treasury made a similar proposal in May, arguing that retail trading in digital assets is more akin to betting on sports than investing.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)