Crypto market: another pullback within the framework of growth

Market picture

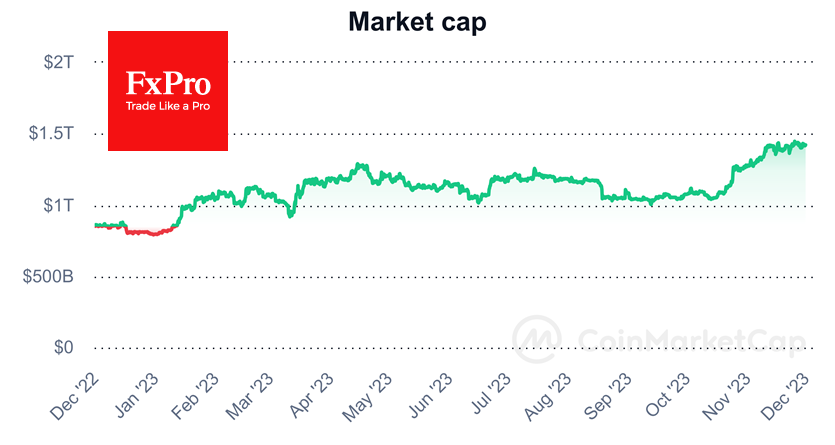

The crypto market cap fell 0.5% in 24 hours to $1.42 trillion, showing another pullback as part of a broader uptrend that started in mid-October but has slowed in the last couple of weeks.

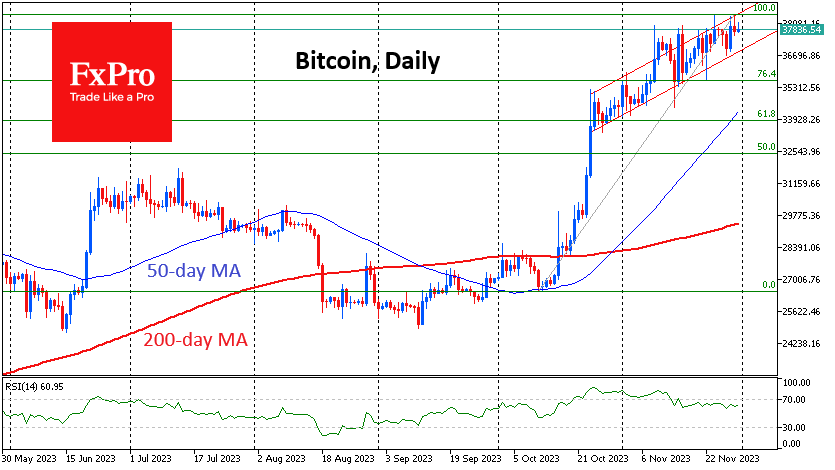

Bitcoin underwent a sell-off on Wednesday afternoon from the upper end of an upward range above $38.4K. Countless times, the market has proven that it's not ready to accelerate, but it hasn't found any reason to go deep down either. Only a failure below $36.7K will confirm that $38K is a solid horizontal resistance. Without this confirmation, the working scenario remains in the upward range.

News background

According to CryptoQuant, crypto whales are sending bitcoins to exchange wallets, which can be seen as a bearish signal.

Standard Chartered Bank confirmed its prediction that Bitcoin could reach $100K by the end of next year. Apart from halving, the catalyst for the rally will be the approval of several spot ETFs in the first quarter of 2024. This will pave the way for institutional investment in Bitcoin and Ethereum.

The US SEC has requested public comment on spot Bitcoin ETFs. Lawyer Scott Jonsson saw this as a signal of the regulator's willingness to approve all applications for the instrument in a one-time manner by 10 January 2024.

Glassnode recorded Ethereum's first post-Shanghai decline in staking, which is slowing issuance. Along with the increased rate of coin burn in light of increased network activity, inflation has been replaced by deflation.

Binance, the world's largest crypto exchange, announced that it will delist its own BUSD stablecoin as part of a deal with US authorities and will stop supporting it starting on the 15th of December.

US presidential candidate Vivek Ramaswamy said that his " policy will guarantee a bright future for cryptocurrencies", which will give freedom to Americans.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)