Crypto market deepens correction

Market picture

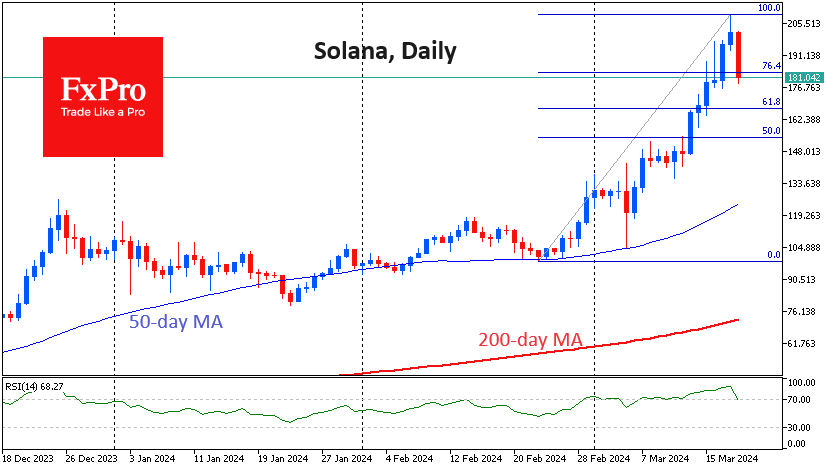

The crypto market lost 6% in 24 hours to $2.42 trillion. Solana reversed Tuesday's decline, losing 9% in 24 hours - the last of the major altcoins to fall into a correction.

Bitcoin is down 5% after falling to $64.4K. That's its lowest level in two weeks and 13.5% below its high. A close below $65.5K would signal a move to a deeper level – the classic 61.8% retracement of the rally with a potential target near $60K.

Solana had been above $210, reaching highs not seen since late 2021 before following the general corrective mood of the markets. A classic retracement pattern suggests a downside potential of $168. However, if this level is approached, one needs to look at bitcoin sentiment and global risk appetite to understand whether this support will be strong enough.

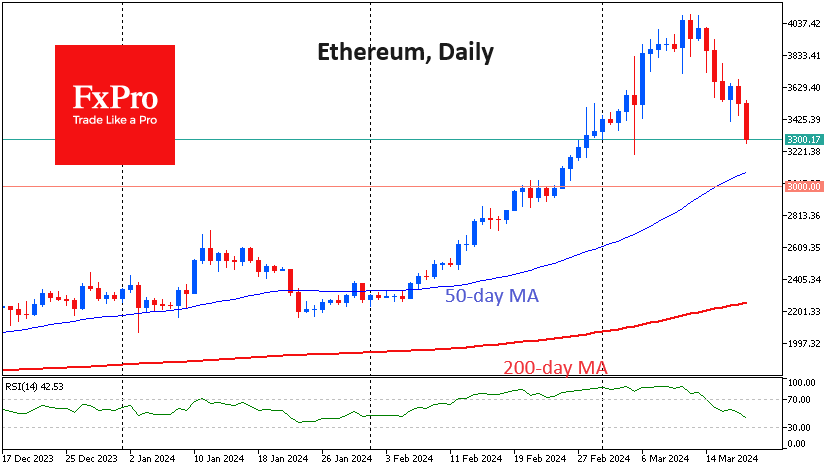

Ethereum is under selling pressure and has already pulled back to $3300, erasing all gains since early March. Having fallen below the 61.8% retracement of the rise from the January lows, ETHUSD can only hope for support in the form of the 50-day average ($3080) and $3000 (previous consolidation, plus the round level).

News background

According to CoinShares, crypto fund investments rose by a record $2.916B last week, surpassing the previous record set the week before ($2.685B) and continuing significant inflows for the seventh consecutive week. Bitcoin investments increased by $2.896B; Ethereum decreased by $14M, and Solana decreased by $2.7M. Investments in funds that allow shorting Bitcoin increased by $26M.

Bitcoin is in a bullish phase of a cycle like December 2020-January 2021. The current correction is "healthy" and removes some of the leverage in the system, said Crypto.com CEO Chris Marszalek.

Rekt Capital warned of a "danger zone" ahead of the upcoming halving in April. Historically, bitcoin has fallen weeks before the event. The depth of the correction was 20% in 2020 and 40% in 2016.

According to new data from Bitcointreasuries, 93.6% of total bitcoins (19,656,760 BTC) have already been mined as of mid-March 2024. Miners have only 1.34 million BTC left to mine, significantly limiting the future supply of the asset.

Ethereum issuance fell to its lowest level since August 2022 following the activation of the crucial Dencun update on 13 March, CryptoQuant noted. According to The Block, the ETH network has reached annual highs in the number of active and new addresses, daily transactions, and transaction volume.

The buzz around meme coins has boosted the token rate of the networks on which they are issued. The Solana (SOL) and Avalanche (AVAX) cryptocurrencies updated local highs. In pre-selling, users send network tokens to a wallet address in exchange for a corresponding number of coins when the meme token is launched. Solana has once again become the trendiest crypto asset among traders, with new Meme tokens appearing almost every minute, according to ContentFi Labs.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)