Crypto market grows on altcoins

Crypto market grows on altcoins

Market Picture

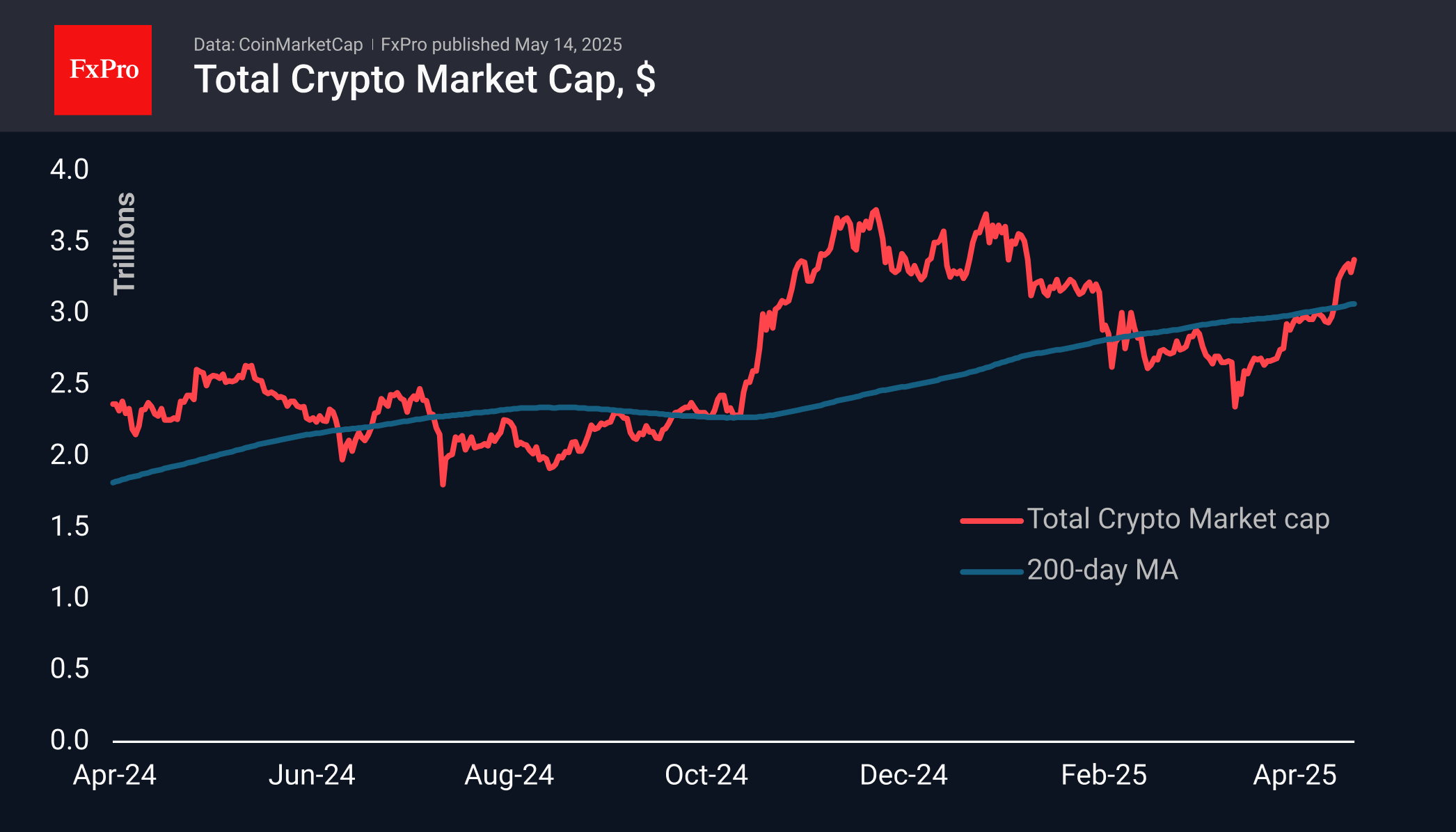

Market capitalisation rose 2.7% in the last 24 hours to $3.38 trillion, with the market reaching $3.40 trillion the previous evening. These are the highest values since early February, driven by increased altcoin buying.

The sentiment index reached 73, indicating that it is approaching extreme greed territory, but remains far from the overbought zone, giving the bulls reason for further gains.

Bitcoin has been hovering around the $104k level for the sixth day, experiencing increased rotation. This is quite expected behaviour as we approach the all-time highs of December and January, which served as turning points.

Ethereum is trading around $2615, having failed to consolidate above the $2700 mark, around which the 200-day moving average also passes. It is likely that after rallying 55% over the past seven days, the second-largest capitalised cryptocurrency will probably take a pause or start a correction with a potential target at $2400.

News Background

Bitcoin Magazine analysts point out that recent data points to a significant expansion of global liquidity (monetary aggregate M2), which historically accompanies bitcoin's growth.

Glassnode experts note that the breakthrough of the psychological level of $100,000 has sparked interest from new bitcoin buyers, while experienced traders are cautious. According to Santiment, wallets with balances between 10 and 10,000 BTC have purchased an additional 83,105 BTC over the past 30 days.

Coinbase exchange shares will join the S&P 500 index from 19 May, replacing Discover Financial Services securities. Coinbase will become the first cryptocurrency company to be part of the U.S. broad market stock index. Bernstein estimates the new demand for the exchange's shares from index funds to be $9bn.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)