Crypto may be ready for a new leg down

Market picture

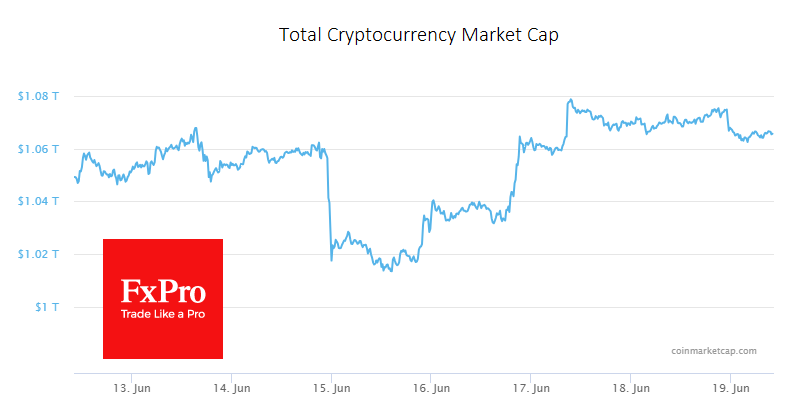

The crypto market capitalisation rose 1.5% last week to reach $1.066 trillion at the start of the new week. But it wasn't a smooth ride, as Bitcoin gained 2% last week to end the week down 4% at around $26,500. Ethereum lost 1% to $1730. Other leading altcoins in the top 10 fell between 0.4% (TRON) and 6.4% (XRP). The exception was BNB (+2.6%).

Thanks largely to positive equity market traction, bitcoin found support on the downside below $25,000 and formally closed above its 200-week average. The market was near the upper end of the downside range on the smaller timeframes. Given the overbought equity market, more downside risks could push BTCUSD lower, leaving it within the bearish trend. Only a rally above $27.2K - the area of previous local highs and the 50-day moving average - can effectively break this trend.

According to Bloomberg, Bitcoin's share of the total market value of all cryptocurrencies has reached its highest level since mid-autumn 2021. Traders are more likely to keep their money away from altcoins.

News background

Digital asset platform Bakkt has announced that it is removing Solana, Polygon and Cardano cryptocurrencies from its available assets until regulatory uncertainty is resolved.

US financial giants BlackRock, Bank of America and Fidelity are increasing their investment in MicroStrategy shares, with more than $200 million invested. MicroStrategy holds more than 140,000 BTCs.

The Securities and Exchange Commission (SEC) agreed with the Binance exchange to restrict employees of the parent platform from accessing the assets of Binance.US customers.

French authorities have opened an investigation into the Binance exchange, Le Monde reported, citing the Paris prosecutor's office. The authorities suspect the exchange of money laundering, failure to comply with KYC procedures and other violations of French law.

Tesla CEO Elon Musk denies insider trading in the Dogecoin cryptocurrency. He says he does not own the cryptocurrency wallets allegedly used for DOGE transactions.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)