Crypto takes its time

Market picture

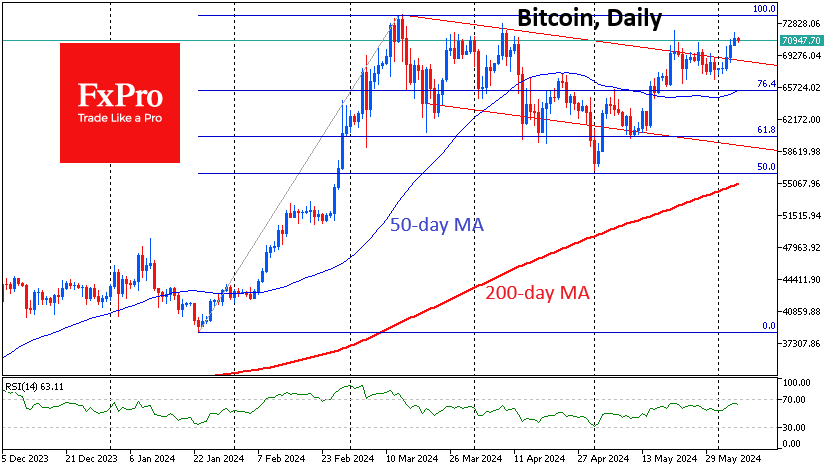

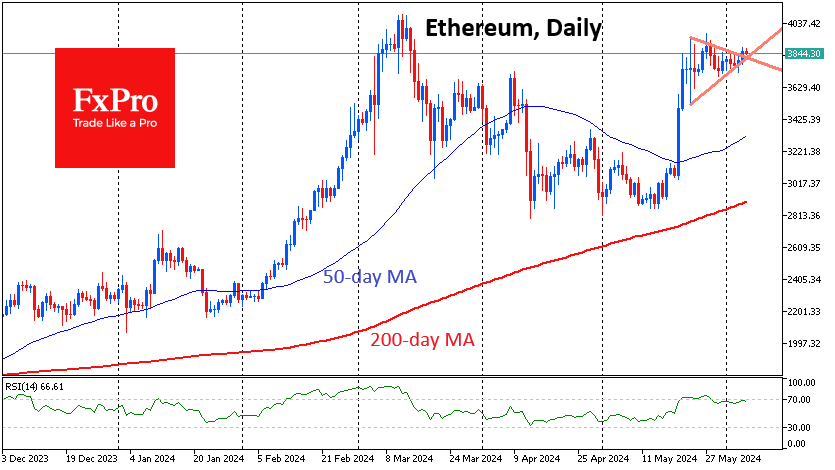

The cryptocurrency market decided to storm the local highs set almost two months ago. However, the growth has not yet developed, and some players rushed to fix profits quickly despite the positive sentiment in the US stock markets.

Bitcoin is trading near $71K, where it was a day ago, but Ethereum (+1%) has moved up - a small but important step up from the consolidation range. These two coins account for over 70% of the total crypto market capitalisation and show no signs of excitement so far. It seems that the market preferred to climb smoothly to the March highs. So, we should not expect an acceleration of growth immediately after reaching them because, with smooth growth, traders will move stop orders higher.

On June 5, BNB and TON quotes updated their historical highs at $715 and $7.8, respectively. Toncoin jumped on the background of news about the addition of TON to the European trading platform Robinhood Crypto.

BNB's rise is likely due to the Simple Earn programme, which runs from June 5 to 25 and will allow you to lock in BNB or SUI for that period for additional profits.

News background

According to SoSoValue, net inflows into spot bitcoin ETFs in the US totalled $886 million on 4 June, the second highest on record after the $1.05 billion recorded on 12 March. Inflows into spot bitcoin ETFs have continued for 16 consecutive days. Bloomberg noted that total investments since the beginning of the year reached $15 billion.

Fidelity Investments believes that most market participants should have positions in Bitcoin, regardless of their beliefs. To do so, they need to allocate just 1-5% of their capital to BTC.

Ripple CEO Brad Garlinghouse said that the launch of the Ethereum-ETF will open the door for other cryptocurrencies to enter the ETF market. He believes the emergence of XRP-based spot exchange-traded funds is "inevitable." Other ETF contenders could include Solana (SOL) and Cardano (ADA).

FTX, which is in bankruptcy proceedings, has settled a lawsuit by the US Internal Revenue Service (IRS). According to the parties' settlement agreement, the agency will receive, at best, $885 million from FTX instead of the $24 billion originally sought.

The company behind StarkNet, StarkWare, intends to make the L2 network a single level of scaling for the first cryptocurrency alongside Ethereum. This requires implementing the OP_CAT update to Bitcoin, which will bring smart contract functionality back to the blockchain.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)