Crypto’s landslide; Bitcoin’s trying to form a trough

Market picture

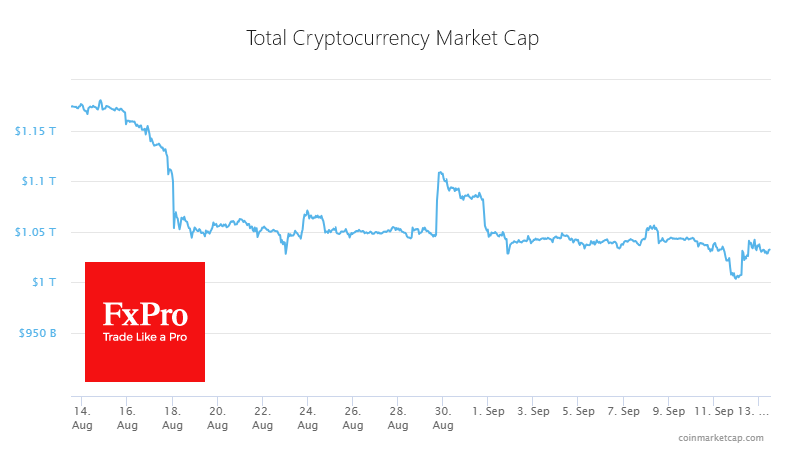

We saw another attempt to shake up the crypto market on Monday and Tuesday. Still, the balance sheet quickly recovered with a total capitalisation of $1.033 trillion, just as before Monday's $1 trillion failure. On a broader basis, the market is still sliding down bit by bit, as the equilibrium level was closer to 1.05 from the 18th to the 30th of August, dropping to 1.04 in early September, and is now hovering just above 1.033.

The technical picture of Bitcoin is beautiful in its ambiguity. BTCUSD failed spectacularly and bounced from 25k at the beginning of the week, reinforcing the belief that this price is an inflexion point. It also rallied from there in June and accelerated higher in March. From August last year to February this year, it repeatedly played the role of resistance.

On the other hand, a death cross has formed on the daily timeframe, which means that more traders focused on long-term technical analysis will be looking to sell on the upside.

On Wednesday and Thursday, Bitcoin may have no problem rising from the current $26.0K to $26.4K. The question is whether this will cause the sell-off to intensify.

News background

Volatility, liquidity, trading volume and the amount of bitcoin value transferred on the chain are at historic lows, according to Glassnode. This reinforces the likelihood that the market has entered a period of extreme apathy and exhaustion, suggesting significant price fluctuations soon.

Matrixport enabled the collapse of altcoins by selling FTX. Experts pointed to the court decision that allowed the bankrupt exchange's creditors to sell $3.4 billion worth of cryptocurrencies as early as this week.

The Lightning Network (LN) could solve the resource-intensive process of sending money between countries and bring global payments out of the "fax era", said Lightspark CEO and former head of Meta's blockchain division David Marcus.

Payments giant PayPal has launched a service to convert cryptocurrencies into US dollars directly through wallets. The company previously integrated the ability to buy cryptocurrency with fiat.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)