Daily Comment – Dollar falls amid trade war escalation

Trade war 2.0 has begun

It’s all about tariffs nowadays, with US President Trump reiterating his intention to proceed with reciprocal tariffs at his first speech to Congress since taking office. Following the imposition of duties on Canada, Mexico and China, the US President said that further tariffs would follow on April 2, including reciprocals, aimed at balancing out years of trade imbalances.

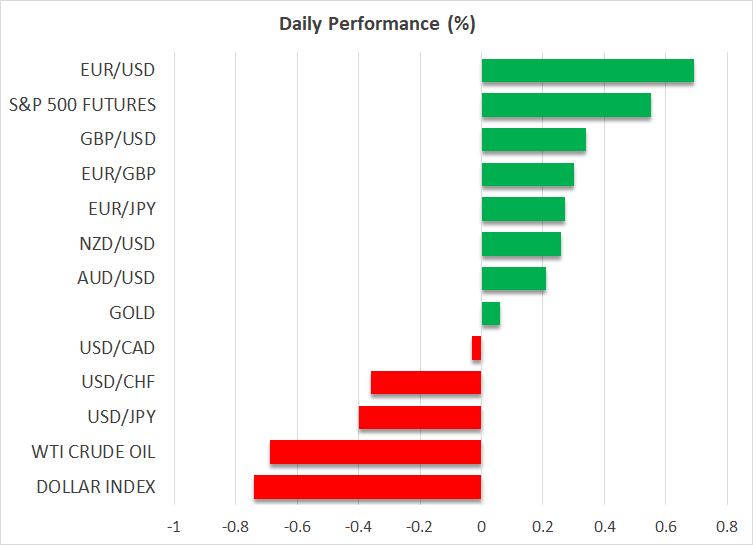

The dollar extended its tumble against most major currencies, corroborating the notion that traders are not so worried about tariffs refueling inflation but seem increasingly concerned about the growth outlook of the US economy, which is already showing signs of weakness. This is also evident by the fact that heightening trade tensions are leading investors to increase their Fed rate cut bets instead of reducing them.

ISN non-mfg. PMI enters the spotlight

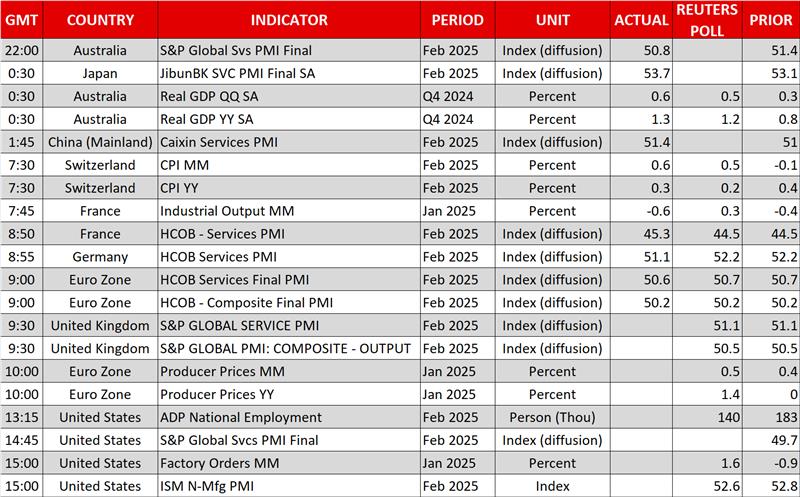

Following the softer-than-expected ISM manufacturing PMI for February, investors today are likely to lock their gaze on the ISM non-manufacturing index as the service sector accounts for more than 75% of US GDP. In January, this PMI dropped from 54 to 52.8 and another decline may increase worries about the performance of the world’s largest economy and the US dollar may extend its decline.

The Atlanta Fed GDPNow estimate, which pointed to a 2.8% contraction for the first quarter of 2025, may be revised lower if the weakness in the US data continues, something that makes Friday’s NFP report also extra important.

Euro gains after German debt brake agreement

The euro took big advantage of the dollar’s weakness as it benefited from news that the parties discussing to form a governing coalition in Germany agreed to loosen borrowing rules to allow for higher military spending and revive growth. The news suggests that a coalition now is more likely than a few days ago and eases some political uncertainty at a time when the Eurozone may also need to deal with Trump’s tariffs.

Despite the risk aversion, the aussie and the kiwi gained against the dollar, extending their gains today as well. The former was probably boosted by Australia’s better-than-expected GDP data, while the latter shrug off news that RBNZ Governor Adrian Orr suddenly resigned, three years before his term ends.

Wall Street bleeds, gold attracts more safe-haven flows

On Wall Street, all three of the main indices extended their losses with the Dow Jones bleeding the most. The imposition of tariffs on imports from Canada, Mexico, and China, the retaliation of China and Canda, the pledge of Mexico to also respond and other nations biting their nails awaiting what is in store for them, constitute the beginning of a trade war that could not only raise prices for Americans but also slam economic growth.

That said, Chinese equities traded in the green after authorities announced more fiscal support aimed at boosting consumption and protecting economic growth amid a new trade war with the US. The Shanghai Composite gained 0.53%, while Hong Kong’s Hang Seng rallied nearly 3%.

In a risk-averse environment, the ultimate safe haven gold continued attracting flows, getting closer to its record high of $2,956, hit on February 24. With Chinese officials appearing willing to safeguard their economy, the PBoC may also accelerate its gold purchases to further loosen its dependency on the US dollar.

Oil prices stabilized as WTI bulls continued seeing the $67 zone as an attractive entry point. That said, unfavorable supply-demand dynamics may continue to weigh on prices, with tariff uncertainty posing extra risks to the demand side. Thus, the key floor of $67 may not hold for long this time around.

.jpg)