Trump announces tariffs on Mexico and EU

Dollar strengthens on more safe haven inflows

The US dollar gained against nearly all its peers on Friday, and continued to march north today, mainly driven by safe haven flows as US President Trump continued threatening the US’s trading partners with more tariffs.

Last week, Trump said he would impose 25% tariffs on goods from Japan and Korea, then threatened Brazil with a 50% levy and other partners with lower rates, while on Thursday, he issued a letter that said a 35% tariff rate will apply on all imports from Canada.

But that was not the end of Trump’s attacks. Although he extended the deadline for such tariffs to be implemented to August 1, on Saturday, he threatened to impose a 30% tariff on imports from Mexico and the European Union.

Inflation risks turn the spotlight to CPI data

Apart from his tariff-related threats, Trump took the opportunity on Sunday to attack Fed Chair Jerome Powell for the umpteenth time. He said that it would be a “great thing” if Powell stepped down, calling once again for interest rates to be lowered.

However, according to Fed Fund futures, investors have not changed their view on the future path of interest rates. They continue to expect 50bps worth of rate cuts by the end of the year, while the probability of a quarter-point reduction at the upcoming meeting remains low at 7%.

Perhaps Trump’s new tariff threats are keeping traders concerned about the upside risks of inflation, despite his desire and repeated calls for lower interest rates. This suggests that tomorrow’s CPI data may attract special attention. Although the slide in the prices subindex of the ISM non-manufacturing PMI poses some downside risks, the actual forecast of the headline CPI rate is for an increase to 2.6%, even with the year-on-year change in oil prices being negative. This means that underlying inflation may accelerate as well.

Sticky inflation could wipe out the possibility of a July rate cut and may allow the US dollar to gain a bit more. However, it is too early to argue that the broader outlook of the world’s reserve currency has turned bullish. Should tariffs start impacting not only inflation, but the US’s economic activity as well, investors may lose more trust in US assets, thereby selling dollars again.

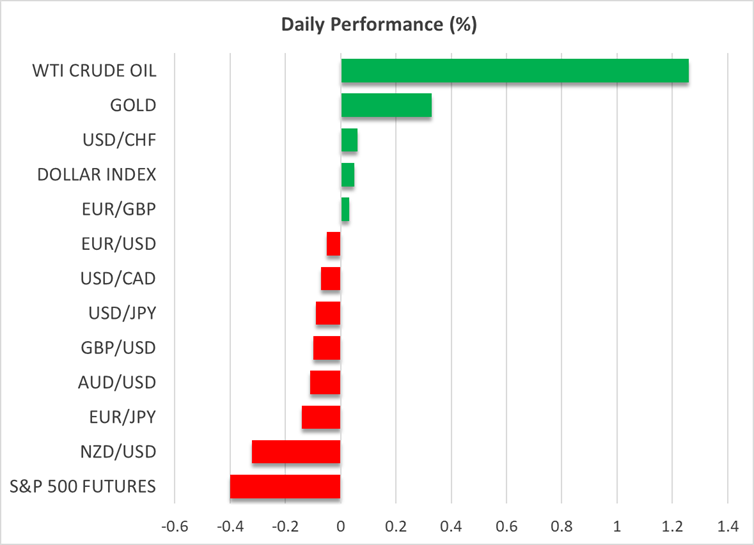

Wall Street slides, gold rises, Bitcoin at record highs

On Wall Street, all three of its major indices closed in negative territory on Friday, with the Dow Jones losing the most, while stock futures are pointing to a lower open today. Combined with the spike in the VIX index, this confirms investors’ anxiety over the global trade landscape.

However, the market reaction is nowhere near close to the selloff that followed April’s ‘Liberation Day.’ It seems that investors are still holding the view that Trump is using tariffs as a negotiating tool for securing the deals he wants. Nonetheless, should August 1 come without meaningful accords and the duties take effect, investors may start behaving differently.

Gold also reflected the risk-off mood, as it moved higher notwithstanding the dollar’s advance. The precious metal could be headed for the high of June 16 at around $3,450, the break of which could pave the way for the record high of 3500 hit on April 22.

In the crypto sphere, bitcoin rallied to a fresh record high of $123,153.22 today, driven by accelerating inflows into bitcoin ETFs. This suggests that the rally is driven by long-term institutional buyers as the so-called ‘Crypto Week’ begins today, where a series of crypto-related bills will be debated in the House of Representatives.

.jpg)