Dollar bounces from six-week low, BoC decides on rates

Dollar rebounds on trade-talk hopes

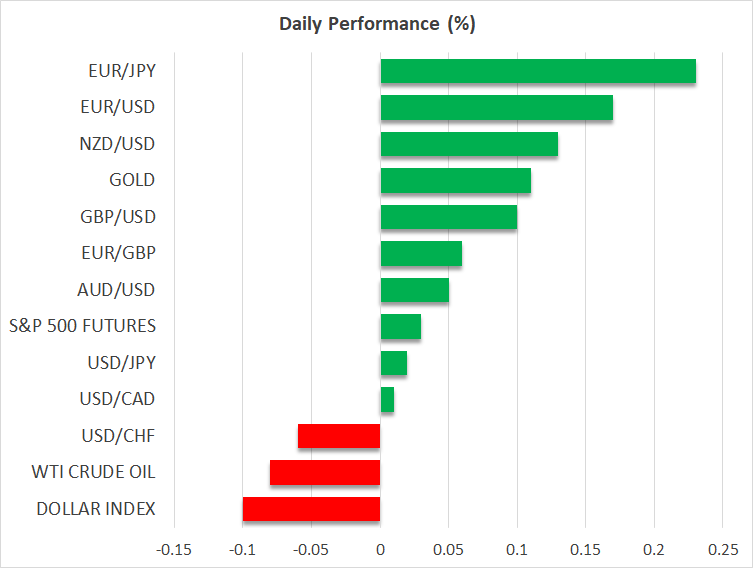

The US dollar rebounded against all its major counterparts on Tuesday, and it is extending its gains today, perhaps due to White House announcement that President Trump will likely have a call with Chinese President Xi Jinping to sort out the trade-related conflict between the world’s two largest economies.

The news confirms once again an observed pattern amidst all this trade turbulence. Usually, soon after Trump toughens his rhetoric and stance, softer headlines that promote willingness of finding common ground emerge.

Having said that though, the increase on steel and aluminum duties to 50% took effect today, while the Trump administration has been pressing its main trading allies to provide their best offer by today. This is likely to keep the dollar’s rebound in check, although traders may also pay extra attention to economic data as they try to better assess how Trump’s strategy has been affecting the broader outlook.

US data suggests softness

On Monday, the ISM manufacturing PMI revealed that factory activity contracted further in May, mainly due to a tumble in imports. Although the employment index improved somewhat, it remained below the boom-or-bust zone of 50 as well. Yesterday, the JOLTS job openings for April increased, but this was in tandem with a pickup in layoffs, which suggests that the labor market may be feeling the impact of Trump’s trade decisions.

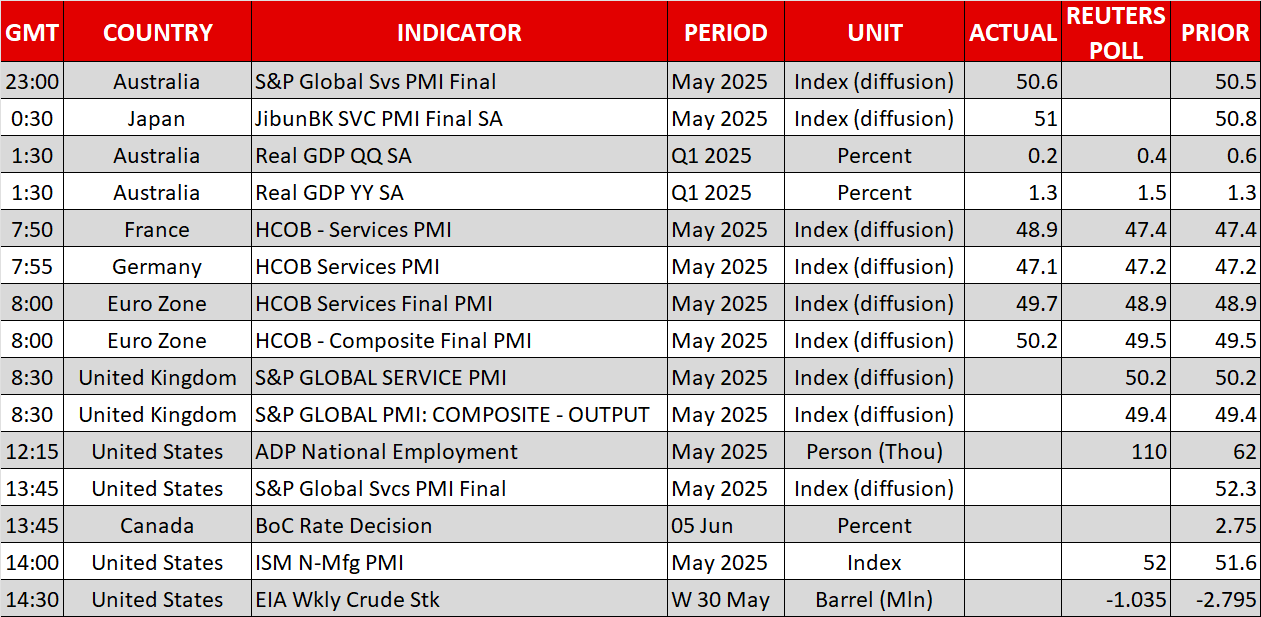

Today, the ADP report on private employment will provide a glimpse of how the labor market did in May, but the spotlight is likely to fall on the NFP report on Friday, where payrolls are expected to have increased by 130k and the unemployment rate to have held steady at 4.2%. The ISM non-manufacturing PMI is also on today’s agenda.

Eurozone inflation cools, BoC to remain sidelined

Flying to Europe, the euro came under selling interest after the Eurozone CPI data revealed that headline inflation slipped a tick below the ECB’s 2% objective and that the core rate dropped from 2.7% y/y to 2.3%. Following the soft PMIs for May, the inflation numbers are adding credence to the idea that the ECB will accompany its expected rate cut with a dovish message tomorrow.

Speaking of central banks, today, the BoC will announce its own monetary policy decision and expectations are for policymakers to remain on hold. In April, the Bank's officials decided to keep their hands off the rate cut button, ending a streak of seven straight reductions and turning more cautious about the inflation outlook.

The CPI data for April revealed that Canadian inflation slowed to 1.7% year-over-year from 2.3%, but this was due to the removal of the carbon tax that notably reduced energy prices. After all, the median and trimmed mean metrics rose to 13-month highs. Thus, the Bank may sound concerned about inflation again, something that may prompt investors to push back the timing of when they expect the next rate cut and thereby add more fuel to the loonie’s engines.

Stocks get closer to record highs, geopolitics push oil higher

On Wall Street, all three major indices closed in positive territory, perhaps due to the easing concerns about further tensions between the US and China. Although the risk for another episode of escalation remains elevated, stock traders are becoming even more desensitized to trade headlines. They may be holding the view that when Trump is turning more aggressive, this is just a strategy to leverage his position and then scale back to what he actually wants to achieve.

The strengthening of the dollar and the advance in equities pushed gold lower, but oil prices extended their gains on renewed geopolitical concerns as the heightening tensions between Russia and Ukraine, and news that Iran is poised to reject the US’s nuclear proposal, are suggesting that sanctions on both Russia and Iran will remain in place for longer.

.jpg)