Dollar clings to trend

Dollar clings to trend

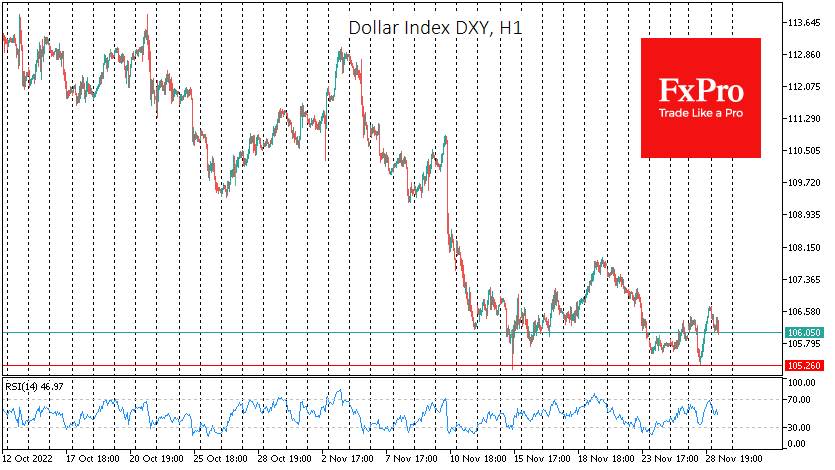

The dollar index started on Monday with a pullback and made an impressive reversal, adding 1.3% to the intraday lows. Comments from Fed officials again dashed hopes of an interest rate cut soon.

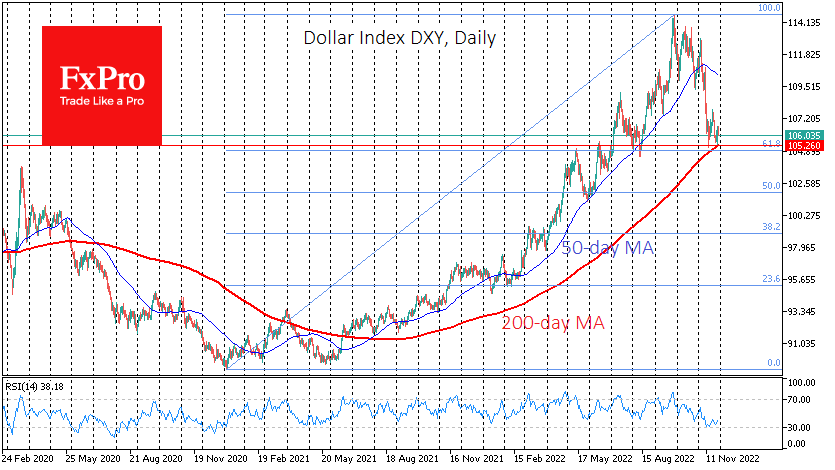

The dollar gained significant support, one step away from an important technical frontier, increasing the risks that the bulls on the US currency will fight to maintain the trend that has prevailed since the middle of last year.

Active buying in the USD index started on Monday, just after it reached the area of the 200-day MA at 105.26. Earlier this year, we saw more than one bull and bear fight near 105. Yesterday's sharp rally in the index suggests that the struggle in this area will be harsh this time too.

The two-month drop of the dollar from the peak might be just an overbought correction because, till now, the DXY has not crossed over the 200-day MA, and it is still above the 61.8% Fibonacci line.

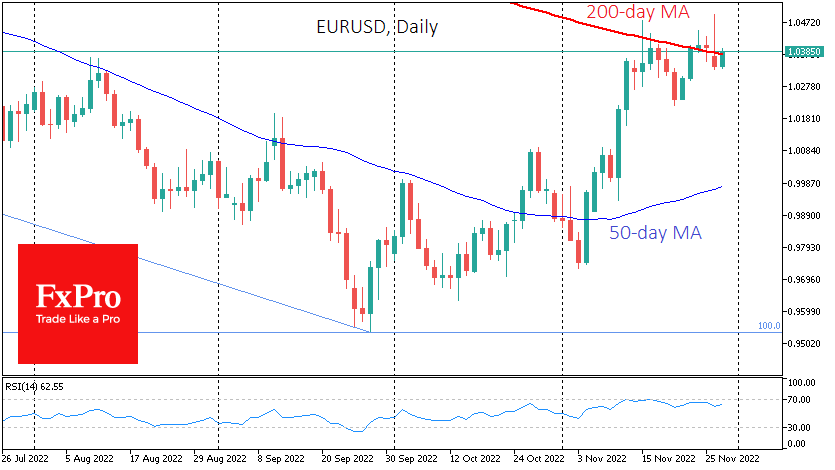

In the EURUSD, the local picture is even more on the side of the USD buyers as they managed to take the pair back under their 200-day MA after touching the 5-month highs and closed the day lower. This is a strong signal from the bears, which could be a new turning point and prolong the dollar rally for months.

Nevertheless, there is no denying that the coming days and weeks will be full of struggles for the long-term trend. For now, there are more signals that the dollar’s peak is behind us. The US economic cycle is a couple of quarters ahead of developments in Europe and Japan, implying that the Fed was the first to start changing policy and finish this normalisation.

Fed officials are in the process of switching to a new phase where they are not fighting rising inflation but the risks of a hiccup. The FOMC should expect fewer rate hikes in the next 2-4 meetings and then take a long pause. In contrast, the ECB continues to talk about the need for further steep hikes and finalises the parameters for how the balance sheet will be reduced.

For investors and traders, this means that in the coming months, we will see a convergence of monetary policy parameters between the Fed and other major central banks, which promises to swing demand away from the dollar. One of the macro impacts of de-globalisation is higher inflation. And this process will affect Europe to a greater extent, as they will have to find new ways of obtaining energy and markets. This political outlook means that in the long term, central banks in the Old World will have to do more work to contain inflation, which will work against the dollar.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)