Dollar Dominance Rises: Treasuries Surge

The U.S. dollar continues its relentless ascent, fueled by soaring Treasury yields and Federal Reserve rate hikes expectations. Recent data, including a robust uptick in U.S. Core Durable Goods Orders, further solidify the dollar's position. Gold, in contrast, has dimmed as it hits a six-and-a-half-month low, succumbing to the pressure of rising yields and a strong dollar. Oil prices surged on bullish inventory data despite the dollar's rise. The Dow faced headwinds from surging Treasury yields, while the Pound Sterling's decline reflects a bleak UK economic outlook. AUD/USD and Japanese yen remain in the grip of the dollar's dominance.

------------------------------------------------------------------------------------------------------------------------------------------------------------ Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.0%) VS 25 bps (22%)

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Market Movements

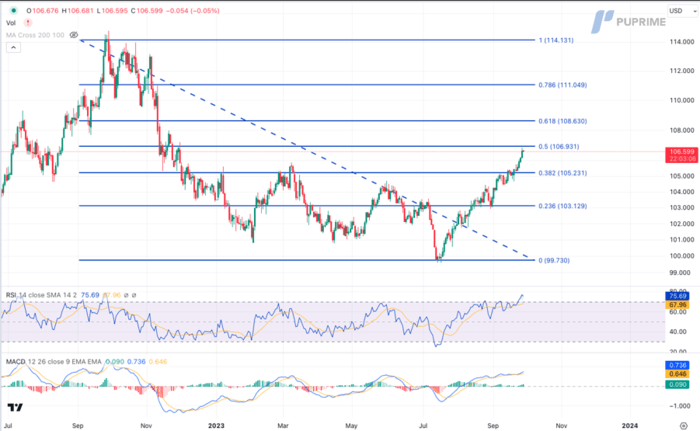

DOLLAR_INDX

The U.S. dollar's meteoric rise persists, bolstered by a relentless surge in the U.S. Treasury yields. These yields have recently scaled impressive heights not witnessed since the heady days of July 2007, signalling a seismic shift in the financial landscape. Further emboldening the greenback's ascent are robust economic indicators. The Census Bureau's revelation of an impressive uptick in U.S. Core Durable Goods Orders, from a meagre 0.10% to a substantial 0.40%, surpassed market forecasts.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the index might enter the overbought territory.

Resistance level: 106.95, 108.65

Support level: 105.25, 103.15

XAU/USD

Gold, traditionally considered a haven in times of market turbulence, has recently witnessed its lustre fade. The precious metal tumbled to a six-and-a-half-month low after breaking the psychologically significant support level of $1900 per troy ounce. This downward spiral is largely attributed to the relentless surge in U.S. Treasury yields and the commanding performance of the U.S. dollar.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the commodity might enter oversold territory.

Resistance level: 1885.00, 1900.00

Support level: 1875.00, 1855.00

BTC/USD

The cryptocurrency market, often considered a high-risk asset class, is not immune to the ripple effects of rising bond yields. As investors grapple with the evolving landscape of Federal Reserve monetary policy, Bitcoin and its peers are feeling the squeeze. The bond yield surge prompts caution among cryptocurrency enthusiasts as they navigate an uncertain terrain.

BTC/USD is trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting BTC/USD might extend its losses after its breakout of the support level since the RSI stays below the midline.

Resistance level: 27335, 28115

Support level: 25990, 25110

GBP/USD

A downward trajectory has plagued Pound Sterling, weighed down by a gloomy economic forecast. Experts anticipate that the UK's economic woes, compounded by persistent inflation and a labour shortage, will result in contractions in both 2023 and 2024. In stark contrast, the Eurozone and the United States appear poised for growth during these periods. This lacklustre economic outlook for the UK is expected to continue to pummel the value of Pound Sterling.

GBP/USD is trading lower following the prior breakout below the previous support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 77, suggesting the pair might enter oversold territory.

Resistance level: 1.2190, 1.2370

Support level: 1.2040, 1.1935

AUD/USD

The Australian dollar (AUD) finds itself locked in a protracted slide against the resurgent U.S. dollar. Investors are now closely monitoring the upcoming monetary decisions of the Reserve Bank of Australia (RBA). The persistently high Consumer Price Index (CPI), well above the RBA's target range of 2-3%, suggests that the central bank may maintain a hawkish stance.

The AUD/USD is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 32, suggesting the pair might enter oversold territory.

Resistance level: 0.6395, 0.6510

Support level: 0.6285, 0.6205

Dow Jones

The Dow Jones Industrial Average has experienced headwinds as surging Treasury yields continue to exert pressure on U.S. equities. The 10-Year Treasury yield's recent ascent to a formidable 4.63% marks a fifteen-year high. As yields rise, they become more attractive to investors seeking secure returns by purchasing US bonds, leading to a reallocation of funds away from stocks, thereby dampening stock market performance.

The Dow is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, RSI is at 33, suggesting the index might enter oversold territory.

Resistance level: 33590.00, 34355.00

Support level: 32745.00, 31645.00

USD/JPY

The Japanese yen is experiencing a pronounced selloff, largely attributed to the growing yield differentials between the U.S. dollar and the Japanese yen. The U.S. dollar's latest ascent has brought the USD/JPY pair tantalisingly close to the psychological threshold of 150 per dollar. Traders remain on high alert for potential interventions by Japanese authorities, ramping up their rhetoric to counter the yen's slide.

USD/JPY is trading higher following the prior breakout above the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the pair might enter overbought territory.

Resistance level: 150.25, 151.45

Support level: 148.50, 146.25

CL OIL

The oil market is ablaze with bullish fervour, propelled by favourable inventory data. The Energy Information Administration (EIA) unveiled a significant drawdown in U.S. oil inventories, shrinking by a notable -2.170 million barrels, outstripping market expectations. This substantial decrease underscores robust oil demand, coupled with constrictions in supply—particularly the ongoing production cuts from industry titans Saudi Arabia and Russia.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the commodity might enter the overbought territory.

Resistance level: 94.40, 101.00

Support level: 87.80, 79.65