Dollar eases from 158 yen as BoJ rate hike bets boosted slightly

No end in sight to dollar’s strength

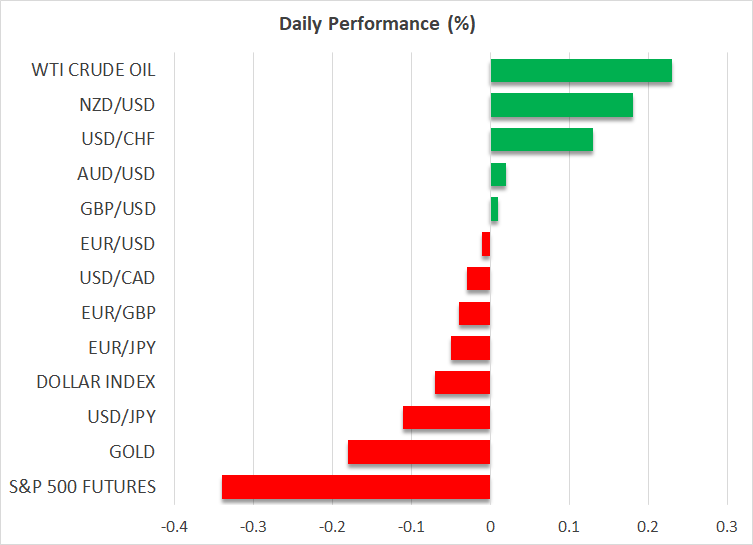

The US dollar was slightly firmer on Friday against a basket of currencies, maintaining the pressure on European currencies like the euro, pound and franc, but losing some ground against the yen and Canadian dollar.

US Treasury yields continue to edge higher, with the 10-year yesterday hitting a near eight-month peak of 4.64%. Expectations that the Federal Reserve will have little room to trim rates in 2025 amid a strong economy, sticky inflation and price-boosting polices by Trump have stymied the Fed’s hope to slash borrowing costs from decades highs.

Consequently, the dollar is on track for its third straight monthly gains and to finish the year more than 6.5% higher.

This week’s data have only reinforced the robust picture for the US economy. Core capital goods orders jumped by 0.7% m/m in November and weekly jobless claims fell to 219k. There was, however, a bigger-than-expected increase in continued jobless claims, which underlined the cooldown in the US jobs market even if massive layoffs aren’t on the horizon just yet.

Yen modesty lifted by rate hike expectations

In contrast, the Japanese yen is the worst performing major currency of 2024 despite the Bank of Japan’s historic move to end years of ultra-accommodative policies. Last week’s decisions by the Fed and BoJ underscored the headaches the yen is facing as the former is cautious about cutting rates while the latter is hesitant about hiking them.

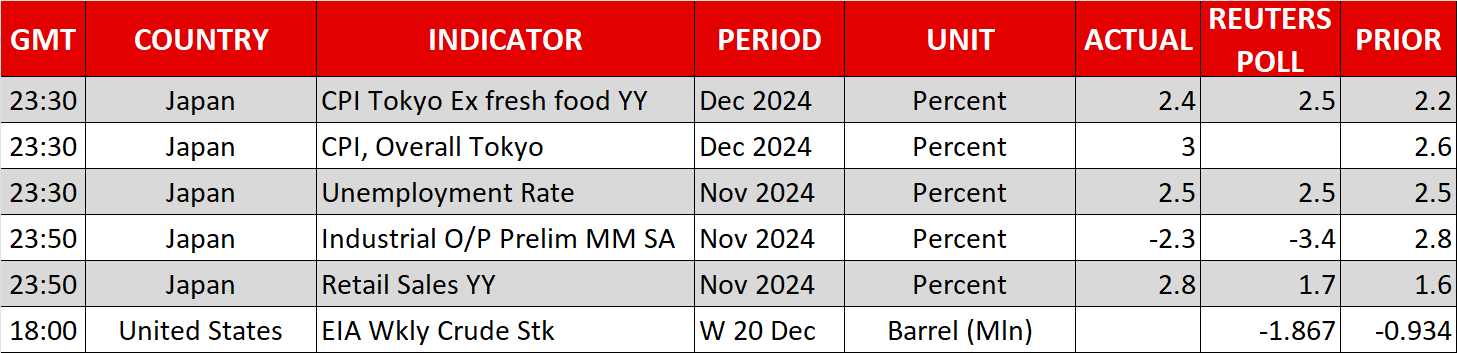

There was a slight boost for the beleaguered yen overnight, however, as data showed that core inflation in the Tokyo region accelerated to 2.4% y/y in December, while overall CPI jumped to a one-year high of 3.0%.

BoJ keeps open mind about January hike

More importantly, the Summary of Opinions of the BoJ’s December policy meeting suggested that a rate increase could come sooner than what markets were led to believe by Governor Ueda in his post-meeting remarks. Speaking on Wednesday, Ueda again avoided giving any explicit signals about the timing of the next rate hike, but the Summary published today appeared to keep the door for a January move wide open.

Uncertainties about domestic fiscal policy and the threat of tariffs by the incoming Trump administration may have been a factor for keeping rates unchanged in December. The Japanese government just approved its largest budget ever for the next fiscal year but passing it through parliament may be trickier after the LDP party lost its majority in October’s snap election.

Nevertheless, both the data and rhetoric by policymakers support expectations for further rate increases and the only question mark is the timing. Bets of a 25-basis-point hike in January inched up slightly today, helping the yen appreciate below 158 per dollar after brushing five-month lows yesterday.

Fresh verbal intervention against the yen’s sharp slide this month further supported the currency on Friday. Japan’s finance minister again warned that the government will take “appropriate action” against excessive moves. Still, the only modest lift in the yen indicates that near-term risks remain tilted to the downside.

Stocks lack direction

In equity markets, European shares opened mostly higher after the Christmas break, even though shares in Asia were mixed and US futures were in the red. A third consecutive month of year-to-date declines in Chinese industrial profits in November weighed on sentiment in Asia.

On Wall Street, meanwhile, the tech rally lost some steam on Thursday, with the S&P 500 and Nasdaq closing virtually flat.

.jpg)