Markets await trade deals as Trump makes new tariff threats

New threats and extensions

The dreaded July 9 deadline for countries to reach trade deals with the United States is only two days away and President Trump has already pushed it back, amid signs of both progress and frictions. Despite promises of 90 deals in 90 days, the US has so far agreements in place only with the UK, China and Vietnam.

Negotiations with other countries are ongoing, with the focus being primarily on the 18 trading partners that make up 95% of the US deficit, according to Treasury Secretary Scott Bessent. Several deals such as with India, the European Union, Switzerland, Indonesia and Thailand could be announced in the next few days.

However, Trump has warned that starting today, he will send letters to about 12-15 countries that he’s not happy about the progress, effectively setting the tariff rate unilaterally if no deal has been struck by the new deadline of August 1. About 100 smaller countries already face the higher levy rates that were imposed then delayed on April 2.

But as is now to be expected from Trump, there is a new twist to the tariff saga, as he’s threatening to slap an additional 10% duty on all countries who align themselves with the BRICS organization, which is made up of Brazil, Russia, India, China and South Africa.

Higher yields prop up dollar but are a drag on gold

Markets have brushed off the fresh confusion and drama from over the weekend, however, as the pushing back of the July 9 deadline by three weeks has been taken as a sign that the Trump administration is keener to get trade agreements in place than to re-escalate tensions.

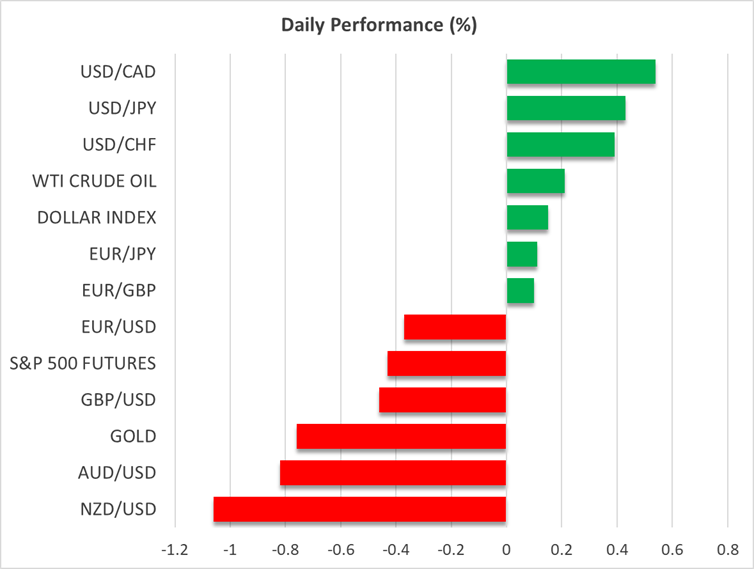

The US dollar is trading slightly higher today, extending its post-NFP gains from last Thursday when the solid June jobs report led to a significant paring back of rate cut expectations for 2025.

Still, the dollar’s gains are very modest when considering its year-to-date losses and this is a reflection of the ongoing caution, not just about whether higher tariffs with most nations can be avoided, but also about the growing concerns about the budget deficit.

The House of Representatives finally passed Trump’s ‘big, beautiful bill’, just in time for the President to sign it into law on July 4 when America celebrates its Independence Day. The bill is expected to add at least $3 trillion to US debt, and combined with the upbeat payrolls numbers, Treasury yields have been ticking higher in recent days, with the 10-year yield rising 15 basis points from last week’s lows.

This is supporting the dollar but potentially weighing on gold, which has slid to around $3,310 today, even though uncertainty about trade deals remains as high as ever and there’s been some flare-ups in the Middle East after Israel attacked Houthi targets in Yemen earlier on Monday.

Not a good start to the week for the aussie, kiwi and yen

Amid the wait for trade deal announcements, there are two central bank decisions that should preoccupy investors, while the Fed is due to publish the minutes of its June meeting on Wednesday.

The RBA and RBNZ will set rates on Tuesday and Wednesday, respectively, with the former expected to cut by 25 bps and the latter to stay on hold. Both the Australian and New Zealand dollars are sharply down today.

Neither Australia nor New Zealand appears to be close to striking some kind of a trade agreement with the US, and with time running out, investors may now be panicking about the prospect of the Antipodean countries having to pay the higher reciprocal tariffs on August 1.

Japan’s trade talks with the US also don’t seem to be going as well as hoped. It is thought that Japan is included in the list of countries that’s due to receive a letter from Trump over the coming days, if not today, as the initial good progress has stalled.

The dollar is back above the 145-yen level today, and the yen is also down against its other major peers.

Stocks continue to shrug off trade risks, oil off lows

Equity markets are mixed, however, where optimism continues to prevail. Shares on Wall Street rallied on Thursday to new all-time highs following the stronger-than-expected NFP report, which eased fears of a US recession. Even though investors no longer think the Fed will cut rates more than two times this year and a July move has been taken off the table, the ongoing resilience of the labour market appears to have impressed traders.

US futures are slightly lower, though, today, and it’s an overall subdued mood as more information is awaited on America’s trade status with the rest of the world. Tesla is a notable loser in pre-market trading.

Meanwhile, oil prices have managed to bounce back from earlier lows when futures dipped after OPEC+ decided on Saturday to increase production by 548,000 barrels a day. This is more than the 411,000 hike decided in previous months and concerns are rising about a possible supply glut, although it should be noted that actual output has yet to match the set targets.

.jpg)