Dollar extends gains, kiwi tumbles after RBNZ

Are investors bracing for a hawkish speech by Powell?

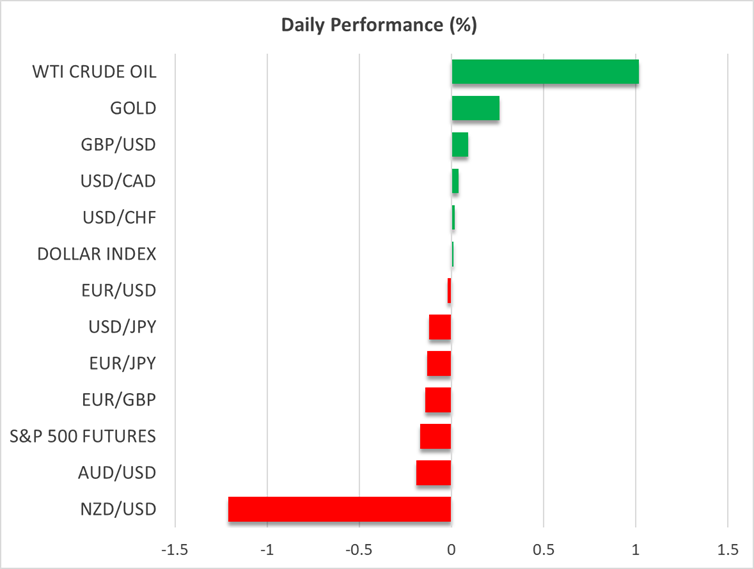

The US dollar resumed its recovery on Tuesday gaining ground against all its major peers, except the Japanese yen. The same pattern continued today, with the greenback gaining the most against the kiwi and slightly underperforming versus its Japanese counterpart.

Dollar traders seem to be discounting a relatively hawkish message by Fed Chair Powell at Jackson Hole on Friday and thus, if this is the case, further advances in the aftermath of the speech may prove limited.

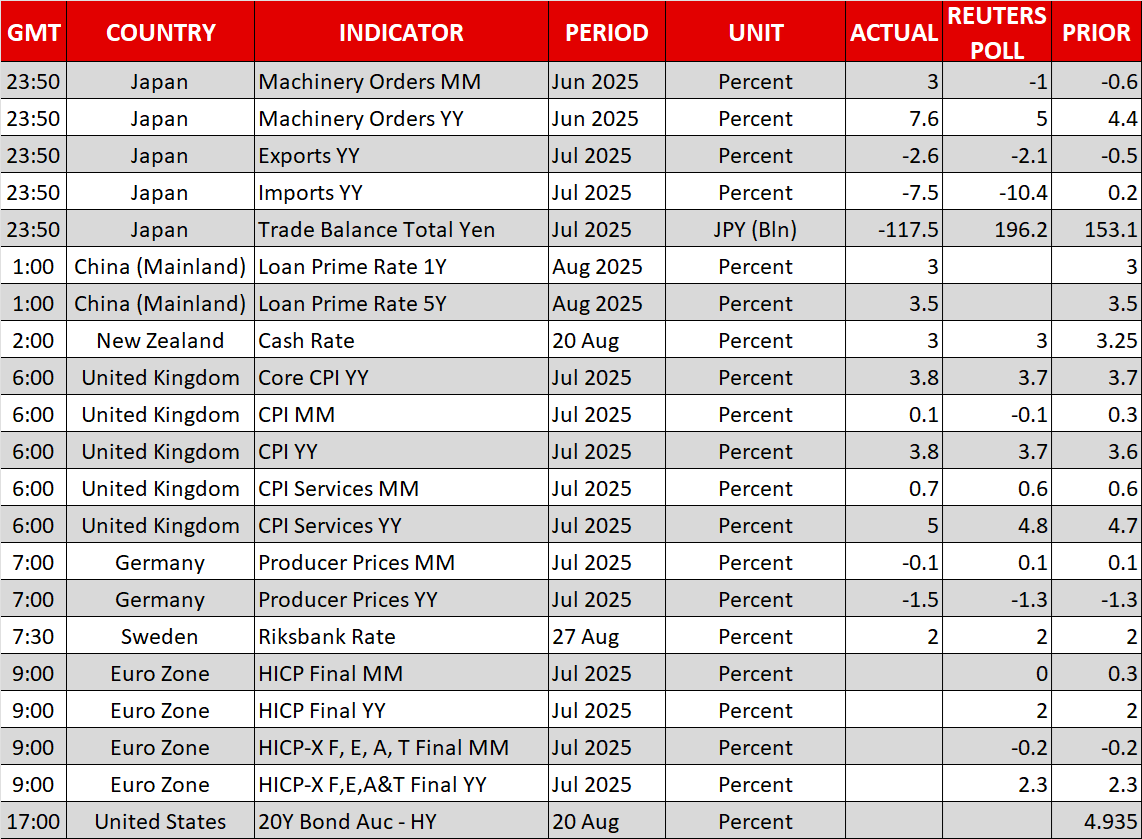

Rate cut bets were boosted following a weak July jobs report and after the CPI report suggested limited tariff-induced inflation. That said, investors got a reality check after the hotter-than-expected producer price data. They are currently assigning an 80% chance of a 25bps rate cut in September, while the total number of basis points worth of reductions by the end of the year stands at 55.

Thus, even if Powell keeps the door wide open to a September cut, as long as he does not pre-commit to additional reductions from there onwards, his message may be interpreted as hawkish.

Today, the Fed will release the minutes of its latest policy gathering, but market participants are likely to treat them as outdated, given that the meeting took place before the disappointing jobs report and the inflation data for July.

BoJ hike calls fuel the yen, kiwi tumbles on RBNZ decision

The yen continued to shine following remarks by a Japanese official that the BoJ must raise interest rates to strengthen a weak yen that has pushed up inflation, while the kiwi fell off the cliff today after the RBNZ cut interest rates by 25bps to 3.0%, revealing that there was discussion about a double reduction. Additionally, policymakers signaled that more rate cuts are underway, lowering their projected floor for interest rates from 2.85% to 2.55%.

All this suggests that the divergence between the BoJ and the RBNZ may be the widest among major central banks, increasing the likelihood of further declines in the kiwi/yen pair, which fell as much as 1.4% today, following a 0.4% retreat yesterday.

Elsewhere, the loonie was also hurt yesterday, as the softness in Canada’s CPI data bolstered the case for further rate cuts by the BoC, while the pound held relatively steady today, not surrendering to the dollar’s strength as UK consumer prices accelerated to 3.8% y/y from 3.6%, corroborating the BoE’s view that the already gradual pace of its rate cuts should slow further. According to the UK Overnight Index Swaps (OIS), the next rate cut by the BoE is expected in March 2026.

Stocks and Bitcoin retreat as investors reduce risk exposure

On Wall Street, both the S&P 500 and the Nasdaq slid, with the latter losing almost 1.5% during yesterday’s session, which adds to the notion that investors may be bracing for a hawkish speech by Fed Chair Powell, even after US President Trump attacked him again yesterday, saying that he is hurting the housing industry by not lowering interest rates.

The Dow Jones hit a new record high yesterday and closed the day fractionally in the green, helped by gains in Home Depot shares after the company kept its yearly projections intact. That said, it could join the other two indices if indeed Powell sounds hawkish on Friday, but in the absence of recession concerns, any further declines on Wall Street could remain limited.

Ahead of the Jackson Hole Symposium, investors reduced their exposure not only to equities, but to Bitcoin as well, with the crypto king falling to a two-week low of $112,578 earlier today, before rebounding somewhat.

.jpg)