Dollar fights an uphill battle amidst mounting tariff pressure

Dollar is swimming upstream

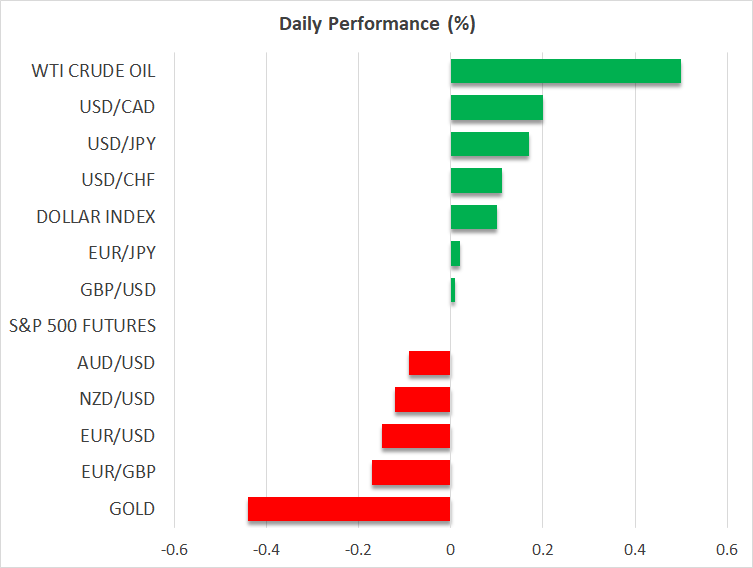

The US dollar continues to exhibit some signs of life, but it is still meeting strong resistance from unwilling investors who remain extremely negative about the greenback’s short-term outlook. Euro/dollar is hovering around 1.1720, and pound/dollar is trading a tad below its recent four-year high.

Interestingly though, dollar/yen is currently on a steep upleg, approaching the critical 146.48-147.72 area, which has acted as a ceiling numerous times. Dollar/yen is up 1.6% this week, and if this gain is maintained, it will be the strongest weekly rally since mid-December 2024.

Tariffs remain in the spotlight

One of the key reasons for this continued market distaste for US assets is Trump’s tariff strategy, which has notched up a gear after last week's approval of the US budget bill. The latest episode in the tariff saga is the 50% tariff on copper announced overnight. The start date for this critical commodity is yet unknown, with most market participants predicting implementation within the next 30 days. Similarly, semiconductors and pharmaceuticals are also going to face import tariffs, but additional information has been scarce.

Meanwhile, at least another seven countries are expected to receive the famous Trump letter today. Should the US administration continue to target smaller countries, the market impact will likely be limited. However, if the EU or India receive such a letter, investors might not be so lenient in their reaction.

That said, US equity indices are currently on the back foot, with the traditional Dow Jones Industrial Average index leading the selloff, giving back a small chunk of its recent sizeable gains. Interestingly, European stock indices are faring much better, with Germany’s DAX 40 index being up by 1.8% this week.

Regarding the EU, there are reports that a temporary "framework" agreement is nearing. This is probably a rather fancy way of saying that more time for negotiations is needed, but Trump is unwilling to miss the opportunity to advertise another success, regardless of the actual progress achieved. This tactic matches the “skeleton” agreement reached with China in early June, where many details still need to be ironed out in order to reach a comprehensive agreement, if this is indeed the target for both sides.

China’s domestic situation cannot be ignored

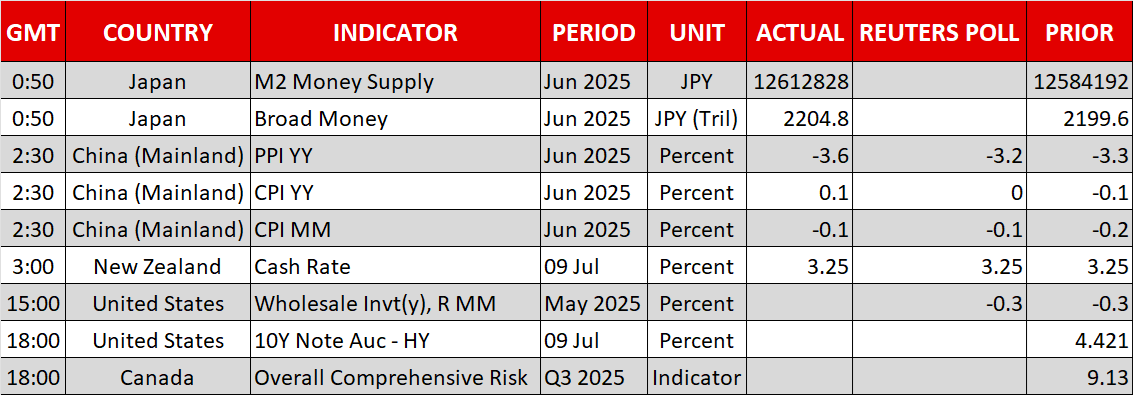

In the meantime, China continues to battle deflation. The June CPI report showed a modest 0.1% YoY increase, but the decline in PPI accelerated to -3.6% YoY, which is the fastest pace of annual producer prices decline since August 2023, maintaining deflation fears. There are growing expectations for another set of domestic-focused measures to ramp up consumption and investment, but markets are extremely skeptical of the effectiveness of such action.

Notably, Trump could also pick up on the latest set of negative inflation prints to emphasize China’s need to secure a proper deal with the US, potentially reopening the door to another round of public disagreement between the world’s strongest nations.

The Fed is always on Trump's mind

Amidst these developments, the US President has not forgotten his favorite subject: the Fed. Once again yesterday, Trump called Fed Chair Powell to resign immediately and open the way for his replacement. The latest market gossip is that Kevin Hassett, one of Trump’s closest advisers, is topping the list, along with former Fed governor Kevin Warsh, who has already been on the wires dismissing the Fed's concerns about tariffs fueling inflation.

Today, the minutes from the June 18 Fed gathering will be released. Considering the US budget bill approval and the ongoing developments on the tariff front, these minutes might prove less market-moving than usual. However, it will be interesting to see if a rate cut was extensively discussed.

RBNZ joins the rate-pause camp

Contrary to the surprise pause by the RBA, the RBNZ did not upset market expectations and kept its main rate stable at 3.25%. It maintained its relatively dovish tone, matching the RBA’s choice to wait for further information on both the domestic front and tariffs, before deciding to ease its monetary policy stance further. Similar to the aussie, the kiwi has been trying to counter the recent dollar outperformance.

.jpg)