EBC Markets Briefing | Japanese stocks remain in the doldrums

Foreign investors bought Japanese stocks for 13 straight weeks to 27 June, their longest buying spree since 2013, data from Japan Exchange Group showed.

"It's my guess that this reflects investors trying to diversify their US-concentrated portfolio," said Shuji Hosoi, senior strategist at Daiwa Securities, noting that such shifts could last about a year.

But some analysts think their buying may wane soon. "There's no sense of euphoria we saw during Abenomics" said Kohei Onishi, senior investment strategist at Mitsubishi UFJ Morgan Stanley.

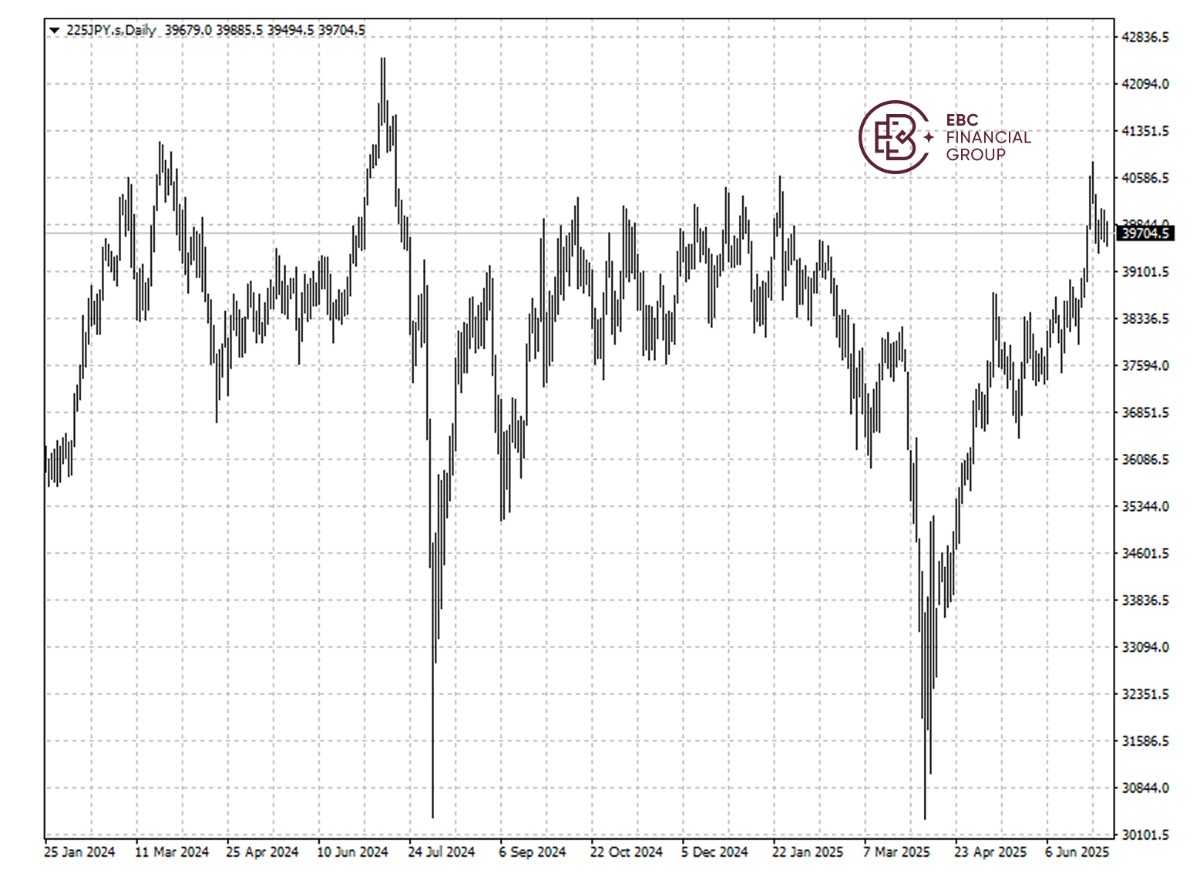

The Nikkei 225 has barely increased this year, among the worst performing major market, although the BOJ has paused interest rate hike cycle. China and Europe drew more interests due to large fiscal stimulus.

While few see Japan's stocks collapsing on a no-deal scenario, some of them forecast the index to fall into the 38,000 range, a decline of more than 4%, rather than rallying above 40,000 if there's an agreement.

The recent rally was mainly driven by entertainment-related names, while carmakers remained depressed. Nintendo shares hit a record peak in June on strong demand for Switch 2.

UBS is neutral on Japan equities overall as the Q2 earnings season that starts in late July could lead to downside over the next three months. The upcoming Upper House election is also worth some attention.

Crop and car

The world is about to get more clarity as the 90-day deadline for trade deals arrives on Wednesday. Trade is one of three pillars of Trump's agenda, along with tax cuts and deregulation.

Treasury Secretary Scott Bessent said Sunday that tariffs announced back in April will take effect next month for countries that fail to reach an agreement with the Trump's administration.

Trump on Monday began telling trade partners - from powerhouse suppliers like Japan and South Korea to minor players - that sharply higher tariffs will start August 1, marking a new phase in the trade war.

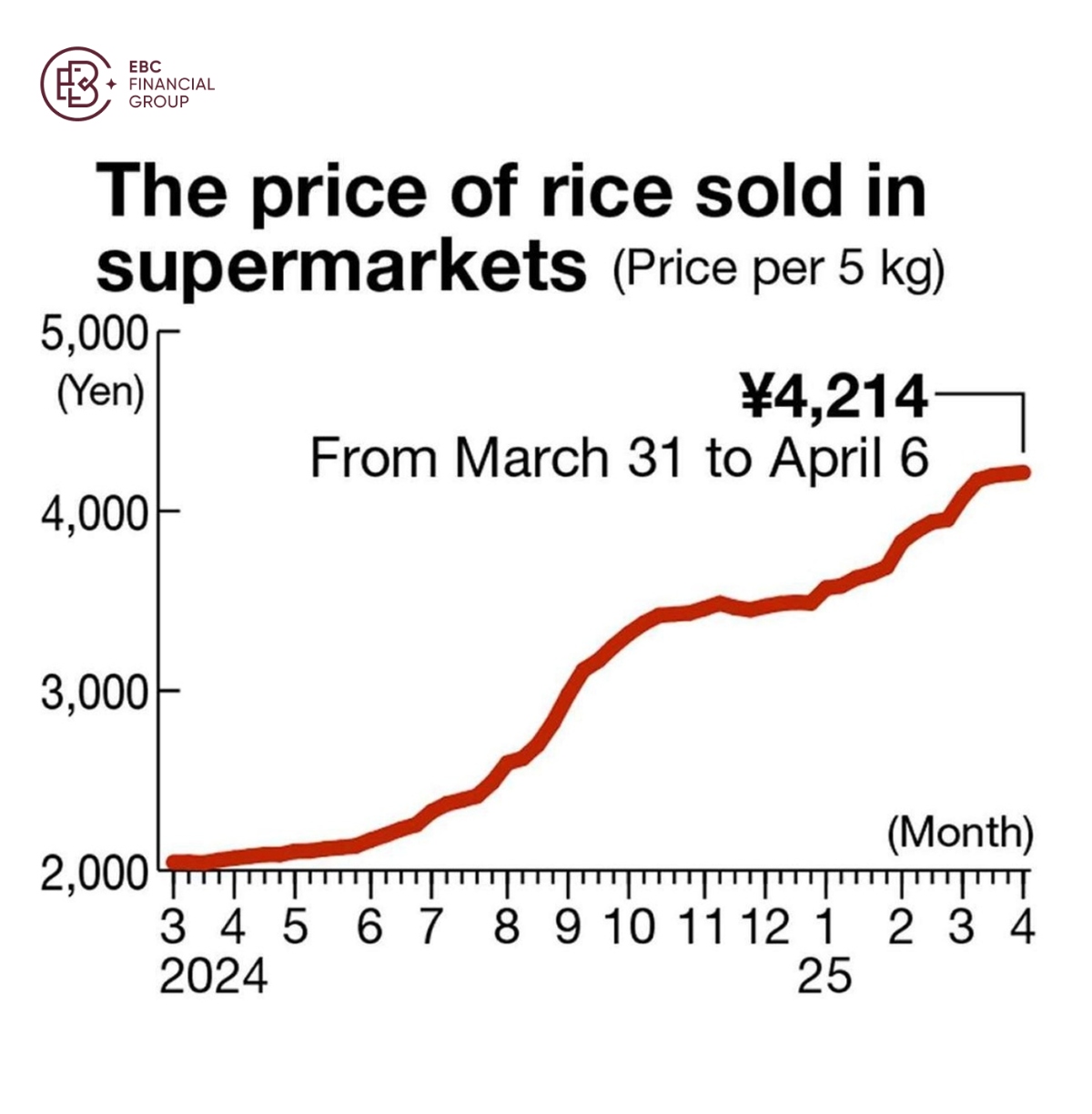

He had taken to social media to say that Japan does not accept American rice imports. It seems less likely that additional sectoral tariffs on cars, steel and aluminium will be repealed.

Tokyo caps tariff-free imports of rice for meals at 100,000 metric tons, compared to total consumption of about 7 million tons. The imports rose in recent month though amid soaring rice prices.

Japan will not sacrifice the agricultural sector as part of its ongoing tariff talks, its top negotiator said last week. The sector has traditionally been an important voting bloc for PM Shigeru Ishiba's party.

Just 7.8% of imported cars sold in Japan in H1 were from US-branded carmakers, industry data showed. Auto analysts say local buyers prefer smaller vehicles due to Japan's narrow roads.

Bigger wage hike

Household spending rose the most since the summer of 2022 in May, above the median economist estimate of a 1.2% gain. A jump in car purchase and tourism showed encouraging signs of consumer resilience.

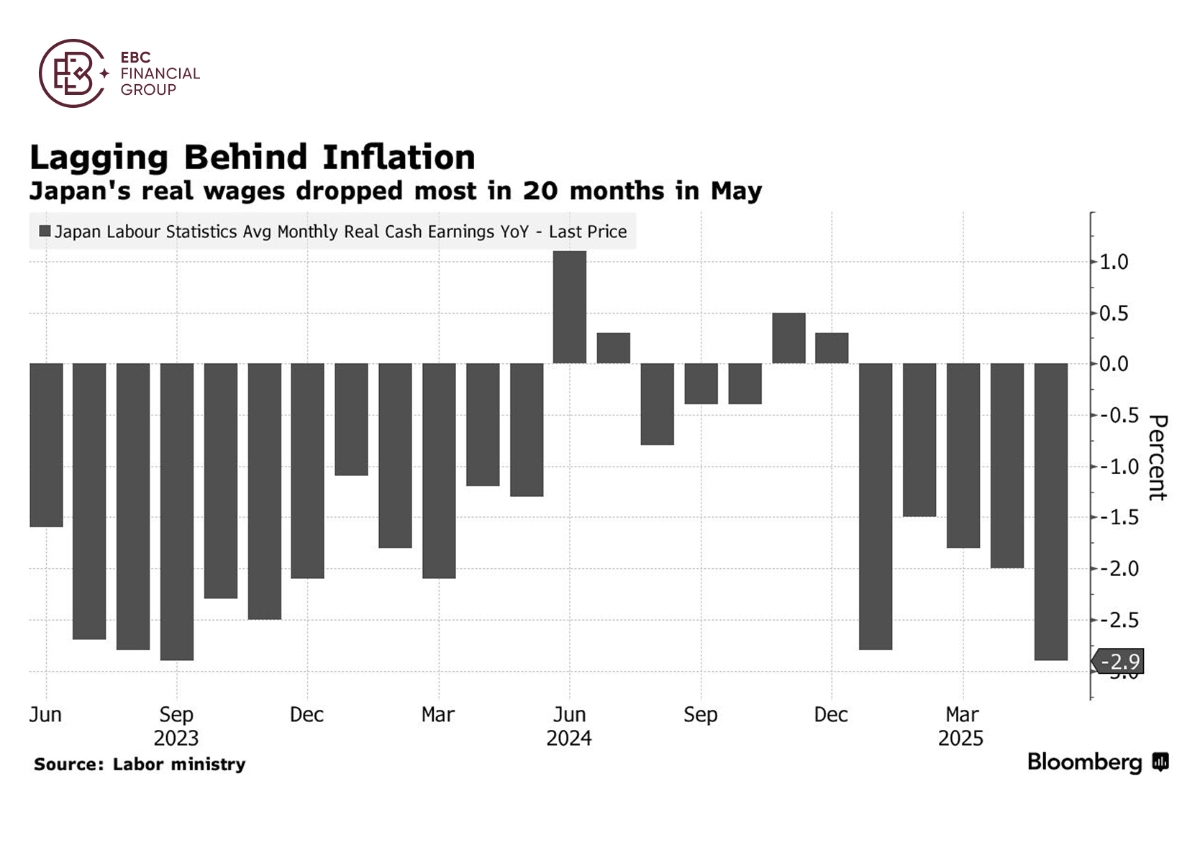

Wage trends are crucial for sustaining this erratic momentum and are among the key factors the BOJ is monitoring to determine the timing of the next interest rate hike.

Japanese companies agreed to raise wages by an average 5.25% this year, their biggest pay hike in 34 years. The measure is crucial for sustaining a consumption-led recovery amid export uncertainty.

Daiwa Securities predicts an average wage hike of 4.5% to 4.9% next year but notes that non-manufacturers will have to step up and take on a leading role in raising pay.

Real wages in May fell at the fastest pace in nearly two years, government data showed. The result of spring labour negotiations may not be significantly reflected in the statistics until summer.

Inflation in Japan, as measured by the core consumer price index, which excludes volatile fresh food prices, is currently around 3.7%. The steep rise in fresh food prices is causing much angst among consumers.

Higher tariffs are set to deal a heavy blow to the Nikkei index immediately. It is too early for us to call it apocalyptic though, as Japan would still have a chance to admit victory over deflation with the burden.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.