Dollar struggles at the ‘game-changing’ level

For the second month, the Dollar Index finds support from declines in the 101 area. Dollar bulls are defending critical levels in the major currency pairs, which could significantly increase the psychological pressure on the US currency. The resolution of this situation is likely to come from politics and macroeconomic data.

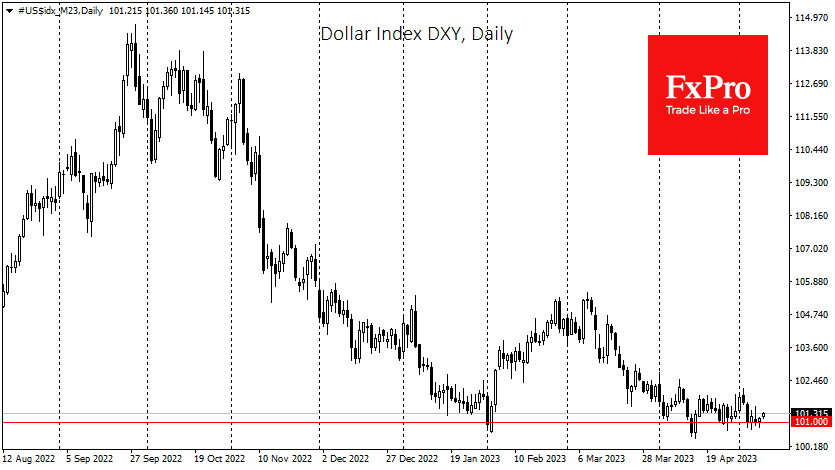

The Dollar Index has been hovering around the 101.30 level for the past four weeks. Attempts to break above 102 have been met with increased selling, but the sellers aren’t picking up the declines below 101 either.

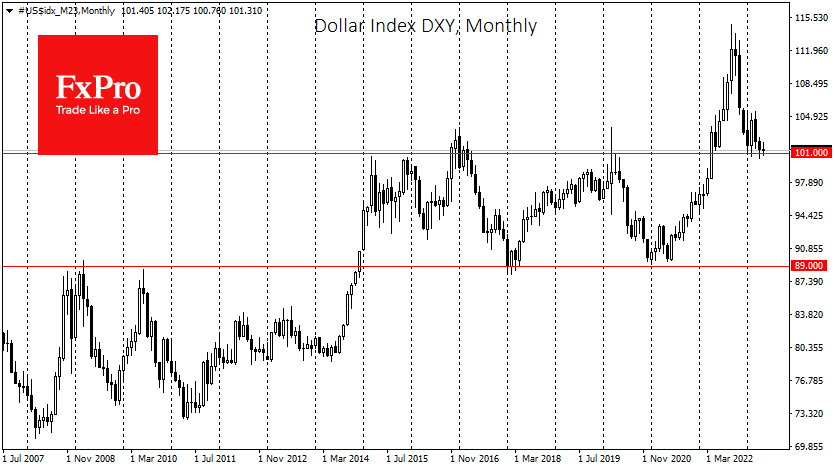

The 101 area of the Dollar Index appears to be more important than the round 100 level, as the Dollar’s rally in the first half of 2020 was halted near this level, apart from a brief spike on the unexpected first lockdowns.

The same level 13 months ago triggered an acceleration of dollar inflows and became a game-changing switch in the currency market. The new switch promises to be as important as last year’s, so it will unlikely be quick and easy.

Moreover, this change is not necessarily going to happen. Between 2006 and 2014, the 88 areas of the DXY was a similar historical resistance. It then became an insurmountable support from which the Dollar was called upon in the recessions of 2018 and 2021.

The more localised picture remains on the sell side of the Dollar. The DXY reversed its decline at the end of September last year on signals that the Fed would slow the pace of rate hikes and pause soon. The rally from February to March was based on hawkish inflation data and expectations that the final rate would be higher than initially expected.

The banking problems nailed the Dollar to support at 101 as markets put an imminent reversal of a rate cut back on the agenda. Last week’s employment data and the Fed’s decision did not change market expectations meaningfully.

However, tomorrow’s inflation data for April may do so. Reading well below 5% YoY would allow the Fed to talk more about outperforming inflation and stop raising rates. On the other hand, a sudden acceleration will lead to a pullback in the Dollar as the markets anticipate more rate hikes in June.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)