Dollar weakness accelerates as risk appetite fades

Dollar behaves like a risk-on asset

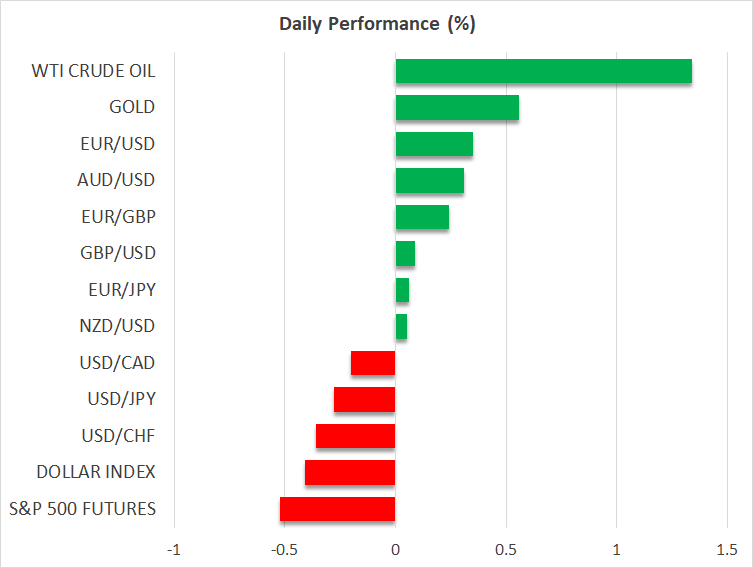

Another day, another weak performance by the US dollar, with investors potentially starting to realize that the recent dollar rally was just a blip and not the start of a new trend. In defiance of decades of historical performance, since US President Trump’s tariff Armageddon, the dollar is behaving more like a risk-on asset rather than a safe-haven asset.

This phenomenon was repeated yesterday and carries on to today’s session, with euro/dollar climbing above 1.13 and dollar/yen dropping towards 143. At the same time, the pressure on US Treasury yields continues, with the 10-year yield rising once again above the 4.5% level, thus preserving concerns about the fiscal situation of the US economy.

Tax bill in focus

Notably, Trump paid a visit to Capitol Hill yesterday, warning the fiscally hawkish House Republicans to drop their objections and support the “One Big Beautiful Bill Act”, which includes the much-discussed tax cuts.

While a nonpartisan watchdog group estimates a $3-5 trillion rise in US debt over the next decade due to this bill, the US administration is confident that strong growth, thus higher revenues, will offset this increase. A vote in the House of Representatives could take place today.

US stocks underperform, risk sentiment worsens

Meanwhile, US stocks lost some ground yesterday, with the S&P 500 index failing to record another green candle, thus raising doubts about the viability of the current rally. Retail accounts have played a key role in the move from the April lows, with reports pointing to strong retail activity during yesterday’s morning session. However, retail accounts might have reached their limit, with considerable buying activity from institutional investors potentially needed to sustain the current rally.

Risk sentiment, though, has turned negative following reports that Israel is preparing to strike Iranian nuclear facilities. This is not a new practice for Israel, but it comes at a time when there are ongoing negotiations between the US and Iran about a nuclear deal. Apparently, the US President is not supportive of aggressive actions, thus potentially creating a small degree of friction between the two long-term allies.

Gold, oil and bitcoin rally

Both gold and oil have taken notice of these headlines, with the former bouncing off the $3,200 level and currently trading north of $3,300. The precious metal has managed to shake off an ECB article warning of a potentially significant credit event if banks fail to meet their gold delivery obligations.

Similarly, oil benefited from the newsflow, but its first attempt to climb above the 50-day simple moving average has failed, and it is currently hovering around the $63 level. Finally, bitcoin appears to defy market trends again, following gold closely in the past few sessions, and potentially paving the way for a retest of the all-time high of $109k.

UK CPI accelerates, pound little changed

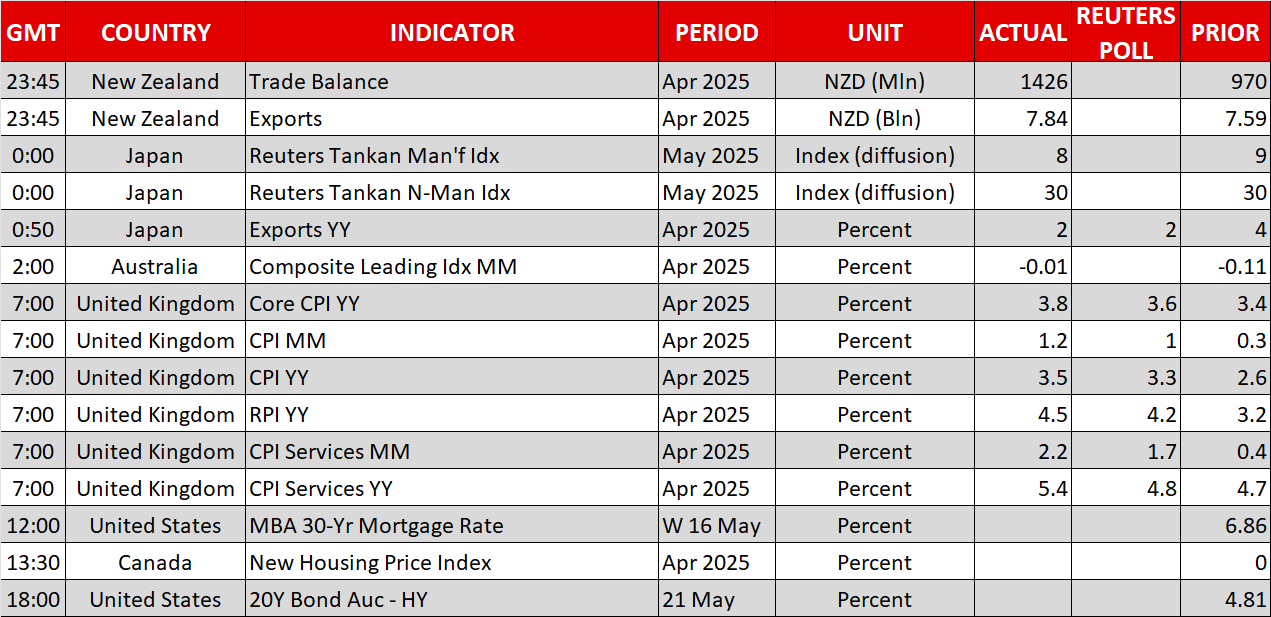

Contrary to softer inflation reports elsewhere and particularly in the US, the April UK CPI report produced a sizeable upside surprise. Both the headline and core indicators accelerated to 3.5% and 3.8%, climbing to the highest level since January 2024 and April 2024, respectively. With the BoE outlook becoming slightly more clouded and the market pricing out a few basis points of easing during 2025, the pound has only gained a few pips against both the dollar and the euro.

.jpg)