DAX40 and FTSE100 outperform the S&P500, rejecting economists' pessimism

DAX40 and FTSE100 outperform the S&P500, rejecting economists' pessimism

Tariff wars have increased the legitimacy of stimulus measures in Europe and Asia. Since the start of the year, the ECB and Bank of England have been aggressively cutting rates against the Fed's continued rate hikes. The People's Bank of China made a small, 0.1 percentage point cut on Tuesday morning. Earlier this year, Germany announced an $800 billion package of support for the economy, abandoning a tight budget framework, contrasting with the mood for budget deficit reduction in the United States.

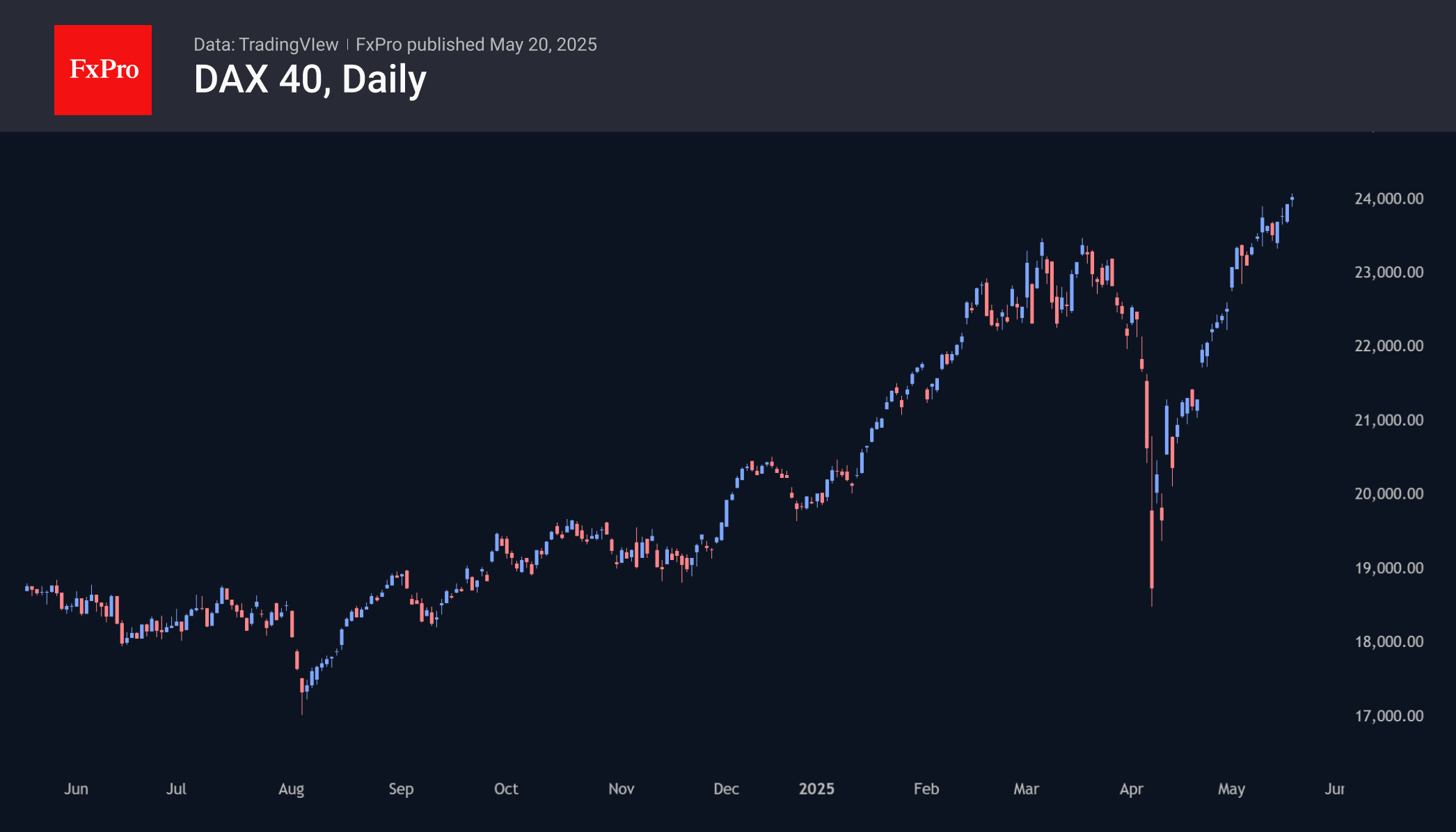

Germany's DAX40 hit all-time highs on Monday. The German market is feeling the envy of its peers, trading in the 24000 area, nearly 28% above the early April lows. The FTSE100 is less than 2% off its peaks set in early March. This has been achieved, contrary to the more than 8% strengthening of the pound and euro against the dollar since the start of the year and is indicative of the strength of Europe's markets against the US. This is a higher rate of growth in the case of the DAX and a stronger recovery in the case of the FTSE.

Stimulus measures from Europe and China are working like a rising tide, boosting the overall level of equities. Should the US enter the stimulus race through Fed policy easing, this would spur the S&P 500 and Nasdaq 100 higher, but it would be just as objectively positive for Europe and Asia.

The market dynamics in Germany and the UK starkly contrast with the sentiment and outlook of economists in light of the trade wars. It is not uncommon to see markets one step ahead of the economic consensus, but that makes it no less interesting to see if markets can thrive against forecasters' pessimism.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)