Dovish Fedspeak lifts risk markets but dollar remains unresponsive

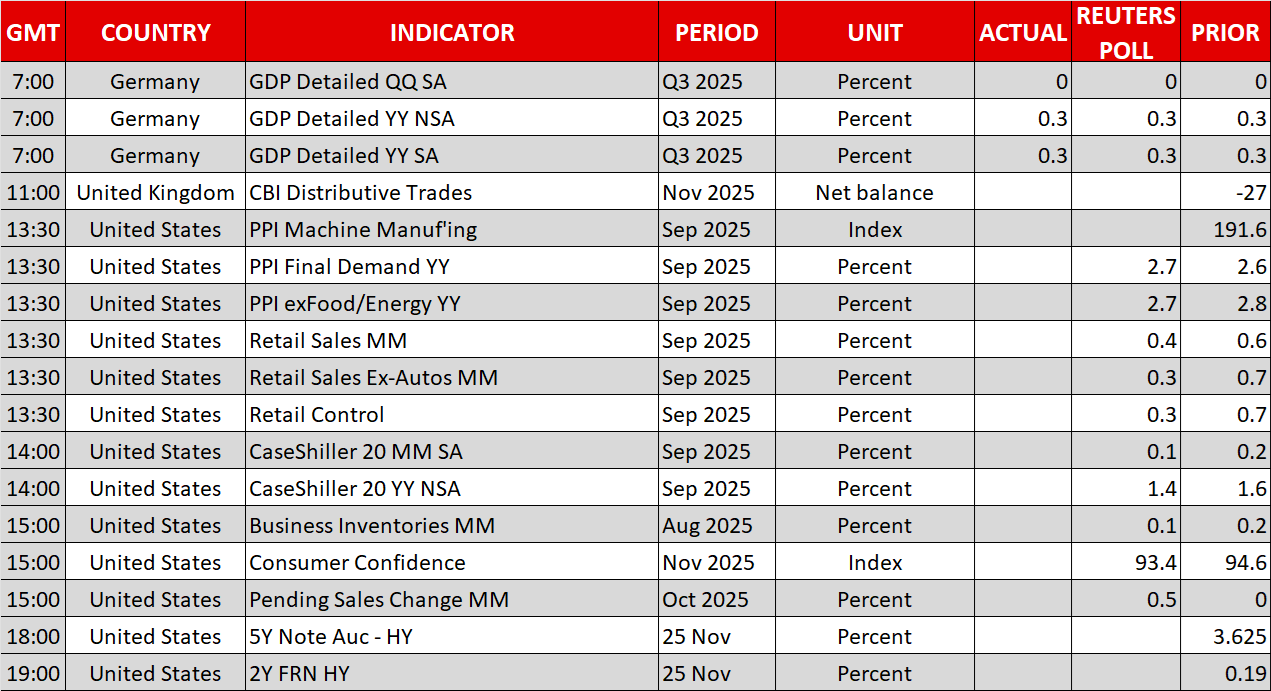

Rich US data calendar today

It has been two weeks since the longest-ever US government shutdown ended, and data releases have been scarce. Today’s PPI and retail sales reports for September, and Wednesday’s durable goods data and jobless claims prints may aid the current risk-on sentiment, but investors are craving data from the shutdown period.

Both the BLS and the BEA are scrambling to collect and process data, but most October data releases are either being cancelled or postponed, such as the October PCE report. Hence, the focus is firmly on the November data, most of which will come after the December 10 Fed meeting, complicating Chair Powell’s job. Interestingly, the November CB Consumer Confidence will be released today, indicating the potential damage done by the shutdown in spending appetite.

Until then, Fedspeak is the only game in town. Following Friday’s comments from NY Fed President Williams, on Monday both board members Waller and San Francisco’s Daly openly talked about a December rate cut, mostly to address labour market weakness.

While dovish comments from Waller are the norm, Daly shifted firmly to the dovish camp just two weeks after stating that “there is a premium on waiting to decide rates until you have as much info as possible”. She does not vote until 2027, but risk markets feed on dovish commentary at this stage. Notably, the Fedspeak calendar appears to be light this week due to the Thanksgiving holiday.

The latest round of dovish Fed commentary has pushed the probability of a 25bps rate cut in December to 70%, up from nearly 20% priced in at some stage last week. This looks slightly inflated considering that the hawks remain unconvinced about the need for further easing and that key data is still missing. Therefore, a drop in these expectations might not be taken lightly by the markets.

Stocks were in good mood on Monday

US equity markets started the week on the front foot, with the Nasdaq 100 index leading the rally with a 2.6% jump on Monday, as it attempts to return to the upwards trend channel that has been in place since mid-May. Despite the absence of major developments, US stocks showed a strong appetite to rally, partly due to investors preparing for the usual post-Thanksgiving rally, which some consider part of the famous Santa Rally. Notably, one of the major investment houses has already recommended that investors take advantage of the current weakness to position for 2026.

Meanwhile, cryptos are struggling to build bullish momentum, despite rising from the November 21 lows. Bitcoin has yet to reclaim the $90k level, while Ether has failed at its first attempt to climb above the $3,000 level. Crypto sentiment appears to be extremely negative, which might mean that the mild uptrend in place since Friday might have legs.

It is worth noting that the US market will be closed on Thursday due to the Thanksgiving holiday, and will observe an early close on Black Friday, with the noticeably lower liquidity potentially amplifying market movements.

Quiet FX space, commodities on the move

Despite the muted risk-on, it has been a relatively subdued start to the week in FX, even in yen crosses. Euro/dollar continues to move along a downward trend that started after the September 17 peak, with the 1.1482-1.1495 zone acting as strong support. A move below this area could gain momentum, with the next support at the August 1 low of 1.1391.

Gold started the week with a strong rally, partly benefiting from increased chances of lower Fed rates despite US inflation being well above target, and the China-Japan squabble. A move towards the upper boundary of the developing triangle at $4,190 might test the bulls’ resolve.

Meanwhile, oil is in waiting mode as Europeans and Ukraine presented their own plan, which has already been rejected by the Russian side. Hence, we are back to square one, with the initial 28-point US plan back on the table. Oil has been dropping in anticipation of an agreement, which means that a bounce higher might be on the cards if there is no light at the end of the tunnel this week.