The crypto market is only supported by America

Market Overview

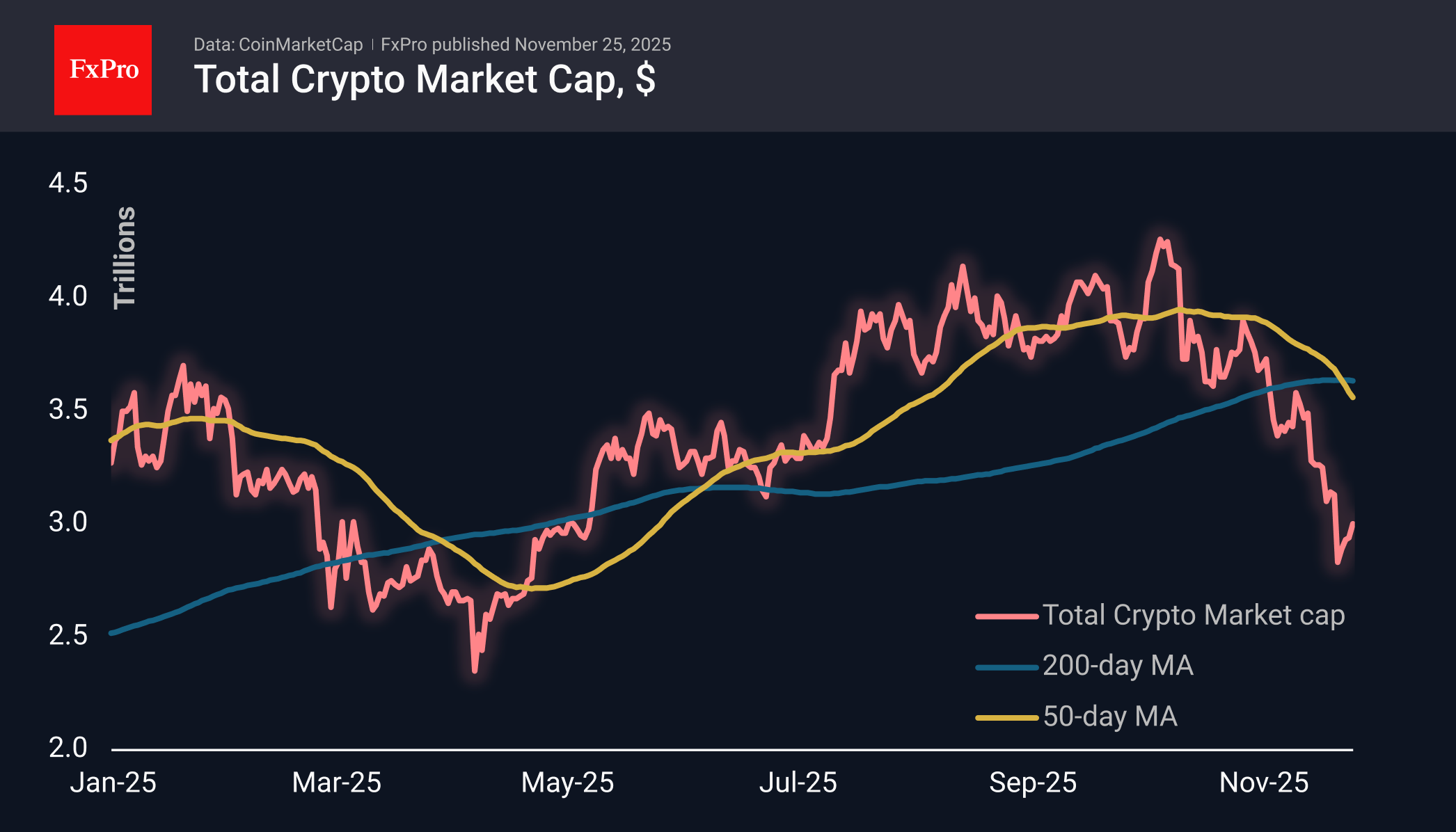

The crypto market capitalisation has recovered to a round figure of $3.0 trillion, adding 1.3% over the past day. Once again, crypto was pulled along by the American stock market, whose sharply positive dynamics broke the dull trading trend of the first half of Monday. But at the start of the new day, the markets are again lacking American optimism, and we are seeing pressure on quotes with the closing of American stock exchanges.

Bitcoin rose to $89K at its peak last night but fell back to $87K in the morning. Since last Friday, BTCUSD has formed an upward trend, rebounding from its upper limit overnight. However, over the past seven weeks, Bitcoin has still had a sharply negative dynamic, within which the latest growth looks like a rebound. In this case, it would be wise to closely monitor signs of a rebound exhaustion. The first such signal would be a consolidation below the $85K level.

A sharp decline in open interest in Bitcoin derivatives may signal that the price has bottomed out and that a market reversal is imminent, notes analyst Darkfost.

Bitcoin closed below its 50-week moving average for the second week in a row, notes analyst Ted Pillows. In 2018 and 2022, the formation of such a pattern led to a subsequent 50% collapse in BTC.

Bitcoin could fall to $50K in 2026, which is about 60% below its historic high of over $126K, according to Bloomberg Intelligence strategist Mike McGlone. This will be facilitated by a decline in the S&P 500 stock index amid growing concerns about a bubble in the AI segment.To confirm a local bottom, Bitcoin needs to firmly consolidate above $88K, according to BTC Markets. Kronos Research expects BTC to consolidate in the $85K-90K range.

Strategy's role as an intermediary for Bitcoin ownership is weakening after the launch of the BTC ETF. The largest investment funds reduced their positions in Strategy shares by $5.38 billion (almost 15%) in the third quarter, CryptoSlate notes.

China's share of Bitcoin mining exceeded 14%, despite an official ban on such activity. Reuters calls the revival of cryptocurrency mining in China ‘one of the most important signals’ for the market in recent years.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)