EBC Markets Briefing | AI rally goes on and on even without rate cuts

The S&P 500 and Nasdaq 100 scored record highs on Monday as technology shares rallied on enthusiasm over AI. The chance of that the Fed will not cut rates this year is shaken off, Bloomberg’s latest survey showed.

More than half of the respondents said the 14% surge in the S&P 500 during 2024 will extend regardless of what the Fed does, with nearly a quarter saying central bank easing is needed for stocks to thrive.

Investors’ confidence remains focused on the AI boom. About half the respondents said non-tech stocks would either lag or fall further behind this year, regardless of whether borrowing costs fall.

A majority of survey participants expect a swelling deficit to have a significant impact on longer-term bonds, no matter what the central bank decides. That could help stocks continue to outperform bonds.

Citigroup’s strategist boosted his year-end forecast for the stock benchmark on Monday, to 5,600 from 5,100, after Evercore ISI boosted the target to 6,000 from 4,750 on AI frenzy.

The S&P 500 trades at 22 times forward one-year earnings, compared with an average of 18 times since 1990. It is inarguably expensive though it may be premature to be define the market as frothy.

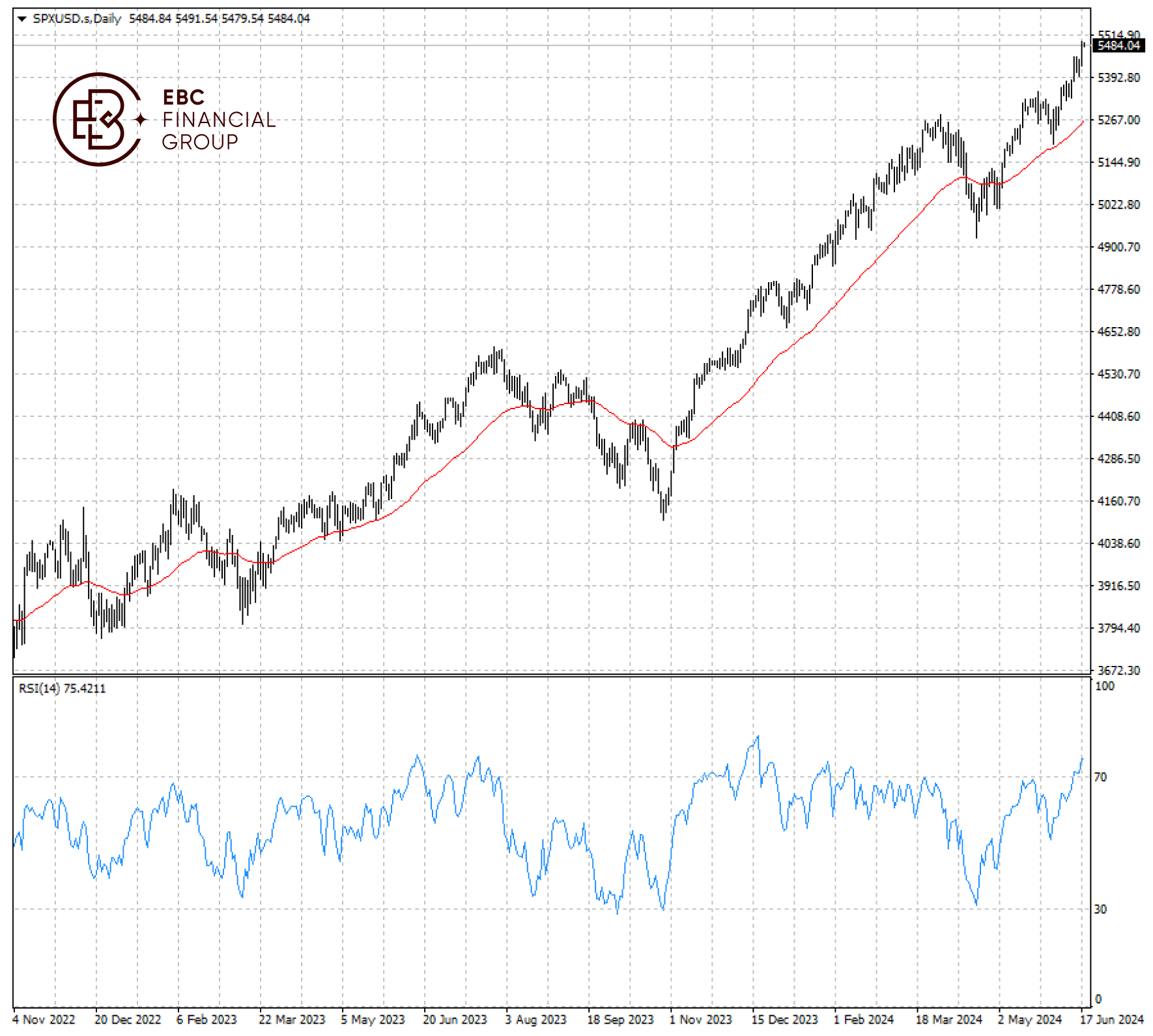

The index has become overbought, so short-term traders should be on alert for correction. That being said, the uptrend will remain intact as long as the 50 EMA is respected.

EBC Economic Research Findings Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.