EBC Markets Briefing | Aussie dollar muted on caution

The Australian dollar was largely muted on Tuesday after Trump said most trading partners that do not negotiate separate trade deals would soon face tariffs of 15% to 20%.

Higher tariffs have worsened the economic outlook for developing Asia and the Pacific, the Asian Development Bank said in a report as it lowered its growth forecasts for the region for this year and next.

Domestic demand is expected to weaken as factors including geopolitics, supply chain disruptions, rising energy prices and uncertainty in China's property market linger in the region, the report said.

Australia and India are likely to expand their free trade agreement, according to Australia's trade minister. The countries signed an initial FTA in2022, which eliminated tariffs on a large proportion of goods and services.

The country's goods exports saw a month-over-month decrease of 2.7% in May, reaching a 3-month low. This decline is partly driven by demand disruptions China that was grappling with Trump's tariff threats.

The Reserve Bank is wary of cutting interest rates until it has gathered more evidence that inflation remains on a path back towards the 2.5% target, said the RBA governor Michele Bullock.

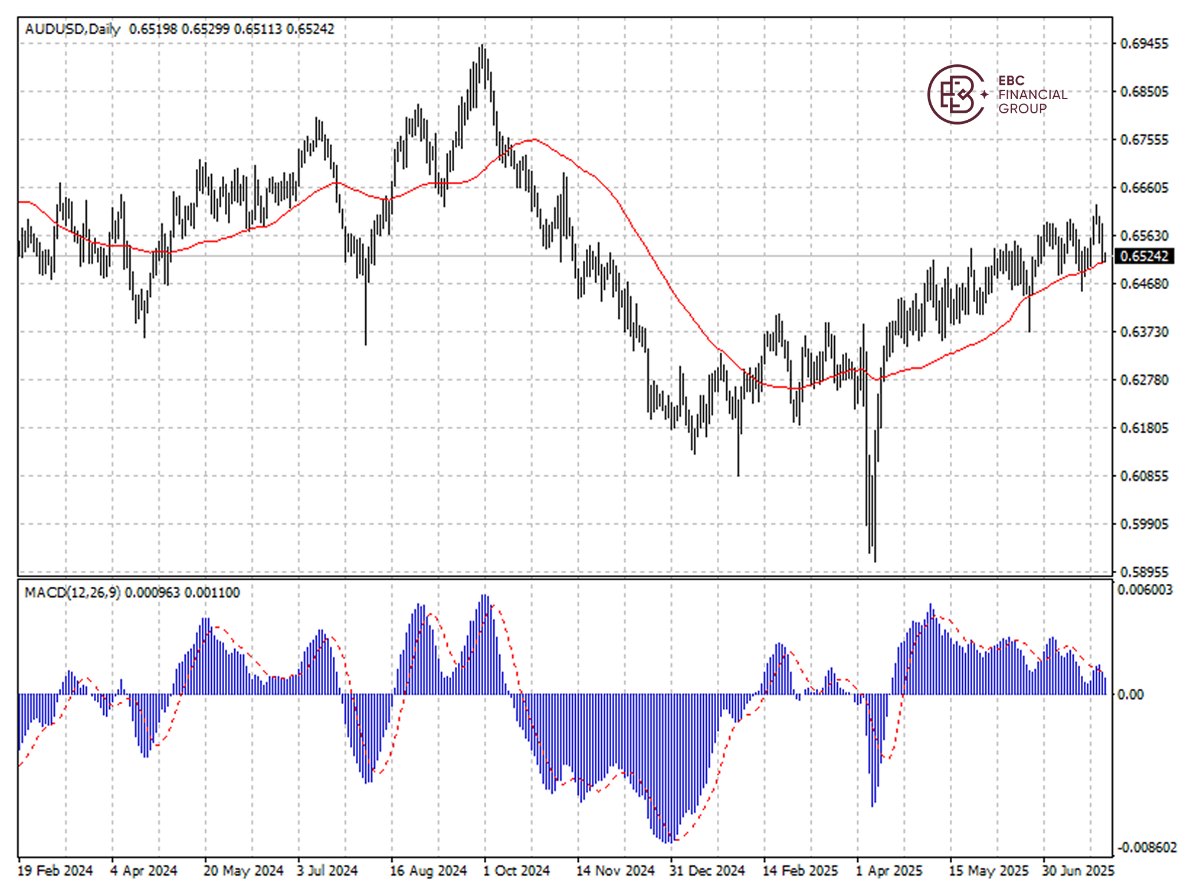

The Aussie moved along the ascending trendline above 50 SMA, but bearish MACD divergence points to an immediate pullback towards the support level.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.