EBC Markets Briefing | Australian dollar hits six-month high due to iron ore rally

The Australian dollar hit a six-month peak on Friday on US economic slowdown and rising iron ore prices. The commodity touched its highest in nearly a month as traders bet on rising demand in China’s steel market.

Futures in Singapore rose the previous four trading days on Thursday and was up more than 6% in the week amid hopes for a stimulus boost at a major Chinese political gathering.

The steelmaking ingredient is now solidly above $110 a ton after trading below that threshold for most of June. However, China’s real estate prospects are still murky despite a few signs of a recovery.

Global economic growth this year is expected to be slower than the average in the half decade before the pandemic. Yet the World Bank believes commodity prices will remain close to 40% above 2015-2019 levels.

The RBA pondered whether a further rise in interest rates was needed to bring inflation to heel at its June policy meeting, but decided to stand pat in part due to the risk of a sharp slowdown in the labour market.

Broad-based weakness in the ISM services index coupled with an upward trend in jobless claims suggests an exhaustion in the world’s largest economy ahead of the presidential election.

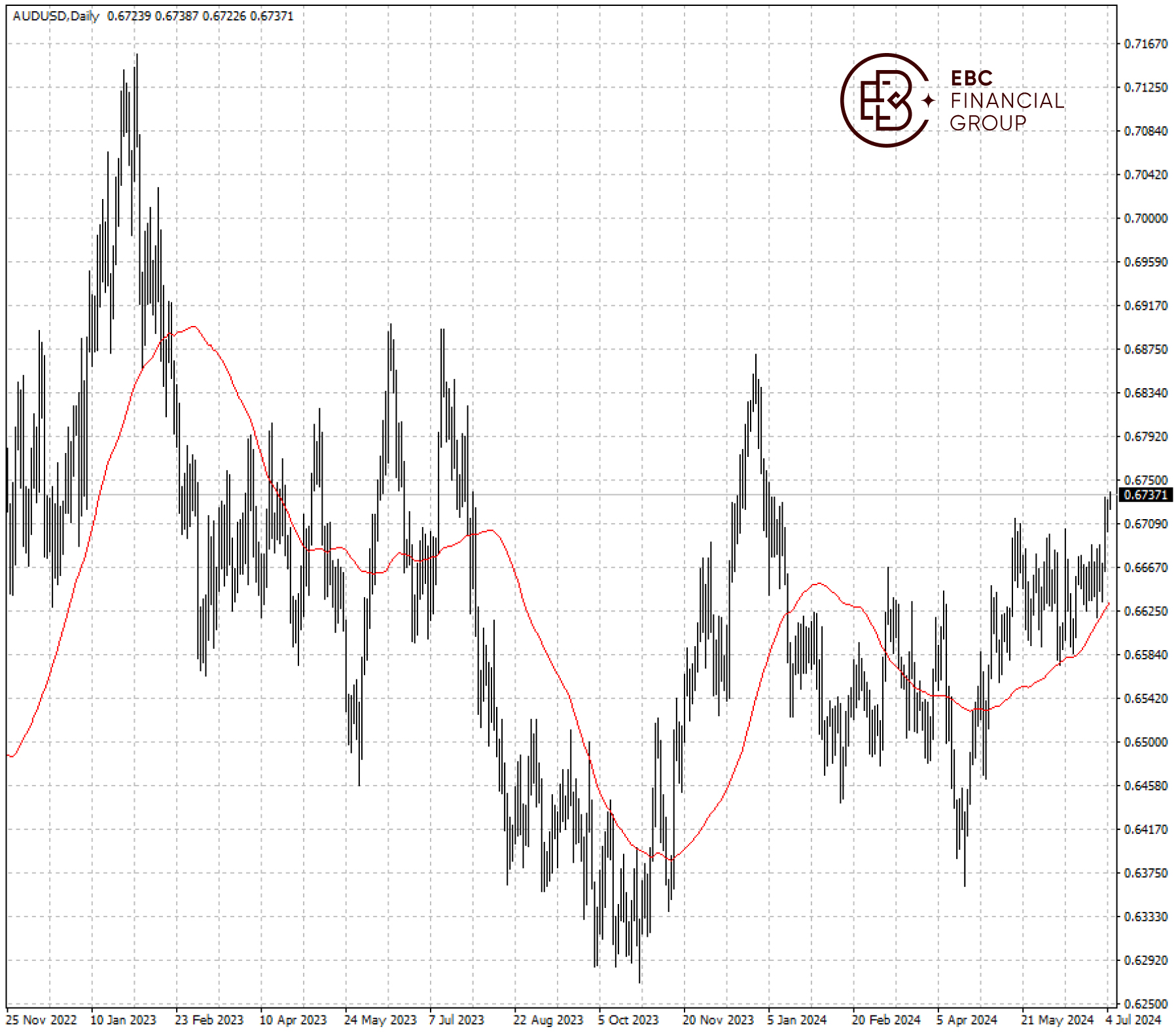

The Australian dollar breached the resistance around 0.6700, exposing 0.6800 it hit in December. The bullish bias remains as 50 SMA is well respected.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.