EBC Markets Briefing | Austrian dollar overlooks weak GDP

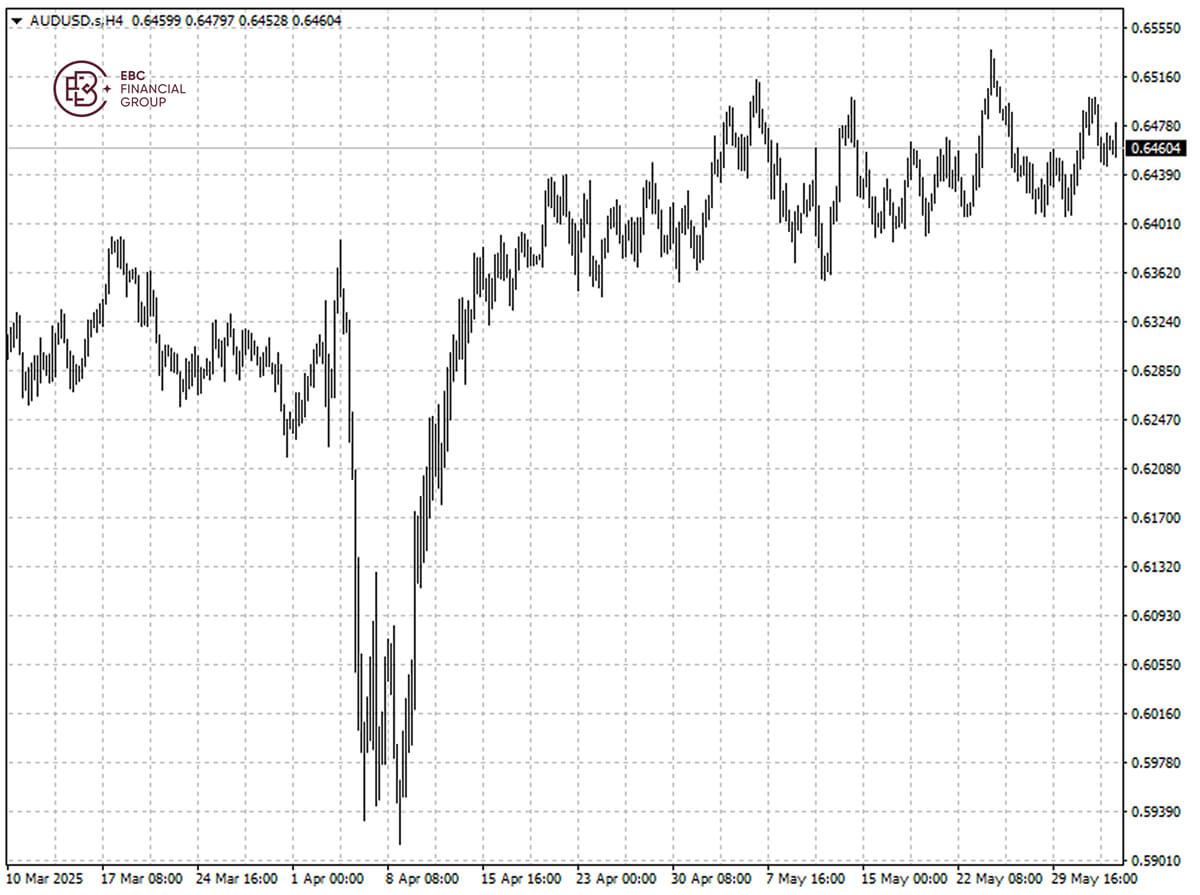

The Australian dollar was little changed on Wednesday following the release of GDP figures. Markets await developments in Trump's tariff negotiations with key trading partners.

Australia's economy barely grew in Q1 as consumers stayed frugal and government spending sputtered to a standstill. The weakness calls for the RBA to ramp up policy stimulus.

The central bank has already cut interest rates twice since February. Swaps imply an 80% probability of a rate cut in July, with a total easing of almost 100 bps priced in by early next year.

Governor Sarah Hunter said on Tuesday that higher US tariffs would drag on the global economy and put near-term downward pressures on prices of traded goods, though the exact impact is hard to asses.

Chinese producers are trying to redirect their products to other markets where tariffs are lower, making products cheaper and lowering inflation, he added.

The country's independent wage-setting body raised the national minimum wage by 3.5% effective July 1 as headline consumer price inflation held at a level in line with the 2%-3% target in Q1.

The Australian dollar has been directionless for almost a month. Therefore, the base scenario is that it continues to move between 0.64 and 0.65 in the short term.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.