EBC Markets Briefing | Bullion edges up on new tariff threats

Gold hovered around its record peak on Tuesday after Trump says he will impose tariffs of 25% on all steel and aluminium imports into the US. But he considered exemption for Australia.

Biden struck deals with the EU, UK and Japan that allowed them to export a certain amount of their steel and aluminium to the US duty-free. The increased tariffs could push producer prices higher.

The US Dollar Index has been barely changed so far in the year as Trump did not rush to impose heavy tariffs on China and the EU. Despite that, a tit-for-tat trade war has reared its ugly head.

Recent data from the CFTC showed swathes of speculators piling on "bullish" dollar trade, stretching net-long bets to a near-decade high last month. That strength will not falter any time soon, said analysts.

High gold prices are making purchases too expensive for many Chinese consumers though the PBOC expanded its gold reserves for a third month in January to hedge rising trade barriers.

The so-called Shanghai premium flipped to a discount for most of the last six months, indicating weak appetite for physical gold. Meanwhile, ETF backed by the precious metal rose to record levels.

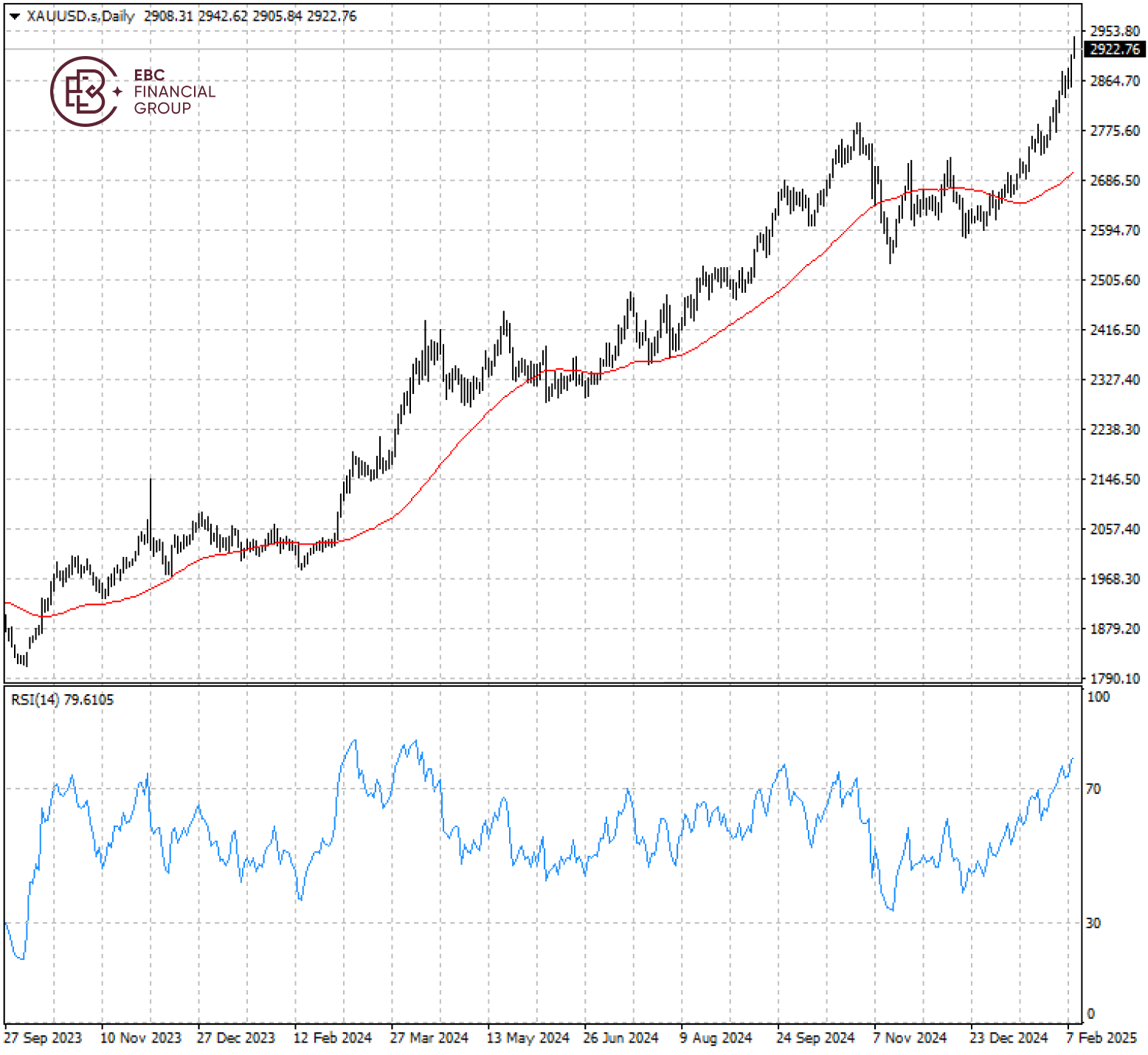

Bullion has entered overbought territory so we see a moderate pullback as likely in the short term. Still it will likely stay above $2,900 amid a highly volatile environment.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.