EBC Markets Briefing | China stocks whipsaw after soft data

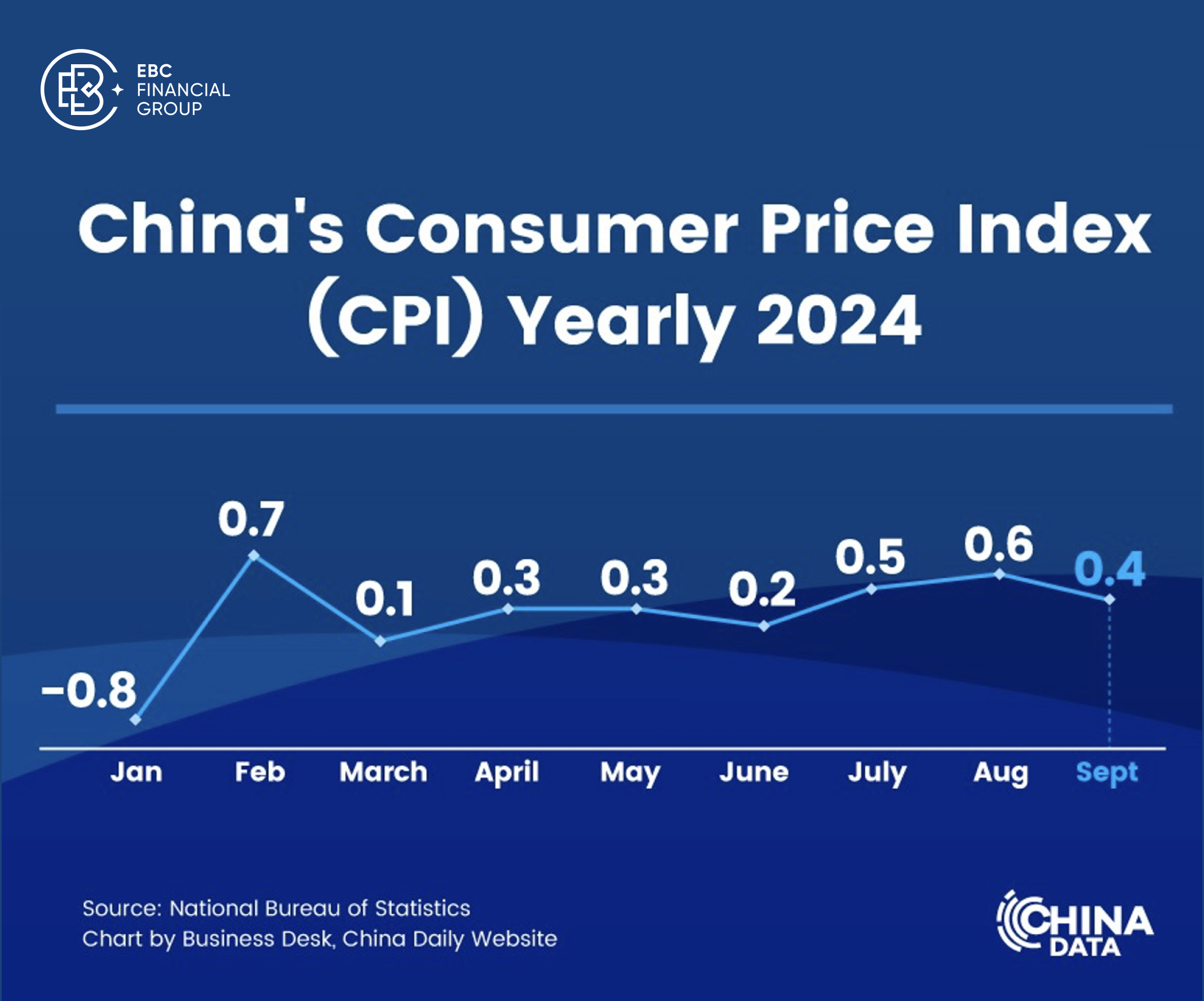

China’s A50 index traded sideways on Tuesday after data disappointed. Consumer inflation rate fell in September, while producer price deflation deepened. That underlined flagging demand and confidence.

Export growth slowed sharply in the month while imports unexpectedly decelerated, undershooting forecasts. China unveiled fiscal stimulus at the weekend given increasing tariffs from the west.

A Chinese exchange-traded fund tracking the tech-heavy ChiNext Index drew the largest inflow among ETFs worldwide last week, as retail investors chased returns based on the technological independence policy.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.