EBC Markets Briefing | Crude prices edge up on balanced market

Oil prices rose in early Asian trading hours on Friday as signs of strong summer demand and easing inflationary pressures in the US bolstered investor confidence.

Refineries and offshore production facilities saw limited storm damage and have largely returned to normal operations, easing concerns of a supply disruption.

Crude inventories fell by 3.4 million barrels in the week ended 5 July, according to the EIA, compared with analysts' expectations in a Reuters poll for a drop of 1.3 million barrels.

The agency warned global oil demand growth will slow to just under a million bpd this year and next as Chinese consumption contracted in the second quarter.

But OPEC stuck to its forecast in the latest report for relatively strong growth in global oil demand in 2024 and 2025, citing resilient economic growth and a rebound in air travel in the summer months.

In the Middle East, Hezbollah chief Sayyed Hassan Nasrallah said that if Hamas reached a Gaza ceasefire deal with Israel, Hezbollah would stop its operations with no need for separate talks.

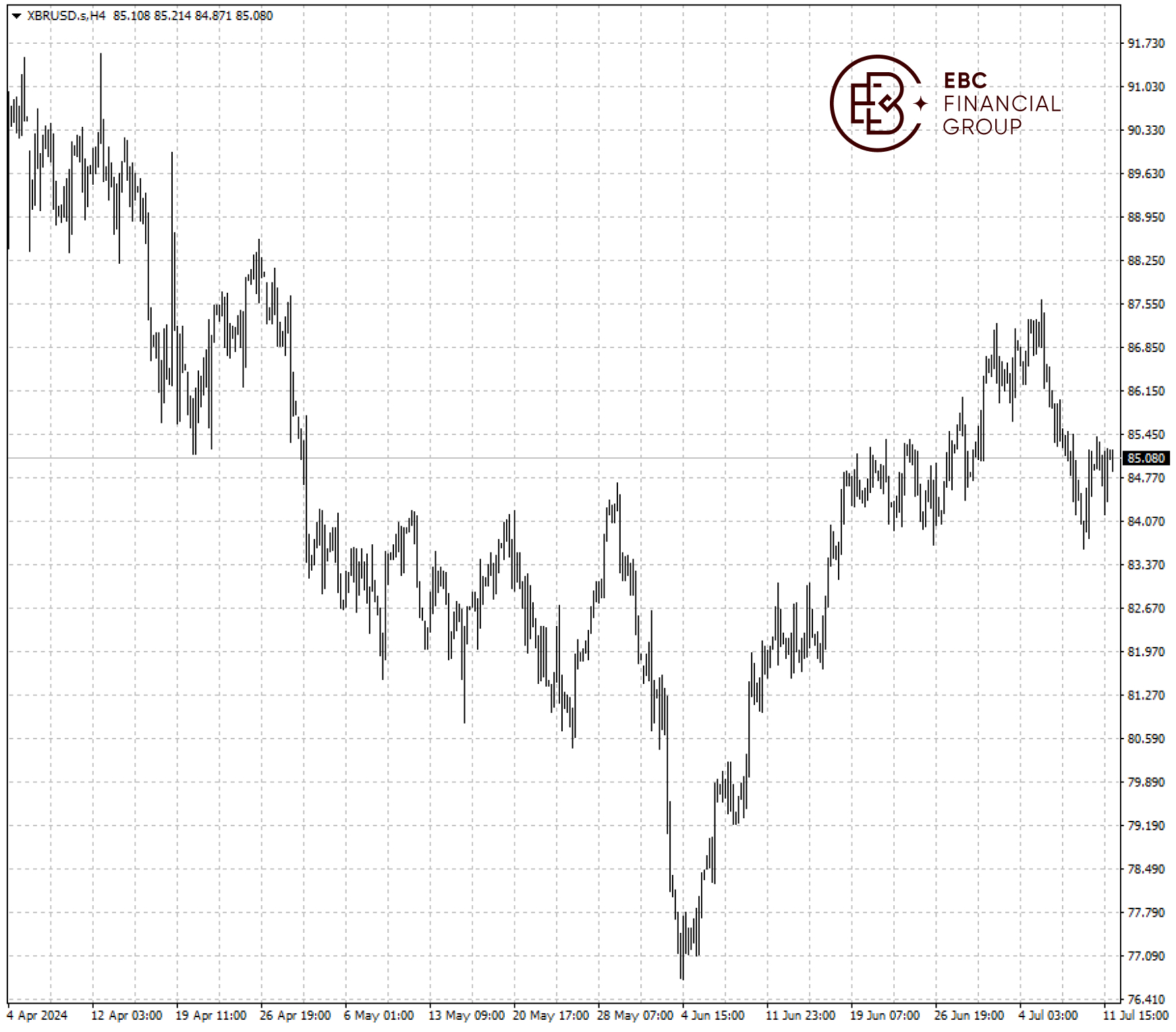

Brent crude still look sluggish with the head and shoulders pattern indicating the correction may not be over. A break above $86 is needed to negate the bearish bias.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.