EBC Markets Briefing | Doldrums in the gold market remain

Gold moved sideways on Thursday after data showed US private payrolls rose at a moderate pace last month, while investors digested remarks from Fed Chair Jerome Powell.

Private payrolls rose by 146,000 last month, broadly in line with expectations, the ADP report showed. The indicator is often used as a proxy for gauging the pivotal NFP report due a couple of days later.

Powell said the recent performance of the economy will allow the central bank to be more judicious with the future path of interest rate cuts. The remark echoed his last appearance in mid-November.

US services sector activity slowed in November after posting big gains in recent months, but remained above levels consistent with solid economic growth in Q4.

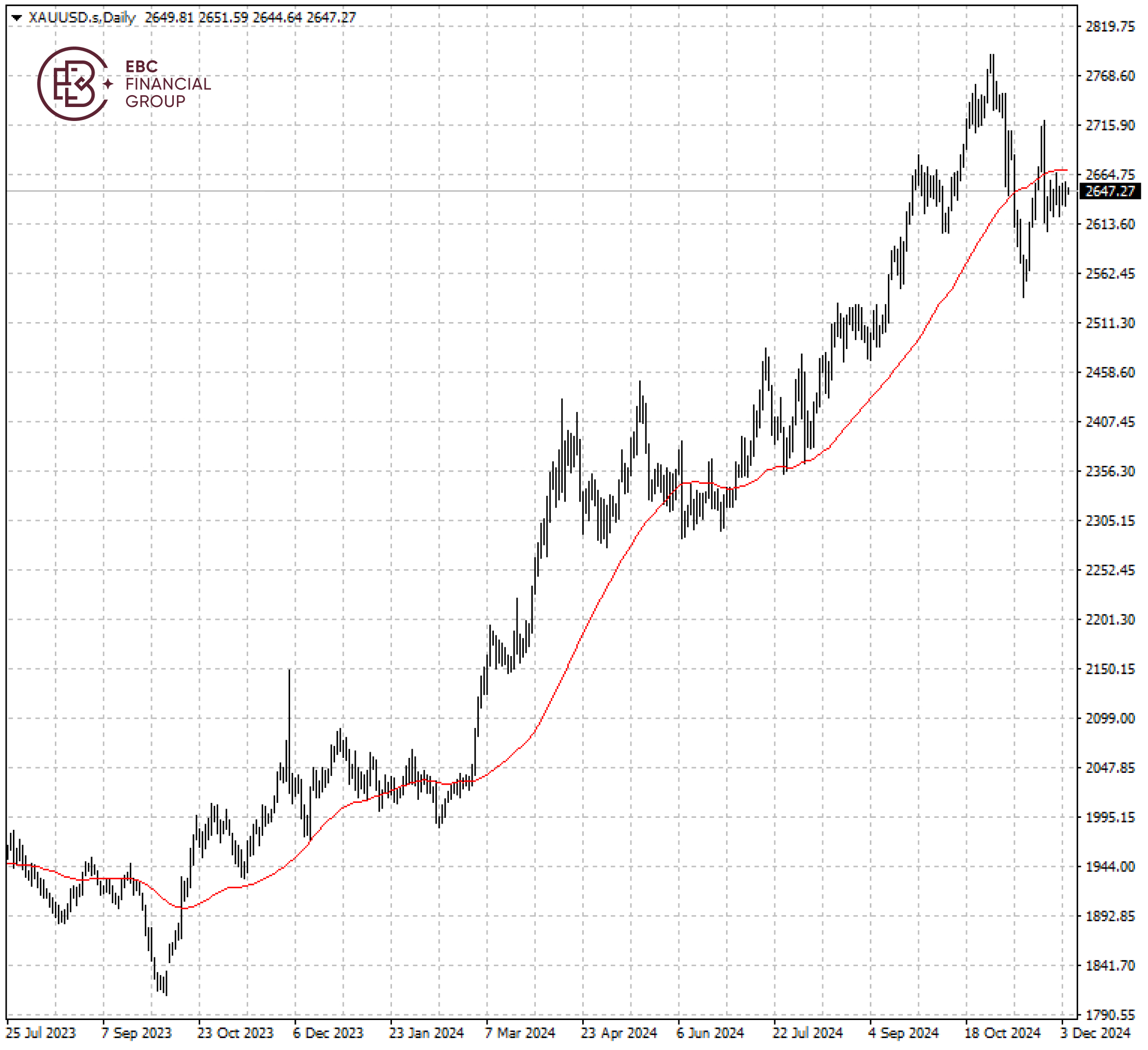

Bullion has just seen the worst loss since September 2023 after a post-election sell-off driven by Donald Trump’s win. The volatility has been muted so far in December.

South Korean lawmakers have proposed impeaching Yoon for the debacle that has rattled global markets. Gold price did not react to the farce as the influences were expected to be limited.

Gold is capped by the resistance of 50 SMA, a level to break above to reverse the bearish bias. Otherwise it would likely fall towards $2,600.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.