EBC Markets Briefing | Euro shakes off robust NFP report

The euro edged up on Monday after clocking its best weekly performance since 2009 last week boosted by Germany's fiscal reforms. US job growth picked up in February, but cracks are emerging amid tariffs.

European Central Bank officials are bracing for tough negotiations over whether to cut interest rates further or hold fire when they next set borrowing costs in April, according to people familiar with their thinking.

Lagarde referred repeatedly to elevated uncertainty, with Trump’s decision to step back from defending Ukraine and Europe triggering a rush to rearm. Traders currently price about 12-bp reduction for next month.

If the central bank pushes ahead again, easing since June would reach 150 bps, twice what the BOE has so far managed during its cutting cycle and also more than the Fed’s 100 bps.

However, the euro has strengthened against both sterling and the dollar this year thanks to improved economic outlook. Analysts expect only marginal changes to quarterly projections for growth and inflation.

The markets will focus on whether the ECB continues to describe policy as “restrictive.” Removing that wording from this month’s statement was already seen as an option after January’s meeting.

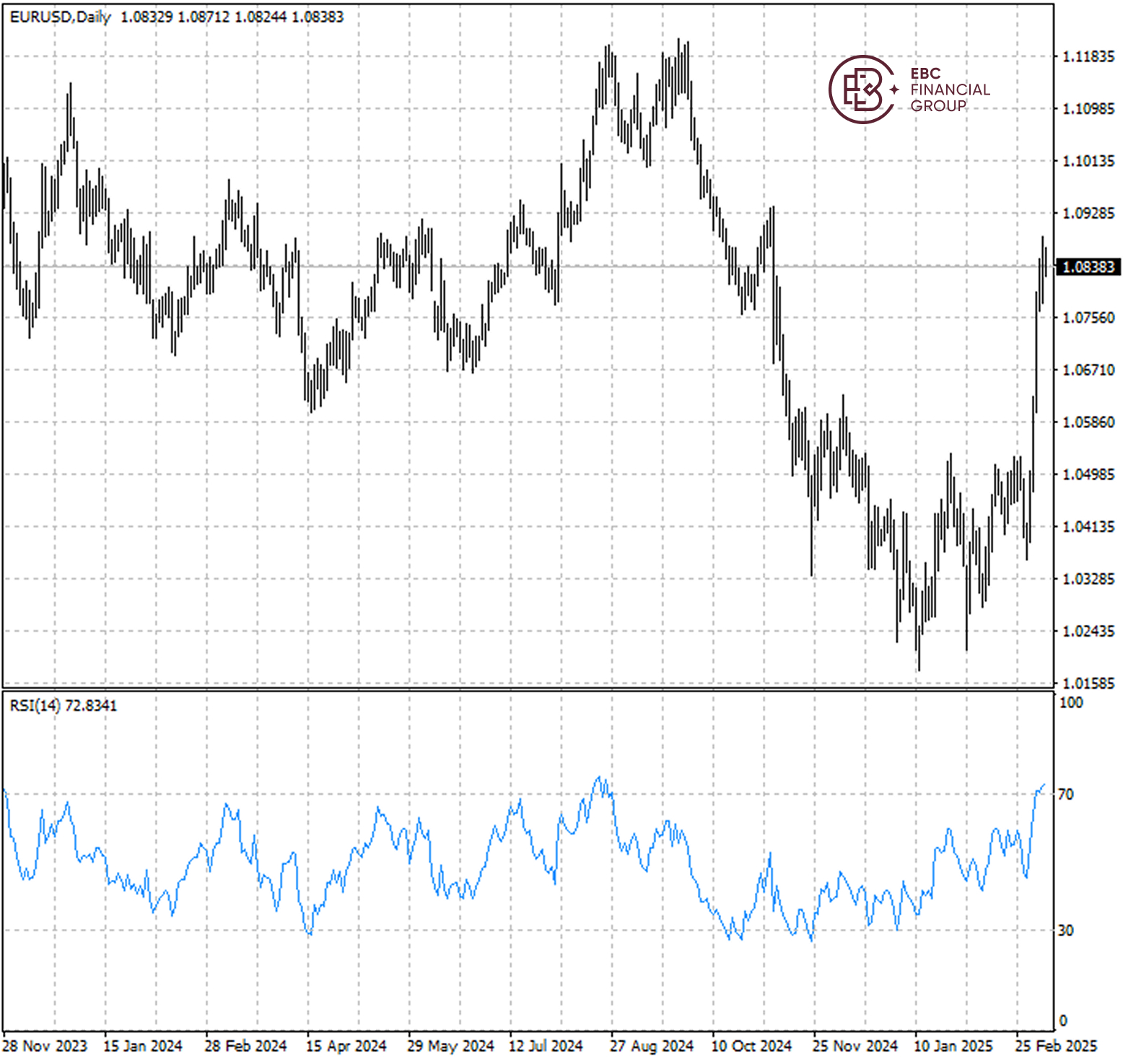

The single currency shows few signs of fading momentum, though the RSI indicates a pullback imminent. We see the rally continue until it hits the resistance around 1.0900.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.