Trade tensions heat up, dollar firms, but stocks and cryptos stay bullish

No letup in tariff war as Trump ups stakes

As the week draws to a close, trade tensions continue to escalate, with President Trump being in an uncompromising mood amid the race to secure crucial trade deals ahead of the new deadline of August 1. Despite the frequent citing of progress with major economies such as the European Union, India and Japan, it doesn’t appear that the stumbling blocks are close to being overcome.

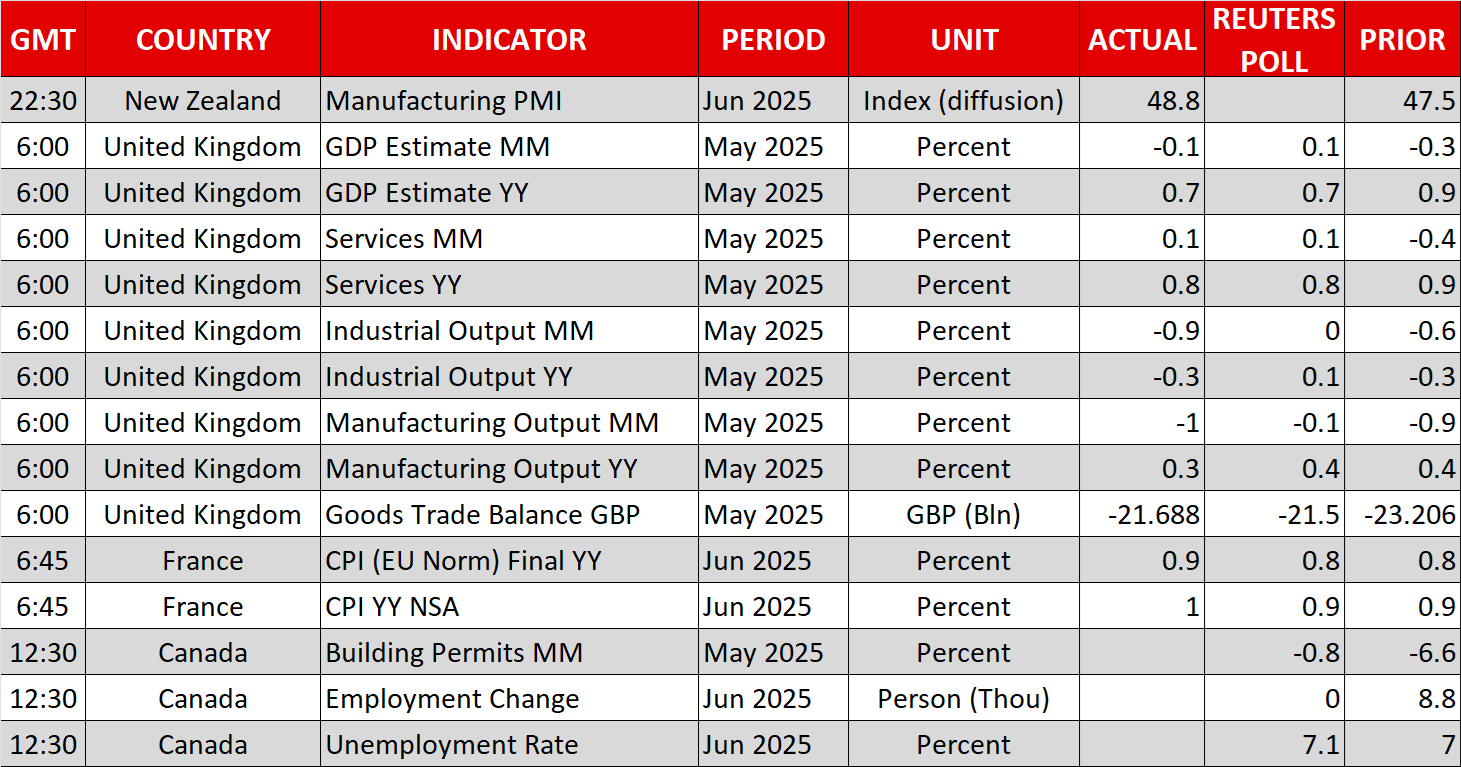

Negotiations with Canada, which has its own deadline of July 21, are also not proceeding as Trump would have probably liked, putting the country next in the firing line, following the surprise decision earlier in the week to slap Brazil with 50% tariffs. Newly elected Canadian prime minister, Mark Carney, had been hoping to avoid another standoff with Washington, but that’s not going to be possible now after Trump’s latest announcement.

Under the temporary agreement, Canadian goods that are covered in the USMCA agreement are exempt from duties and some sectors such as energy have separate levies, while all remaining goods are charged 25% tariffs. But Trump wants to raise this rate to 35%.

It is not clear what has angered Trump, whether it is the slow progress in talks or a specific sticking point. However, many suspect that this is just a typical White House tactic to squeeze as many concessions as possible before the final crunch point.

An unpredictable turn of events

But what has alarmed investors this week is how Trump is using political or personal motives in his trade war to get his way, such as threatening Brazil with steep tariffs so as to force Brazilian authorities to drop the charges against the former president Jair Bolsonaro.

If there was one hope of a major breakthrough this week it was with the EU, but it doesn’t look like a deal is forthcoming there either, as Trump has signalled he could send a letter to the block by Friday.

Following on from the letters sent earlier in the week where the White House outlined tariff levels on more than a dozen, mostly Asian nations that include Japan and South Korea, Trump is warning that all remaining countries where levies have yet to be set could face a blanket rate of 15% or 20%.

If the EU is included in this list, it will be a major setback for the bloc, which has been negotiating hard to reach a framework deal similar to the one the UK signed with the US. Europeans are very worried about their vital auto industry and want to reduce the 25% sectoral tariff currently faced by EU car exporters to the US.

Euro and pound find support but loonie and yen tumble

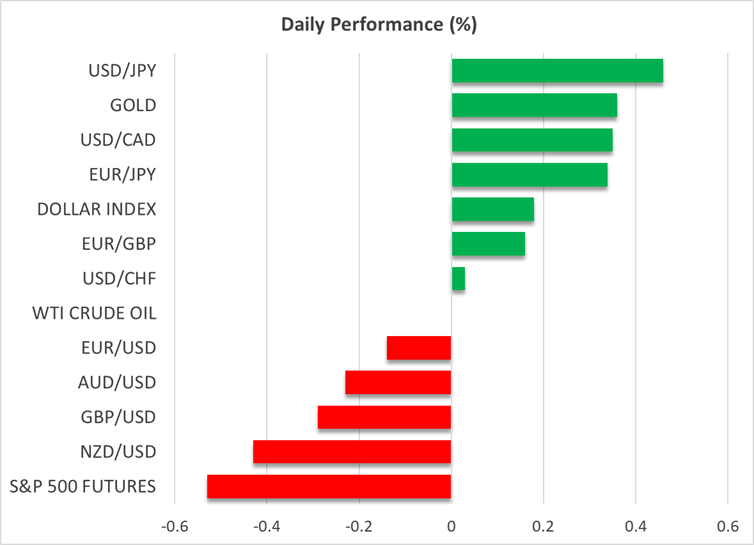

Nevertheless, the euro is only marginally lower today despite this significant setback. Sterling is also holding its ground and is down modestly, brushing off today’s UK data that showed a second consecutive monthly contraction in GDP.

The Canadian dollar, on the other hand, experienced a more notable drop, briefly breaching the C$1.37 per US dollar level before firming just below it. The Japanese yen is also underperforming today, as Japan’s intransigent stance in the negotiations has raised concerns that a US deal won’t be struck and its exports will be hit with a 25% levy on August 1.

As for the US dollar, it’s on track to post its first weekly gain in three weeks against a basket of currencies, suggesting that trade frictions are no longer the headwind for the currency they used to be during this Trade War 2.0. One reason for this switch is the fact that the US economy continues to demonstrate resilience against Trump’s radical policies, something that was highlighted only yesterday by the latest weekly jobless claims numbers, which fell slightly from the prior week.

Gold up, oil steadier after drop

The greenback’s gains have not been much of a hindrance to gold, however, as the precious metal is climbing for a third straight day to advance to the $3,340 area, amid the heightened trade uncertainty.

In contrast, oil prices suffered a more than 2% slide on Thursday as trade tensions weighed on the demand outlook. But futures have stabilized today on speculation that the US could announce fresh sanctions against Russia on Monday, following recent comments by Trump that suggest the President is losing patience with Moscow for failing to work hard enough towards a ceasefire deal with Ukraine. Reports that OPEC+ could pause its output hikes in October are also supporting oil today.

S&P 500 hits record, European stocks stumble, cryptos surge

In equity markets, European stocks are in the red today on the receding hopes of an EU-US trade deal, bucking the mostly positive trend seen in Asia. The gains in Asia were led by a small rally in Hong Kong and Chinese indices on the back of a report that the PBOC is urging Beijing to ramp up its stimulus by a further $209 billion.

US futures are down too, taking a breather from Thursday’s record highs for the S&P 500 and Nasdaq Composite. Nvidia enjoyed a third day of closing in record territory as investors turn more optimistic as the Q2 earnings season gets underway.

Cryptos also had a strong week. Bitcoin is testing the $118,000 level, having soared by about 8.5% this week. Ethereum is rallying too amid strengthening demand by institutional investors for spot ETFs and the rise in crypto treasury companies.

There is also excitement building ahead of next week’s ‘Crypto Week’ where the US House of Representatives will be discussing a number of crypto-related legislations.

.jpg)