EBC Markets Briefing | Falling inventories offer oil market a reprieve

Oil prices were steady on Friday, but were poised to end the week lower as downward revisions to US employment data raised demand concerns and ceasefire talks in Gaza eased worries about supply disruptions.

Both benchmarks rose for the first time in five sessions on Thursday on expectations the Fed would cut interest rates soon, which helped improve the economic outlook of the top energy consumer.

The market consensus so far is that the weakness in 2024 is temporary and China's import of crude oil will resume an upward trend as soon as the world's second-largest economy regains momentum.

Disagreements over Israel's future military presence in Gaza and over Palestinian prisoner releases are obstructing a ceasefire and hostage deal. US and Israeli delegations started a new round of meetings in Cairo on Thursday.

Crude inventories fell by 4.6 million barrels in the week ending 16 Aug, the EIA said, exceeding expectations in a poll for a drop of 2.7 million barrels.

Some analysts say there are signs that oil could find support in the weeks ahead. Global oil inventories have declined over the past two months, indicating supply growth is lagging demand, UBS analysts said.

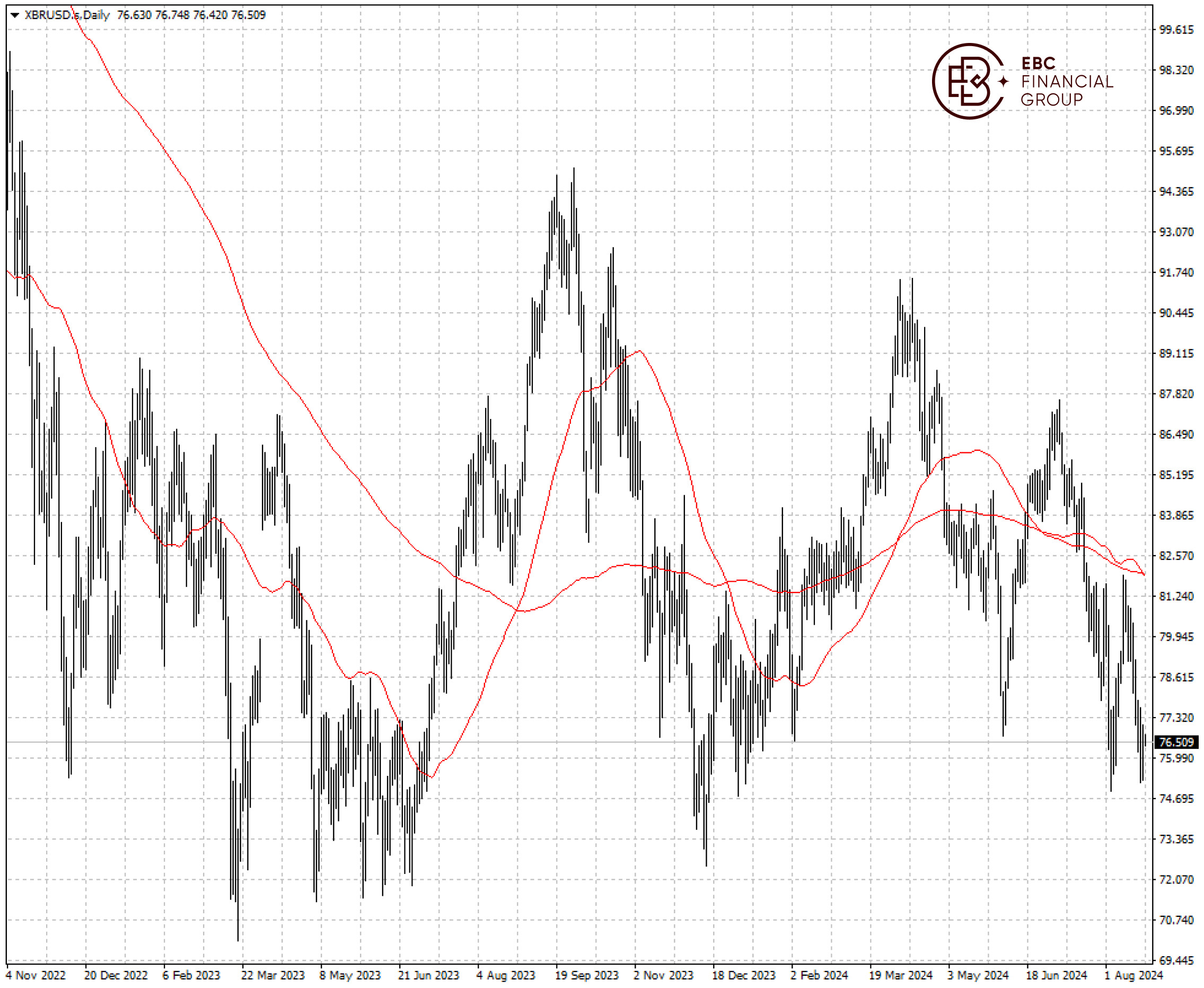

Brent crude has reached a death cross, point to further loss ahead towards $75. It may need to rise above $78 to negate bearish bias.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.