EBC Markets Briefing | Israel retaliation sets oil prices on fire

Oil prices rose in early Asian trading on Thursday, extending strong gains in the previous session after the killing of a Hamas leader in Iran raised the threat of a wider Middle East conflict.

Hamas leader Ismail Haniyeh was assassinated in Tehran on Wednesday, less than 24 hours after Lebanon-based Hezbollah's most senior military commander was killed in an Israeli strike in Beirut.

Iranian Supreme Leader Ayatollah Khamenei in a statement said that Israel “has prepared the ground for severe punishment with this action.” Now cease-fire talks seem more likely to break off.

However, some analysts questioned the potential of the latest escalation to shore up oil prices in the long term as there was yet any sign of actual supply disruptions to push up geopolitical risk premia.

Elsewhere, US crude oil stockpiles lower by 3.4 million barrels in the week ended July 26, data from the EIA showed. They have declined for five consecutive weeks, the longest such streak since Jan 2021.

The demand was at a seasonal record in May as gasoline consumption surged to its highest since before the pandemic. A lower greenback after the Fed’s policy meeting added to oil price gains.

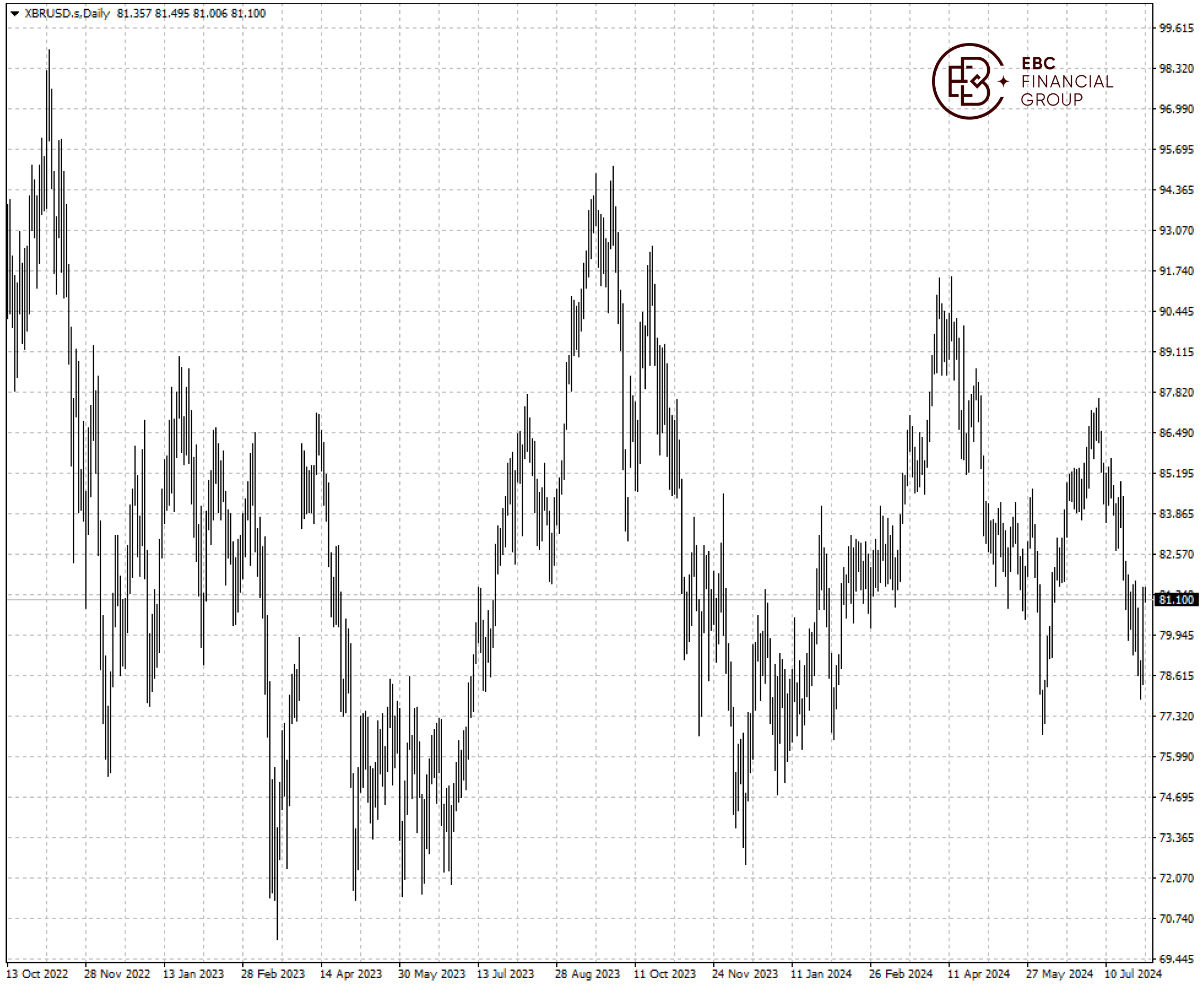

Brent crude gained a solid footing above $80 and it looks neutral in the immediate term. A decisive break above $84.5 could pave the way for heading to the high hit in 5 July.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.