EBC Markets Briefing | Potential for Libyan production deters oil bulls

Oil prices were little changed on Thursday as signs of higher fuel demand and falling stockpiles in the US, offset concerns over demand elsewhere, particularly in China.

Crude stocks dropped by 4.5 million to their lowest level in nearly 2.5 years in the week ended 20 Sep, the EIA said, compared with analysts' expectations for a 1.4 million-barrel drop.

Prices slumped over 2% in the last session as worries over supply disruptions in Libya eased. The stimulus announcement from the world's biggest oil importer proved unpersuasive to bulls.

Delegates from divided Libya's east and west have agreed on the process of appointing a central bank's governor, a step which could help resolve the crisis over control of the country's oil revenue.

In its report, OPEC still predicts strong energy demand growth of 24% globally between now and 2050 and demand will reach 112.3 million bpd in 2029. But some analysts cast doubt on the positive view.

OPEC+ is expected to bring some production back in December, several members are producing beyond their quotas, and more supply is coming onto the market from non-OPEC+ producers like the US, Brazil, and Canada.

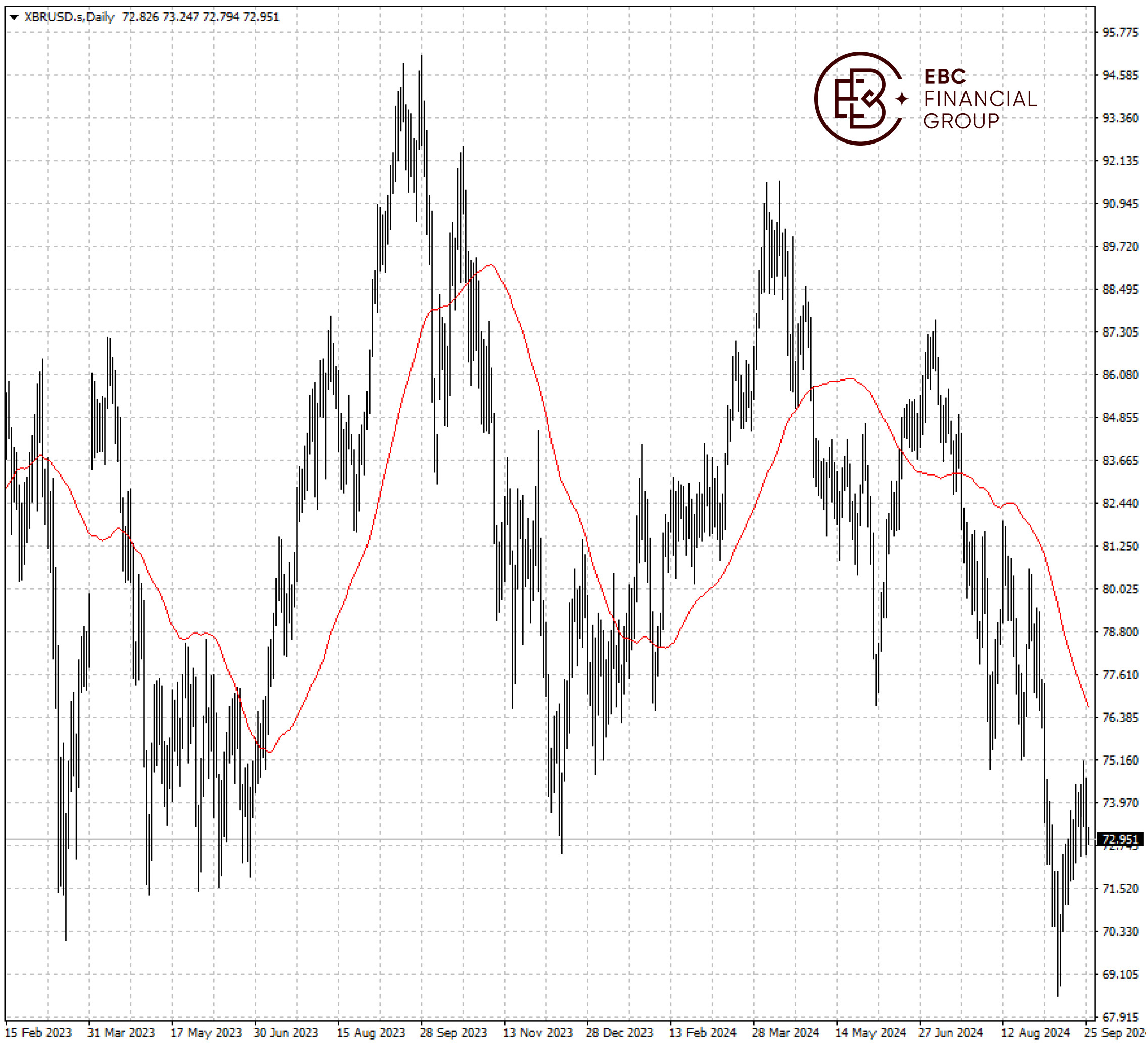

Brent crude bounced back from the support around $72.5. It will likely remain stuck in the tight range, indicative of a retest of $74, though the overall picture looks dim with the price far below 200 SMA.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.