EBC Markets Briefing | Undervalued Norway’s krone poised for a rebound

Norway’s kroner languished around its low in over a year on Monday. Policy easing in Norway will likely take longer than in its main peers, but its currency has been the worst performer in G10 so far.

Societe Generale has a long position on the kroner as a key trade recommendation in the second half, expecting it to reversed the drop by the year end, while the BofA says it is undervalued and sees a rebound.

Similarly, Pictet Wealth Management noted the currency is worth holding as it offers exposure to Europe without the shadow of French political turmoil hanging over the bloc.

Selling picked up this month after a surprising slide in inflation rate boosted expectations of a rate cut by Norges Bank in December. Meanwhile the economy is growing faster than forecast and outperforming on other scores.

The central bank held its key policy rate at 4.5% in June’s meeting and reiterated guidance that the rate is likely to stay at that level for some time, as high wage growth is expected to keep inflation elevated.

According to a survey, in the period ahead business activity is expected to pick up, while inflation continues to fall. Given reduced interest rates among trading partners, the key policy rate will soon be cut in Norway.

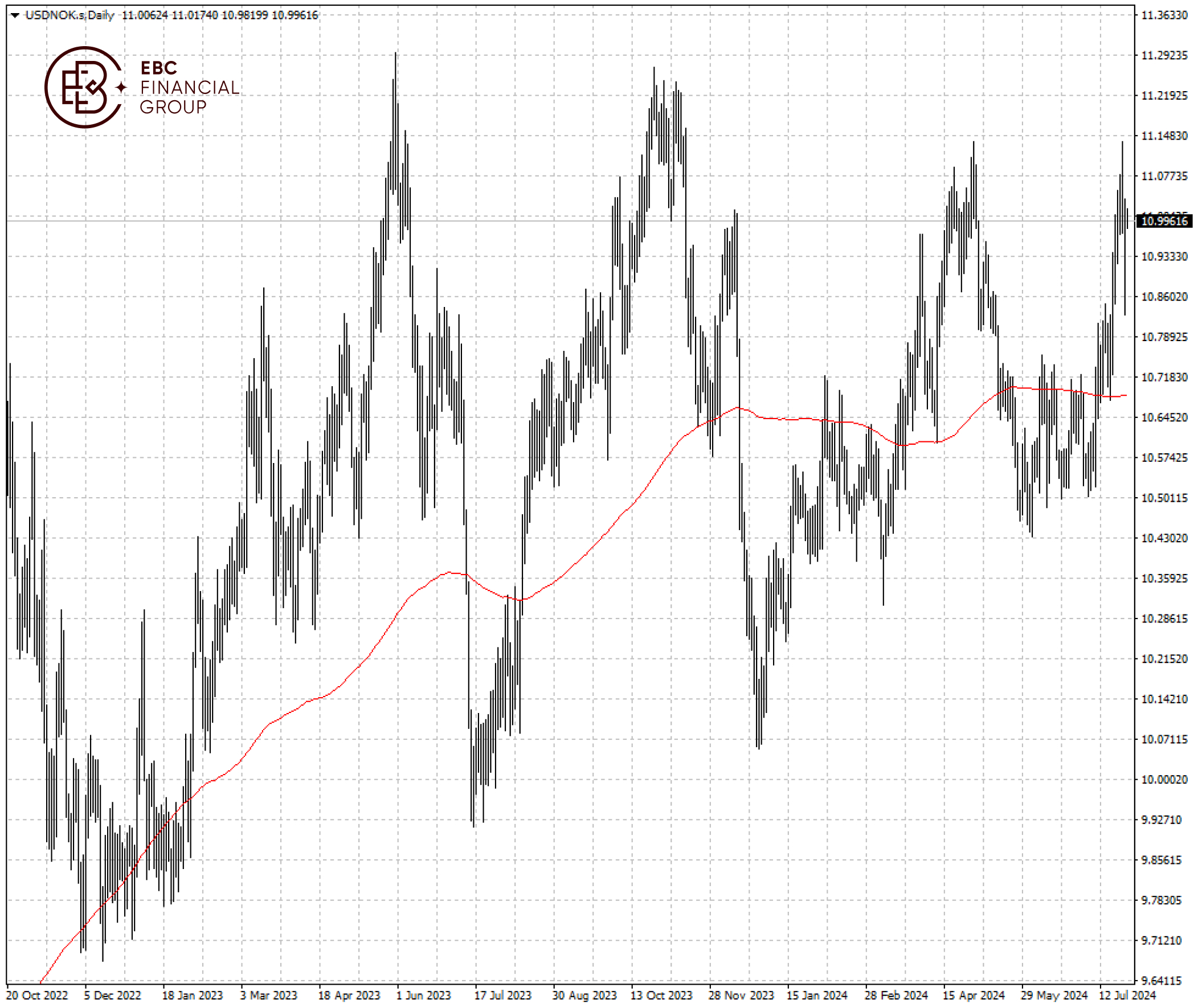

The USDNOK rally snapped again at the resistance around 11.14 per dollar last week. The immediate risk is tilted towards the downside due to few catalysts to fuel a breakout, so the next target could be 200 SMA.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.