EBC Markets Briefing | US stocks firm after a nightmare week

US stocks rebounded on Monday on the heels of the S&P 500's worst week since early 2023, as inflation came back into focus for investors gauging pressures that could influence the size of rate cuts.

All three major stock indexes surged more than 1%, with the S&P 500 and the Dow ending a four-session losing streak. The first debate between Trump and Harris later in the day will be closely watched.

Nvidia shed roughly $400 billion in market value last week after the stock fell nearly 10% on Tuesday. But Goldman Sachs maintained a Buy rating on the stock, saying the sell-off in was overdone.

The bank estimates that generative AI will begin materially contributing to sector growth by the second half of 2025, though investors’ patience is wearing thin amid elevated valuations.

Goldman also said, to get big tech stocks powering higher again, it will take the convergence of two factors – loose financial conditions combined with a whopping earnings growth in excess of 20%.

Treasury Secretary Janet Yellen sought to reassure the public on Saturday that the economy remains strong, despite a string of weak job reports that have rattled investors and weighed on the stock market.

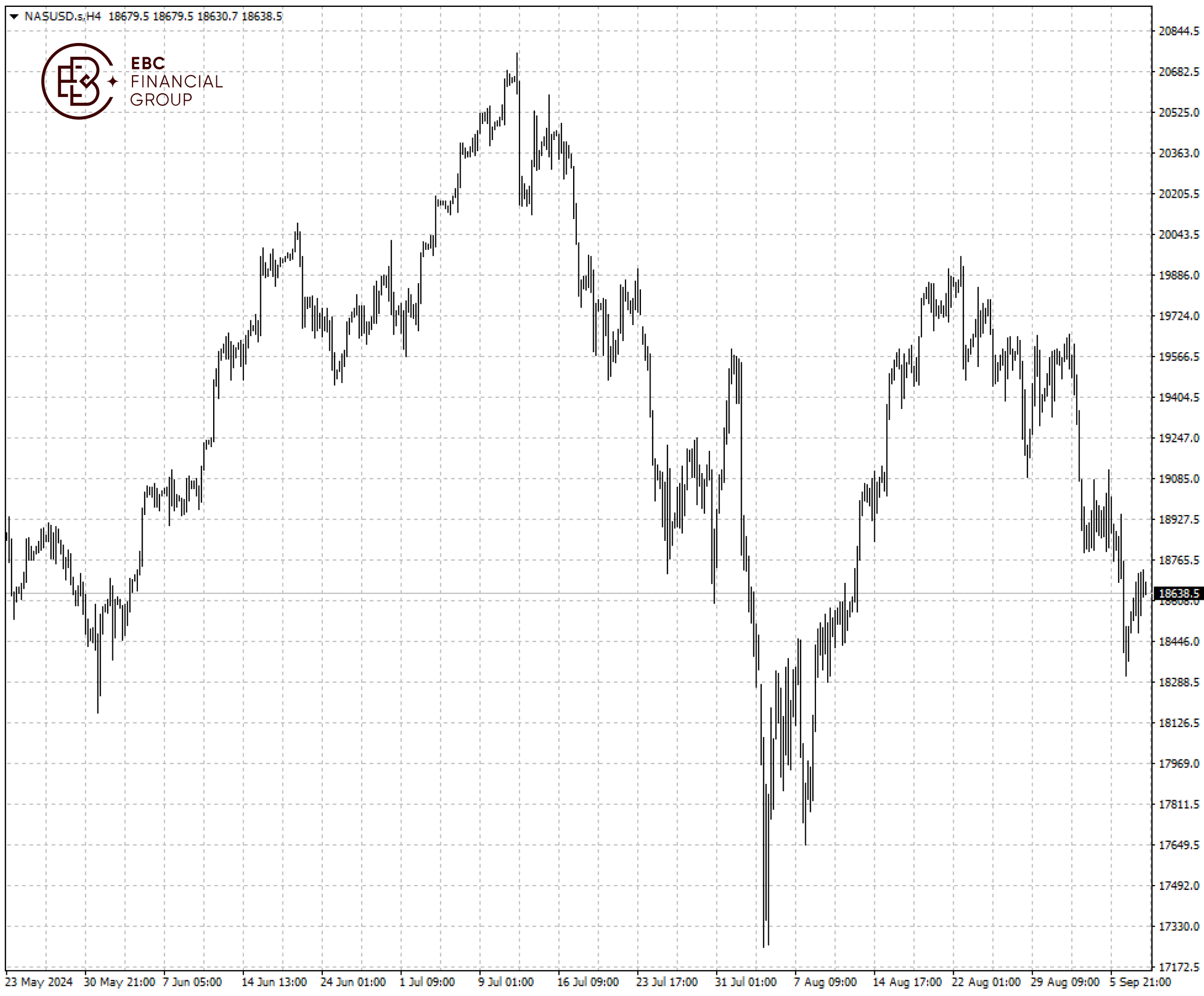

The Nasdaq 100 index has steadied around 18,600. The rally will unlikely last beyond 19,000 by the CPI data due tomorrow.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.