EBC Markets Briefing | US stocks set fresh peaks amid cautious mood

The S&P 500 and the Nasdaq 100 hit all-time highs on Friday as renewed AI enthusiasm and the prospect of a looser monetary policy powered a recovery in the market.

Nvidia hit a fresh record high last week, and the chipmaker reclaimed the crown as the world's most valuable company after an analyst said the chipmaker was set to ride a "Golden Wave" of artificial intelligence.

Market players are preparing for the normally thinly-traded months ahead with even more caution than usual due to geopolitical risks and uncertainty about China and Europe striking trade deals.

One-month VIX futures, which cover July 9, are around a 1.5 point premium over the VIX that currently muted. That means market sentiments could be turning sour anytime soon.

Even so, BMO Capital Markets chief investment strategist Brian Belski boosted his year-end target to 6,700 from a prior forecast of 6,100, joining a growing list of Many Wall Street analysts who have turned bullish.

Trump said Friday he may not stick to the deadline in early July when massive tariffs are set to snap back into effect on a slew of countries. The deadline is less than two weeks remaining.

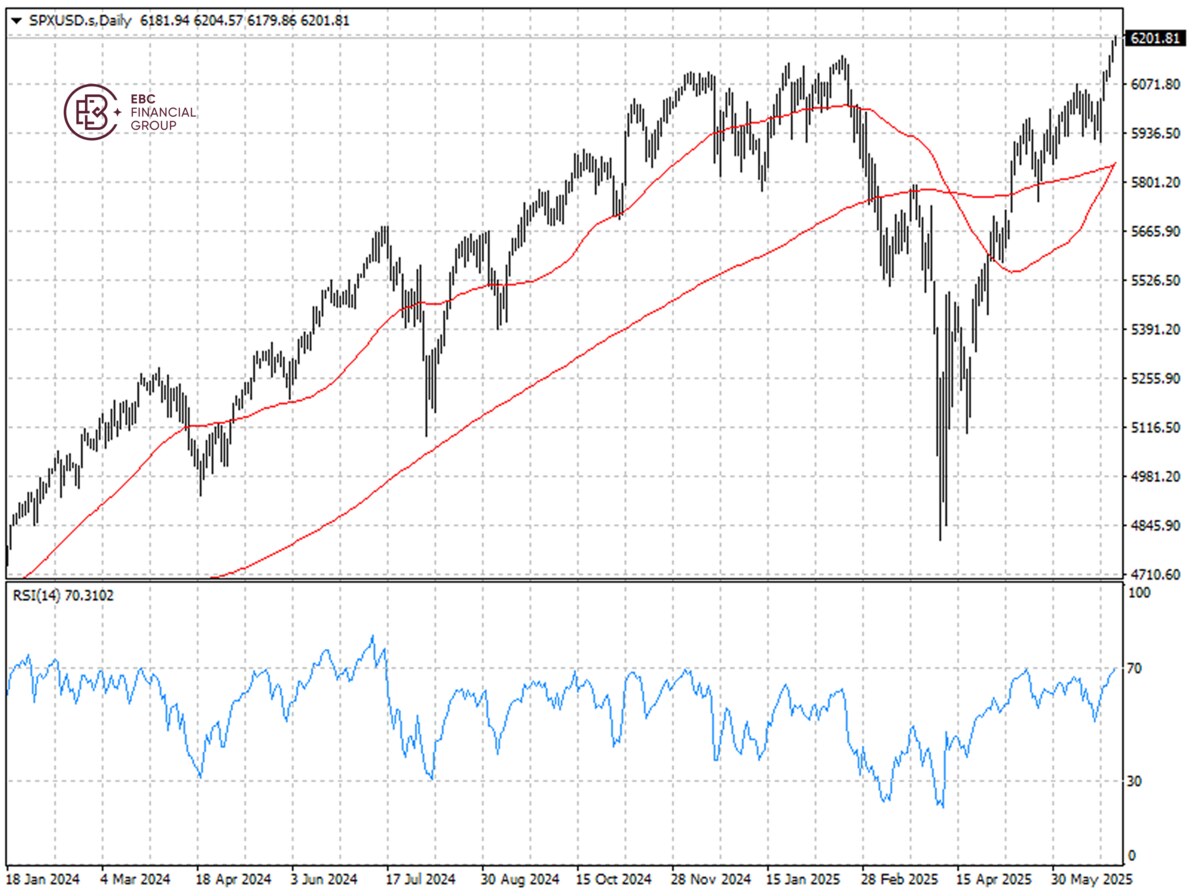

The S&P 500 has logged a golden cross and the RSI is ye t to enter overbought territory, so we expect the rally to continue with limited room for short-term upside.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.