EBC Markets Briefing | Wall St recommend long gold unanimously

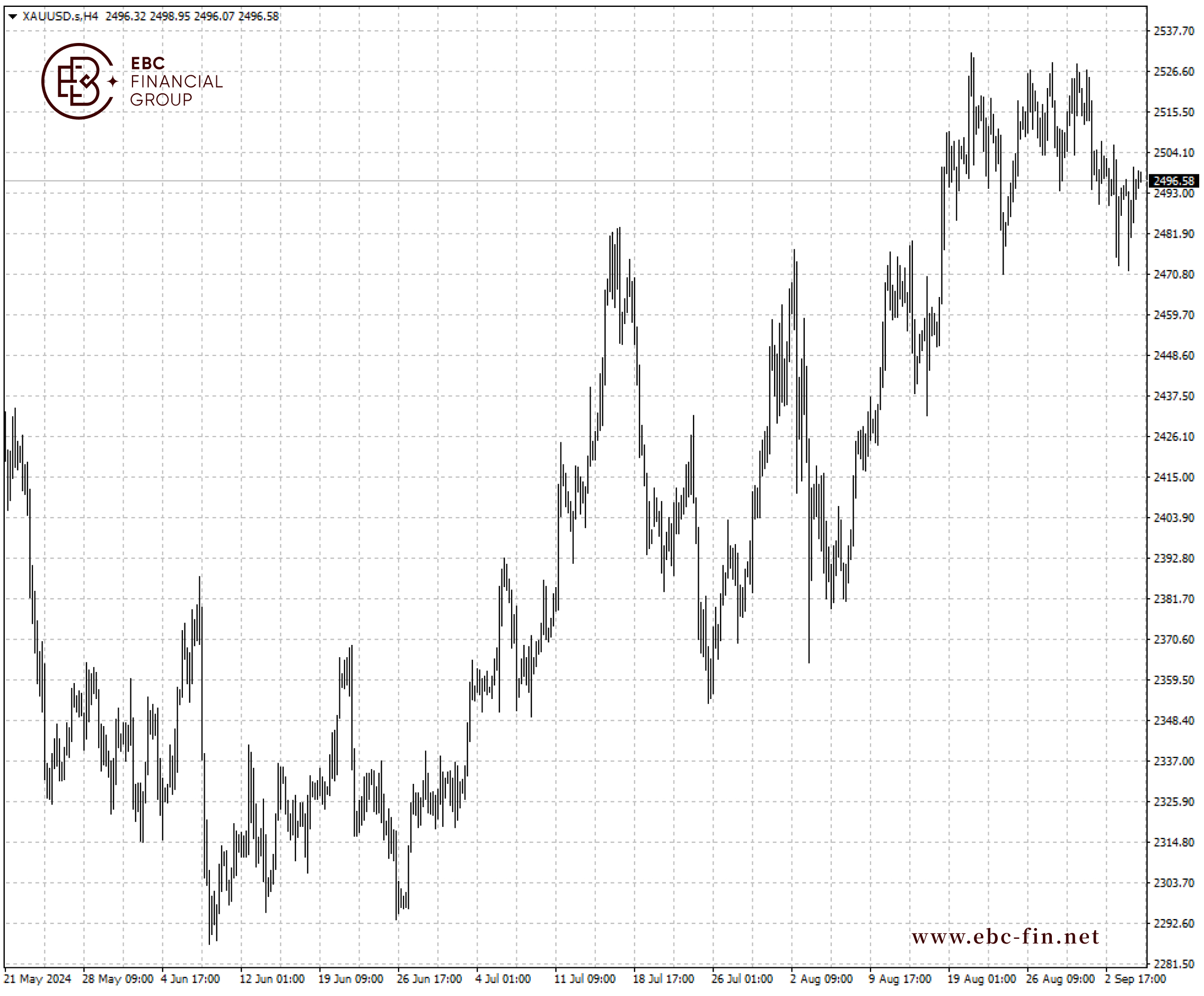

Bullion steadied on Thursday but remained below $2500 as investors took stock following a broad sell-off that rattled markets. It is expected to hover around the level until the NFP report comes out.

Investors should "go for gold" as the precious metal's stellar run is nott over, Goldman Sachs said in a research note. The firm maintains a 2025 target of $2,700 with the "long" recommendation.

BofA estimates gold has now surpassed the euro to become the world's largest reserve asset, second only to the US dollar. Geopolitical risks and economic woes have buoyed prices.

Investment banks are cutting their growth forecasts for China, believing Beijing risks undershooting its official target of about 5%. UBS last week said it projected growth of 4.6% for 2024.

BofA lowered its forecast from 5 % to 4.8% and TD Securities cut from 5.1% to 4.7%. Citi warned that official growth target could be at risk due to a prolonged property sector slowdown and weak confidence.

Global physically backed gold ETFs have now seen inflows three months in a row as Western investors pile into gold, with North American activity outpacing Europe and Asia in July, according to the WGC.

Bullion recovered from the solid support at $2,470 again, signalling the uptrend has not been disrupted. It is seen to rise towards $2,510 if the upcoming inflation figures meet expectations.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.