EBC Markets Briefing | Yen jumps on upbeat GDP report

The yen rose on Monday in a boost from upbeat Japanese GDP data and weaker-than-expected US data. Traders are now pricing in roughly another 35-bp BOJ rate hikes by December.

Japan’s GDP expanded at an annualised rate of 2.8% in Q4 thanks to strong by corporate spending, significantly exceeding consensus analyst estimates and marking the third straight quarter of expansion.

Meanwhile, US retail sales dropped by the most in nearly two years in January, likely weighed down by frigid temperatures, wildfires and motor vehicle shortages, suggesting a sharp slowdown in economic growth.

Geopolitics also remained in focus with reports that talks aimed at ending the Russian-Ukraine conflict will begin in Saudi Arabia this week, though the participants are not entirely certain.

Strong US inflation data and the prospect of a deal to end the war in Ukraine have dented the yen’s appeal, according to Barclays Plc. Still institutional investors remained positive on the currency.

Their net long positions for the yen reached the highest in about four years in the week ended 11 Feb, according to CFTC. The yen has been the best performer against the dollar this year.

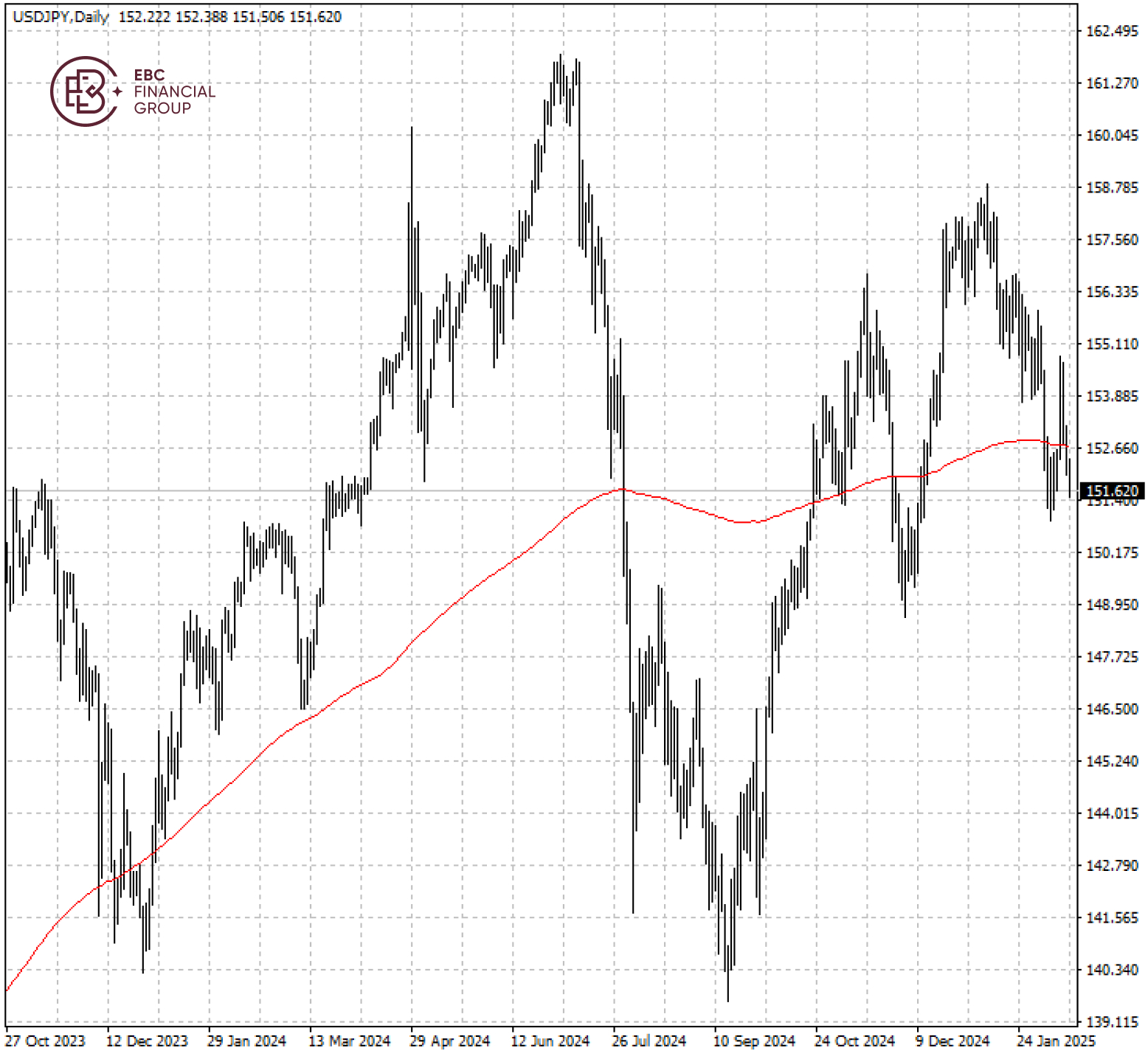

The yen rose above the resistance at 200 SMA, which has heightened the case of the bullish run to continue. The next hurdle could lie around 151.00.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.